Lifestyle Spending Accounts (LSAs): A Comprehensive Guide for HR Leaders

Last Updated Jan 28, 2025

As an HR leader, you know that every staff member is unique. They have their own needs, hobbies, and plans for the future. That's why lifestyle spending accounts (LSAs) are among the best ways to support your staff’s unique lifestyles and boost employee wellbeing.

LSAs are flexible and can be adapted to meet every company's needs. It's up to your HR team to develop and implement an LSA program that will support your team's work-life wellness. Understanding the advantages, eligible benefits, and tax implications of these accounts is the first step in implementing your successful LSA program.

What are Lifestyle Spending Accounts?

A lifestyle spending account is an employee benefit account that allows each staff member to choose what they want to spend their money on. Instead of reserving after-tax funds for a specific use — such as travel reimbursements or PTO — an LSA allows employees to use their benefits for personal fitness goals, home office equipment, pet care, financial classes, and more.

Around 78% of workers value flexibility in the workplace, according to a recent survey by Blue Beyond Consulting. LSAs provide the funds for employees to support work-life wellness, creating more flexibility in their budget for the things they value most.

The Advantages of LSAs

There’s a reason 75% of large companies offer LSAs, as reported by CFO Magazine. These programs offer tons of advantages for HR departments and employees alike.

For Employers

For company leaders and HR professionals, LSAs can:

- Reduce administrative burdens: LSAs require minimal administrative work compared to other spending accounts, leaving more resources to meet your HR KPIs.

- Increase employee happiness: Keeping your staff happy is the best way to support employee retention and boost productivity in the workplace.

- Enhance your benefits package: Adding an LSA to your employee benefits package will help foster employee growth.

- Promote company values: If diversity and work-life wellness are important to your company, an LSA plan is a great way to demonstrate those values in real life.

For Employees

For staff members, the advantages of an LSA go beyond workplace flexibility. LSAs also help to:

- Support workplace diversity: Offering flexible benefits is a great way to manage diversity in the workplace. It allows people of all cultural backgrounds and lifestyles to choose the benefits that best fit them. It can also help support neurodiversity by allowing employees to spend their funds on their own wellbeing, however they define it.

- Improve WFH experiences: Employees who work from home can spend their LSA funds on their home office, creating a more efficient and enjoyable remote work experience.

- Support working parents: LSAs are not designed to cover the cost of childcare. However, they can support working parents by supplementing other caregiving costs, such as parenting classes or new baby equipment.

- Make work easier: What makes work easier for one person might not help another — whether it’s travel reimbursements, home office expenses, or a healthy lunch budget, employees can use their LSA for whatever makes work easier and more efficient for them.

Eligible Expenses: What Can Employees Use LSAs for?

LSAs can be used for a wide range of perks. However, that doesn’t mean LSA spending is unlimited. It’s up to the employer to determine which expenses are eligible under the company’s LSA plan.

Health and Wellness

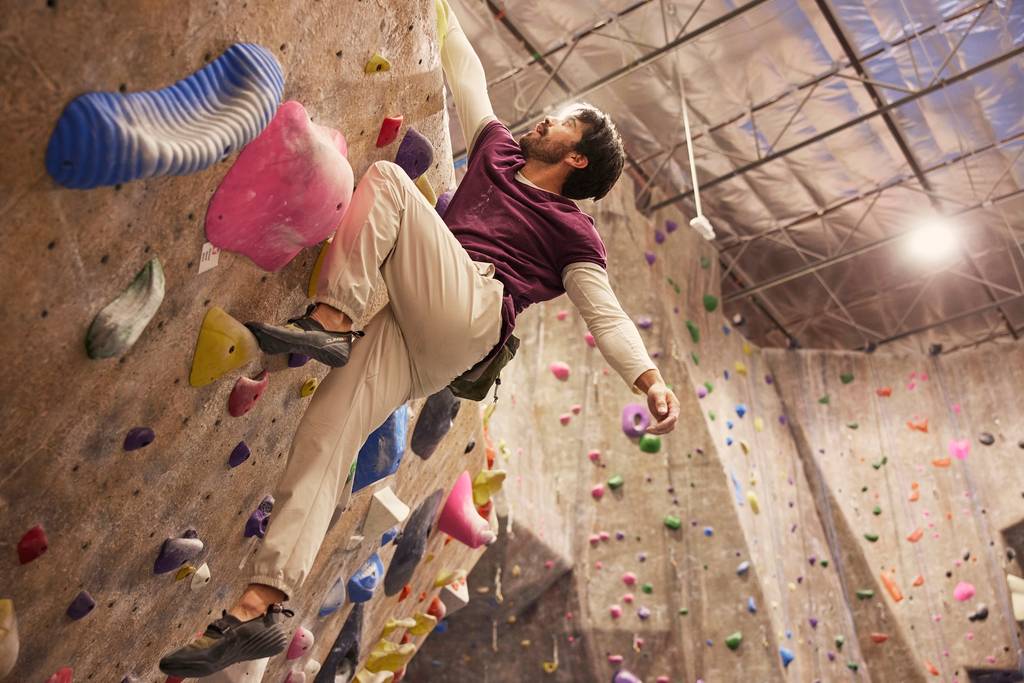

Aside from a corporate wellness plan, offering an LSA is one of the best ways to support your employees’ health and wellness. In this category, employees can spend their funds on:

- Gym memberships

- Fitness classes

- Wellness subscriptions, such as a meditation app

- Mental health support

- Home exercise equipment

The benefits of investing in employees’ wellbeing are clear. 93% of workers say their physical wellbeing impacts their productivity, while 95% say their emotional wellness impacts their productivity, according to Wellhub's State of Work-Life Wellness report.

Student Loan Repayment

Around 43% of millennials and 28% of Gen Z are working to pay off student loans, according to Bankrate. Offering student loan repayment through your company’s LSA plan will help your employees manage their debt. A loan repayment option might also make your workplace more appealing for young workers and recent college graduates.

Charitable Donations

Promote your company’s values and help foster workplace ethics by offering charitable donations in your LSA plan. You can either list eligible charities or allow employees to choose the organization they want to donate to.

Financial Services

Financial services is a helpful spending category for your staff members who value their financial wellbeing as much as their mental and physical wellbeing. This can apply to:

- Financial planning services

- Tax preparation

- Financial consultation and coaching

- Financial literacy classes

If you include financial services in your company’s LSA plan, be careful tospecify what qualifies as a financial service. This category does not include personal investments, although stock investments can be eligible as a separate category.

Return to Office Incentives

The vast majority of employees prefer to work remotely at least part of the time, according to Forbes. Hybrid work can be great for employee wellbeing, but if you want to encourage your hybrid workers to spend more time in the office, consider offering return-to-work incentives through your company’s LSA.

Eligible spending in this category can include healthy food delivery to the office, reimbursements for gas or travel expenses, vehicle maintenance, or custom desk equipment.

Pet Care

This might seem like a silly option, but pet care is a popular spending category for many LSA plans! These expenses help employees care for their furry friends while at work and may include pet-sitting services, grooming, or pet insurance.

Tax Implications and Compliance Considerations

Ideally, LSAs are flexible and adaptable for most workplaces. As long as your plan meets compliance standards, you can decide who receives the benefits, how much they’re eligible for, what they can spend it on, and how it should be taxed.

If you want to discuss the tax implications of your LSA plan in full detail with an expert, consider working with an employee benefits consultant. Here are two crucial considerations you need to know before you start developing an LSA plan.

LSAs are Not Tax-Advantaged

LSAs are non-tax-advantaged accounts. In other words, LSA reimbursements are not pre-tax deductions. That means employees must pay income tax on their LSA spending. There are two ways to handle this:

- The employer can withhold taxes based on the total amount available in the employee’s LSA.

- The employer can withhold taxes based on the amount the employee reimburses during that pay period.

The right solution for your company depends on your preferences and HR resources. It’s also important to note that because LSAs are not tax-advantaged, you cannot use them for any benefit covered by a tax-advantaged account such as an FSA or HAS.

LSAs are Not Medical Coverage

Workplace wellness is one of the most important investments you can make in your business. However, wellness support provided through an LSA is not the same as medical coverage. This is one of the most crucial compliance considerations for your LSA program.

Ensure your eligible LSA spending categories do not include anything covered under your company’s health plan, such as mental health therapy or acupuncture. Employees should understand the difference between their post-tax LSA reimbursements and tax-advantaged medical coverage.

How to Implement an LSA Program

Thinking of launching an LSA program in your workplace? Here are a few steps to help you get started.

Step 1: Set Your Goals

First, identify a few measurable goals you want to achieve with the new LSA program. Some examples might be:

- Improving employee retention

- Encouraging employees to spend more time in the office

- Empowering team members

- Boosting productivity

Step 2: Determine Your Budget

Next, decide how much allowance each employee will receive through their LSA. The national average for an LSA budget is around $750. However, depending on your company size and other benefits, you may offer more or less than that.

Step 3: Decide What is Eligible

Create eligible spending categories that fit with your LSA goals. Remember, these expenses cannot be covered under other benefits accounts — but they can be just about anything else!

Talk to your employees if you’re unsure what to include in your LSA plan. Ask what would help them reduce job creep and enjoy a happier, more productive workplace.

Step 4: Fill in the Details

Once you have your plan in place, it's time to work out the details. Work with your HR team to determine how your LSA will be taxed and how frequently it will reset. You can withhold taxes on an LSA that resets quarterly or to tax reimbursements on a larger, lifetime account. Work out the details with your HR team and, when in doubt, ask your employees what they’d prefer.

Step 5: Keep Your Team Informed

Finally, keep your team up-to-date as you launch your LSA program. It may help to hold individual meetings to ensure every staff member understands how their account works and what they can spend it on.

Ways to Measure the Success of your LSA Program

Want to exceed employee expectations? Remember, your LSA program is not set in stone once it launches. Track its success and make changes as necessary to keep your team happy.

A few key success indicators include:

- Employee engagement: Are people using their LSAs? Do the eligible spending categories meet their needs?

- Prospective excitement: Do prospective employees respond positively to the LSA program during their interview with HR?

- Work performance: Is the LSA program positively affecting work performance? Track this in terms of productivity, efficiency, or output.

Support Employee Wellbeing with LSAs

Lifestyle spending accounts are flexible, adaptable, and a great way to promote wellbeing in the workplace. Starting an LSA program in your office allows your employees to spend their benefits on the things that matter most to them.

A corporate wellness program will complement your LSA plan by boosting employee engagement and supporting a happier, healthier work environment. Programs like Wellhub help employees enjoy work-life wellness — regardless of how they spend their LSA. If you want to learn more about corporate wellness, connect with a wellbeing specialist for more details.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- 19 Essential HR KPIs for Effective Management

- The 30 Best Recruitment Tools for Forward-Thinking HR Leaders

- The Ultimate Guide to Launch and Run a Successful Employee Wellbeing Program (A Step-by-Step)

References:

- What do employees value most? top trends and statistics. Blue Beyond Consulting. (n.d.). https://www.bluebeyondconsulting.com/blog/what-do-employees-value-most/

- McCann, D. (2023, August 16). 75% of large employers offer lifestyle spending accounts: Study. CFO. https://www.cfo.com/news/lifestyle-spending-accounts-FSA-HSA/690996/

- Bareham, H. (2023, October 19). Which generation has the most student loan debt?. Bankrate. https://www.bankrate.com/loans/student-loans/student-loan-debt-by-generation/#stats

- Haan, K. (2024, June 10). Remote work statistics and trends in 2024. Forbes. https://www.forbes.com/advisor/business/remote-work-statistics/

- Omnify employee health benefits. Union Bank & Trust. (2022, July 22). https://www.ubt.com/health

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

By subscribing you agree Wellhub may use the information to contact you regarding relevant products and services. Questions? See our Privacy Policy.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

By subscribing you agree Wellhub may use the information to contact you regarding relevant products and services. Questions? See our Privacy Policy.

You May Also Like

What Are Fringe Benefits? | Wellhub

Learn about the different types of fringe benefits, their tax implications, and how they can benefit both employers and employees.

Designing Benefits for Employee Retention Long-Term | Wellhub

Tired of employees quitting out of the blue? Here’s how to craft a benefits package that’ll have your talent sticking like glue.

Employee Wellness Programs: Key Components for Success | Wellhub

Transform your workplace wellness strategy by integrating physical, mental, financial, and social wellbeing into a comprehensive wellness program that works