2026 Employee Benefits Trends HR Leaders Need to Act on Now

Last Updated Dec 3, 2025

Key Takeaways

- Rising healthcare costs are pushing employers to rethink benefits with a sharper focus on affordability and access. Companies are leaning into alternative plan designs, virtual-first care, and thoughtful cost-sharing to manage budgets without reducing coverage quality. These strategies help employees make smarter healthcare decisions while maintaining support for long-term wellbeing.

- Wellbeing is becoming a multidimensional priority that goes far beyond physical health. Employers are expanding support for mental, emotional, and social wellness with digital mental health tools, lifestyle coaching, and community-driven programs. This whole-person approach reflects employees’ real needs and strengthens engagement, resilience, and connection at work.

- Flexible and personalized benefits are now essential—not optional—as employees demand autonomy and relevance. Organizations are embracing flexible schedules, remote-work stipends, and lifestyle benefits that match diverse life stages and preferences. By using employee feedback to guide decisions, HR teams can build benefits that feel inclusive, supportive, and genuinely impactful.

- Financial wellness benefits are gaining traction as workers face rising financial stress that affects wellbeing and performance. Employers are responding with practical tools like emergency savings programs, student loan assistance, and Roth 401(k) matching to reduce day-to-day strain. When these benefits are easy to access and clearly communicated, they significantly improve confidence, focus, and retention.

- Family, development, and voluntary benefits are expanding as companies aim to support whole lives and long-term growth. Leading employers are adding caregiving support, upskilling opportunities, and opt-in fringe benefits that deliver meaningful value without ballooning costs. Together, these offerings help employees feel supported at every stage while strengthening culture, loyalty, and organizational momentum.

Employee expectations are evolving faster than a 5G download. And if your benefits package still looks like it did five years ago, it’s probably not keeping up.

From inflation to burnout to multigenerational caregiving, the pressure points employees face in 2026 are personal—and constant. That means traditional benefits menus just aren’t cutting it. Today’s workforce wants flexibility, financial support, and wellness options that reflect their real lives, not just generic perks.

The good news? HR leaders who adapt now can turn benefits into a powerful lever for retention, engagement, and equity. And the trends gaining traction aren’t just shiny add-ons—they’re strategic moves backed by data and demand.

Ready to transform your strategy and offer the kind of benefits your people actually want? Unlock the trends shaping the future of employee experience—and build a package that works for everyone.

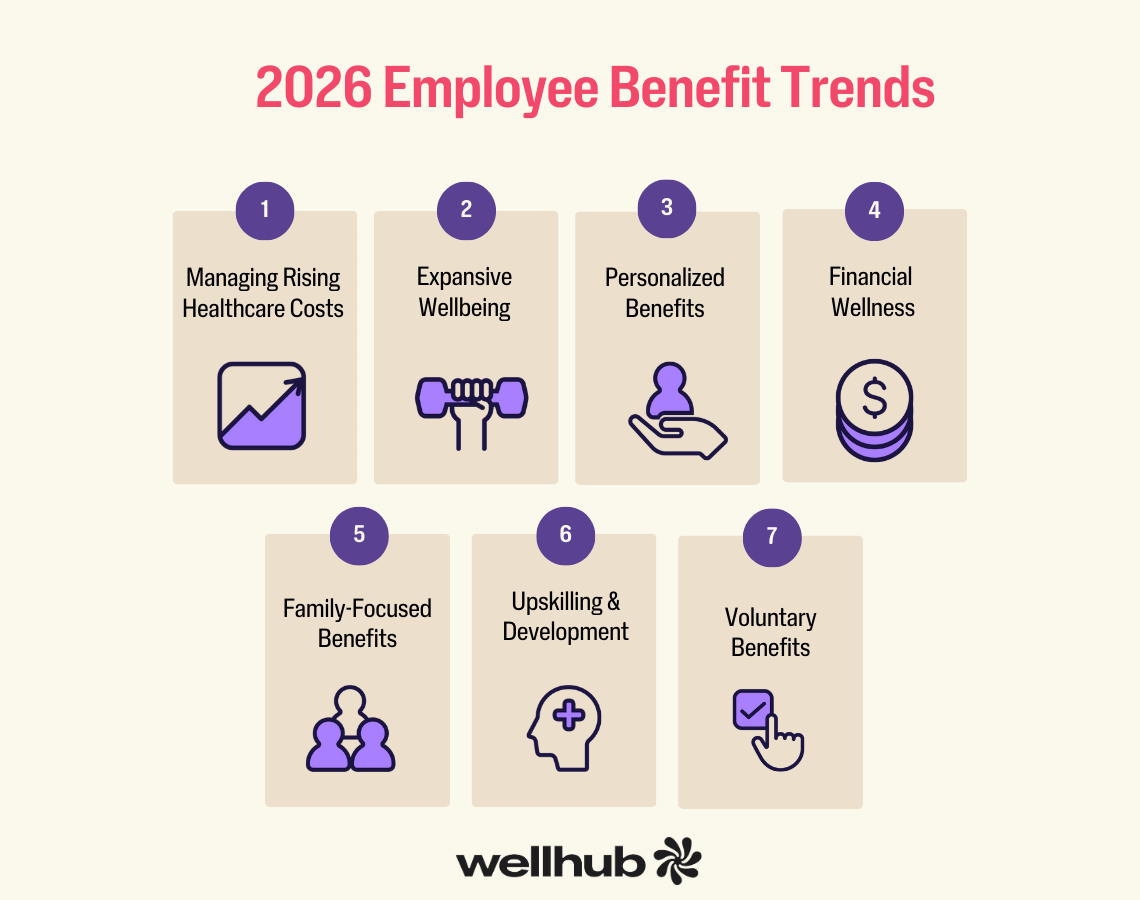

2026 Employee Benefit Trends: Quick Overview

Trend | Key Strategies | HR Action |

| Trend 1: Managing Rising Healthcare Costs | Alternative plan designs, virtual-first care, strategic cost-sharing | Reevaluate insurance models and integrate cost-saving telehealth options |

| Trend 2: Expanding Wellbeing Beyond Physical | Mental health platforms, weight management, social wellness support | Build a multi-dimensional wellbeing ecosystem with targeted solutions |

| Trend 3: Flexible & Personalized Benefits | Flexible schedules, lifestyle perks, feedback-driven planning | Use employee input to design customizable, lifestyle-aligned benefits |

| Trend 4: Financial Wellness Benefits | Emergency savings, student loan help, Roth 401(k) matching | Implement practical, easy-access financial tools to reduce stress |

| Trend 5: Benefits for Working Families | Parental leave, fertility support, eldercare assistance | Support caregiving across all life stages and align with DEI goals |

| Trend 6: Upskilling & Purpose-Driven Work | Tuition support, microlearning, sabbaticals, purpose alignment | Invest in employee growth and tie development to mission |

| Trend 7: Voluntary & Fringe Benefits | Legal services, critical illness insurance, home-office stipends | Expand offerings affordably and increase visibility through education |

Trend 1: Managing Rising Healthcare Costs with Smarter Strategies

Healthcare costs are rising—fast. In fact, employer healthcare costs are projected to increase by 6% to 10% in 2026, marking the highest spike in over a decade. This isn’t just a budgeting concern—it’s a signal that the way we approach healthcare benefits needs to evolve. Fast.

To stay ahead, HR leaders are reimagining their benefits strategy with cost-efficiency and employee wellbeing in mind. Here's how.

Lean into Alternative Plan Designs

Traditional health insurance plans aren’t built for today’s financial or medical realities. Many companies are exploring options like:

- Reference-based pricing to control cost variability

- High-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs)

- Tiered networks that encourage use of high-value providers

These models help employers reduce overall spend without gutting coverage. And when combined with smart employee education, they empower workers to make informed care decisions.

Expand Virtual-First and Telehealth Care

Virtual care is about more than convenience. It's a cost-containment strategy. From on-demand urgent care to virtual behavioral health, telemedicine can reduce costs while improving access. It’s particularly impactful for remote and hybrid teams who need flexible, location-agnostic options.

And the results speak for themselves: 91% of employees say spending time in wellness spaces like gyms or yoga studios helps them manage work-related stress—and virtual care options can provide similar mental and physical relief.

Share Costs Strategically, Not Punitively

Yes, cost-sharing is increasing. But the smartest employers are doing this thoughtfully. Instead of shifting costs across the board, they’re offering incentives for preventive care, reducing copays for chronic condition management, and layering in wellbeing programs that reduce claims over time.

This is especially important now: 89% of employees say they perform better at work when they prioritize their wellbeing. Cutting corners on care can drive up long-term costs in turnover, absenteeism, and disengagement.

Trend 2: Wellbeing Is Expanding Beyond Physical Health

Wellbeing isn’t one-dimensional—and your benefits strategy shouldn’t be either.

In 2026, employees expect their employer to support their mental, emotional, and social health, not just their physical health. This shift is more than a trend. It’s a response to lived reality: 90% of employees say they experienced burnout in the past year, and 95% believe physical, mental, emotional, and social wellbeing are all connected.

If your benefits program stops at step trackers and flu shots, it’s time to level up.

Build a Mental Wellness Ecosystem

Gone are the days of single EAP hotlines. Today’s leading companies are creating integrated ecosystems that support emotional and psychological resilience. Think:

- On-demand access to digital mental health platforms

- Stress coaching to prevent issues before they escalate

- Self-guided mindfulness, therapy, or sleep tools

When paired with proactive communication, these tools can create a culture where it's okay to ask for help—and easy to get it.

Include Weight Management and Lifestyle Coaching

Health isn’t just physical—it’s personal. Medical weight management, nutrition counseling, and lifestyle coaching are rising in popularity as they help tackle the root causes of both mental and physical strain. These services can also support employees navigating stress-related eating, chronic conditions, or energy fatigue.

Want to take it a step further? Offer group challenges or gamified wellness apps that tap into community and accountability.

Prioritize Social Wellness

Social connection is a major predictor of long-term wellbeing. And yet, only 44% of employees say wellness is ingrained in their company culture.

That’s a miss—because when employees feel connected, they’re more likely to engage in healthy behaviors and stay committed to their wellbeing. Consider programs that support:

- Peer-to-peer wellness challenges

- Community-based activities (virtual or in-person)

- Local coworking or fitness meetups for remote workers

With 62% of employees saying social support is key to maintaining healthy habits, this kind of support is no longer “extra”—it’s essential.

Ready to meet your team’s whole-person needs? Speak with a Wellhub wellbeing specialist to build a benefits strategy that supports every dimension of employee wellness.

Trend 3: Flexible and Personalized Benefits Are the New Baseline

Let’s be real: one-size-fits-all benefits don’t fit anyone anymore.

Employees today want flexibility—and they’re willing to walk if they don’t get it. In fact, 39% say they’re not working in their preferred environment, whether that’s remote, hybrid, or in-person.

That preference gap creates friction, and it’s driving disengagement, burnout, and turnover. The good news? You have options.

Ditch Uniformity. Embrace Flexibility.

Flexibility isn’t just about remote work—it’s about autonomy. Here’s what leading companies are offering to meet employees where they are:

- Flexible schedules and compressed workweeks

- Remote work stipends for internet, equipment, or coworking spaces

- Voluntary benefits that let employees choose what matters to them (think: pet insurance, travel discounts, or legal support)

These perks give employees a sense of control—and that control fosters loyalty, productivity, and trust.

Get Personal with Lifestyle Benefits

Employees want benefits that reflect their lives—not just their job titles. That’s why personalization is rising to the top in 2026. Popular offerings include:

- Fertility and family planning support

- Pet insurance for furry family members

- Eldercare assistance and caregiving stipends

These benefits go way beyond checking a box. They show your employees that you see them, and care.

Let Employee Feedback Lead the Way

Not sure which benefits will have the most impact? Ask.

The most successful HR teams are using employee surveys to design benefits strategies that reflect the real needs of their workforce. Go beyond basic satisfaction scores—ask about unmet needs, financial stressors, caregiving burdens, and personal goals. Then take action.

When employees see their feedback reflected in the perks you offer, they’re more likely to engage—and more likely to stay.

Trend 4: Financial Wellness Benefits Are Gaining Ground

Inflation isn’t a headline for your employees. It’s a daily stresser. Sixty-eight percent say their financial situation prevents them from taking care of their wellbeing.

That means it’s not just a money issue—it’s a mental health, productivity, and retention issue. Financial wellness is officially part of the benefits conversation, and in 2026, it’s taking center stage.

Prioritize Practical Support

Today’s workers aren’t looking for lectures on budgeting—they’re looking for help that moves the needle. Employers are responding with:

- Emergency savings programs with company matching

- Student loan repayment assistance

- Roth 401(k) matching for long-term financial planning

These benefits are especially powerful for Millennial and Gen Z employees juggling debt, caregiving costs, and rising rent.

Make Access Effortless

A financial benefit is only as effective as its engagement rate. So how do you drive adoption? Make it automatic:

- Auto-enrollment into savings or education programs

- Incentives for completing financial wellness assessments

- Embedded financial literacy tools that guide employees without overwhelming them

Clarity and ease matter. When employees understand their options and feel confident using them, engagement goes up—and stress comes down.

Connect the Dots Between Money and Mental Health

This is the big one: financial wellbeing directly impacts your team’s ability to show up, focus, and thrive. Employers that integrate financial support into their overall wellness strategy see better outcomes across the board.

Think about it: 89% of employees say they perform better at work when they prioritize their wellbeing—but they can’t do that if money is constantly getting in the way.

Trend 5: Benefits for Working Families Are Expanding

Working families are balancing a lot—and they’re looking to their employers for real support, not just sympathy.

Parenting, caregiving, and fertility journeys are complex, emotional, and expensive. In 2026, companies that prioritize these life stages are seeing big returns in loyalty and engagement—especially among Millennials and Gen Z, who now make up the majority of the workforce.

And here’s a stat that says it all: 85% of employees say wellbeing is just as important as salary when evaluating a job.

Support the Full Family Lifecycle

What does modern family support look like in your benefits plan? Leading employers are moving beyond standard parental leave to offer:

- Flexible and extended leave policies for all caregivers, not just parents

- Fertility and adoption benefits that reduce out-of-pocket costs

- Eldercare stipends or backup care for aging family members

These benefits meet employees at critical moments—and show that your organization understands the realities of life outside of work.

Tie Family Benefits to DEI Goals

Family support benefits aren’t just “nice to have.” They’re a powerful tool to advance your diversity, equity, and inclusion goals.

Offering equal access to fertility care, supporting single parents, and acknowledging multigenerational households can help close equity gaps—and make your workplace more inclusive for everyone.

And for younger workers, this matters. Millennial and Gen Z employees expect their employers to recognize their whole selves, not just their output.

Design with Flexibility in Mind

Support doesn’t have to be one-size-fits-all. Consider creating lifestyle spending accounts that can be used for caregiving, childcare, or family wellness activities. Or offer a menu of family-friendly perks employees can select based on their needs.

When benefits align with real-life pressures, employees are more likely to stay—and thrive.

Trend 6: Upskilling, Development, and Purpose-Driven Work

Career growth isn’t a perk anymore—it’s a priority.

Today’s workforce wants more than a paycheck. They’re looking for purpose, progress, and a workplace that invests in their future. And HR leaders are listening: Upskilling and development programs are quickly becoming retention tools, not just résumé boosters.

Here’s why this matters: 86% of employees say their wellbeing at work is just as important as their salary. Purpose and progress are deeply tied to that wellbeing.

Make Development a Strategic Advantage

The most competitive employers are offering:

- Tuition reimbursement for degree or certification programs

- Microlearning stipends for short, skill-building courses

- Sabbaticals for personal growth, not just burnout recovery

These programs send a powerful message: “We’re invested in your long-term success.” And that’s a message employees remember when weighing their options.

Don’t Forget Purpose

Upskilling is important, but it doesn’t work in a vacuum. Employees want to feel like their work matters. That’s where purpose-driven roles, values-based leadership, and transparent communication make all the difference.

When people feel connected to the mission, they bring their best selves to work. And that kind of culture? It’s magnetic.

Link Growth to Retention

When employees see a path forward, they’re more likely to stay.

Investing in career development increases engagement and reduces turnover—especially in a competitive hiring market. And it works across industries. Whether you’re a tech company or a healthcare organization, giving employees a reason to grow with you can directly impact your bottom line.

Trend 7: Voluntary and Fringe Benefits Are in Demand

Employees want options—and in 2026, voluntary and fringe benefits are becoming essential tools for meeting diverse needs without blowing the budget.

These benefits aren’t just “extras.” They’re strategic solutions that offer flexibility, boost satisfaction, and show your employees that you care about their whole lives—not just their work hours.

Think Beyond Traditional Coverage

Fringe benefits are helping employers meet employees where they are, offering support for everything from legal needs to lifestyle goals. Popular picks include:

- Legal services and ID theft protection

- Critical illness insurance

- Home-office stipends or equipment reimbursement

These benefits add real value—especially in a world where remote work, cyber risks, and life complexity are all on the rise.

Offer Flexibility Without Breaking the Bank

One of the biggest perks of voluntary benefits? They’re cost-efficient. Most are opt-in, meaning employees choose what they want, and employers only pay for what’s used.

That means you can offer a broader range of benefits without dramatically increasing your budget. It’s a win-win: employees get more choice, and you get more control over costs.

Make Education Part of the Rollout

Even the best benefit won’t make an impact if no one knows how to use it.

Companies that succeed here run benefit education campaigns during open enrollment and throughout the year. These might include:

- Interactive benefits fairs (virtual or on-site)

- Explainer videos or one-pagers

- Dedicated Q&A sessions or office hours

When employees understand their options, engagement goes up—and so does the perceived value of your benefits program.

How to Update Your Benefits Strategy for 2026 (Step-by-Step Guide)

Launching or refreshing your employee benefits strategy doesn’t have to be overwhelming. But it does need to be intentional.

Here’s how to build a future-ready benefits program that aligns with your goals, your people, and your budget.

Step 1: Align With Business Goals

Start with the big picture. Your benefits strategy should directly support your company’s broader priorities—whether that's scaling headcount, improving retention, or entering new markets.

For example, if growth is the goal, your benefits should help you attract top talent quickly and competitively. If your focus is retention, double down on wellbeing, flexibility, and purpose.

Step 2: Set SMART Goals

Clarity is everything. Define what success looks like with specific, measurable, achievable, relevant, and time-bound (SMART) goals like:

- Increase benefits utilization by 15% by Q3

- Launch two new voluntary perks before open enrollment

- Improve employee satisfaction with benefits to 80%+ on annual surveys

These benchmarks will guide your plan and help prove ROI over time.

Step 3: Budget With Flexibility in Mind

Benefits can account for up to 30% of compensation—so budgeting wisely is key.

Look for cost-saving opportunities that don’t sacrifice value. For example, virtual care options, fringe benefits, or preventive wellbeing programs can lower long-term claims while improving employee satisfaction. Think of your budget not as a limit, but as a tool to invest where it matters most.

Step 4: Collect Employee Input

Your benefits strategy is only as strong as its relevance. Use surveys, listening sessions, and data analytics to find out:

- What benefits employees use (and love)

- Where there are unmet needs

- Which perks matter most by life stage, department, or demographic

Tailoring your offerings based on this input increases both engagement and equity.

Step 5: Prioritize Personalization and Equity

In 2026, personalization isn’t optional—it’s expected. Design a benefits mix that supports different life experiences, family structures, and health needs. This might include:

- Fertility and family support

- Mental health tools

- Flexible work benefits

- DEI-focused programs

An inclusive, flexible approach improves morale and helps all employees feel seen.

Step 6: Communicate Clearly and Often

Communication can make or break benefits engagement. Build a year-round communication strategy that includes:

- Benefits orientation for new hires

- Midyear refreshers

- Simplified plan breakdowns in plain language

- Visuals, stories, and examples (not just plan docs!)

Employees need to hear about benefits more than once, and through more than one channel.

Step 7: Measure, Learn, and Adapt

Once your plan is live, track progress regularly. Monitor:

- Utilization rates

- Survey feedback

- Claims data

- Turnover or retention shifts

And don’t be afraid to tweak your approach. The most successful HR teams treat benefits strategy like a living system—one that evolves with their people and business needs.

Wellbeing Benefits Are the Thread That Ties Every Trend Together

HR leaders face rising healthcare costs, growing demand for mental and emotional support, and increasing pressure to personalize benefits. Employees want flexibility, financial stability, and purpose—all while navigating burnout and caregiving responsibilities.

A comprehensive employee wellbeing program can address all of these needs in one unified strategy. By offering benefits that support physical, mental, social, and financial health, companies build a resilient, high-performing workforce.

Speak with a Wellhub wellbeing specialist to build a wellbeing benefits strategy that adapts to today’s trends and helps your people thrive.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

How to Attract and Retain Top Millennial Talent | Wellhub

Millennials are the vast majority of today's workforce. These are the millennial characteristics you should know to attract and retain this generation of employees.

Rage Applying to #LazyGirlJob: What HR Can Do About These 6 TikTok Job Trends

From Quiet Quitting to Acting Your Wage, younger generations are shouting their workplace discontent on TikTok, which is a huge help for HR leaders.

How to Manage and Support Generation Z at Work | Wellhub

Generation Z is an ambitious, purpose-driven group of workers that strives for expression and connection. Here’s how you can best support them and their career goals.