Top 8 Employee Benefits Trends Shaping 2025

Last Updated Jun 4, 2025

The traditional benefits package is obsolete.

Gone are the days when a standard health insurance plan and a 401(k) were enough to attract top talent. Today’s employees are looking for jobs that support their overall wellbeing rather than just physical health and retirement.

In fact, as revealed in Wellhub’s State of Work-Life Wellness 2025 report, 88% of workers think their wellness is just as important as their salary.

So what can you do to catch up with this sea change?

Forward-thinking companies are responding to these changes in employee dynamics by revamping their benefits strategies. They’re moving away from rigid and inflexible benefits packages to personalized solutions that acknowledge each employee’s unique needs and circumstances.

As an HR leader, staying on top of these employee benefits trends will help you stay competitive and keep your employees happy, engaged, and thriving.

Trend 1: Personalized Benefits

A one-size-fits-all benefits package won't do much when it comes to attracting and retaining talent. The workforce has changed, and potential employees expect benefits that fit their unique needs and lifestyles. But this shift isn’t just about employee preferences. It’s about recognizing that your Gen Z intern might need different support than your senior manager with three kids.

You can support your employees in all stages by offering:

- Flexible workarrangements: The future of work is flexible. In fact, almost 95% of workers benefit from flexible schedules, according to a Deloitte survey. Offer remote work, hybrid schedules, or compressed workweeks that let employees choose when and where they work best. Some might thrive in a quiet home office, while others need the energy of workplace collaboration.

- Choice-based benefits plans: Create benefits options that let employees build their ideal package. Include traditional options like health insurance along with newer benefits like pet insurance or fertility treatment coverage. Let employees allocate their benefits budget according to their priorities.

- Lifestyle spending accounts: Give employees the freedom to invest in what matters most to them. These accounts can cover everything from fitness classes to professional development courses, home office equipment, and even mental wellness support.

- Customizable health plans: Offer tiered health insurance options that let employees choose their coverage level and deductible. You can also offer add-ons like dental and vision, and specialized care so employees can build the plan that works best for them.

- Professional development funds: Create personalized learning budgets that employees can use for courses, certifications, or conference attendance based on their career goals. This is one of the most popular benefits, as over 90% of workers consider professional development to be important, according to a BetterBuys survey.

Creating Personalized Benefits That Actually Get Used: An Action Plan

Today’s employees want more than just coverage—they want choice. Personalization isn’t a luxury anymore; it’s the expectation. And it can be your secret weapon for boosting retention, engagement, and wellbeing. But to create a truly personalized benefits experience, HR teams need a clear, scalable approach.

Here’s how to bring personalized benefits to life in your organization:

Step 1: Understand your workforce’s needs

The first step to personalization is insight. Conduct regular pulse surveys, demographic analyses, and 1:1 interviews across departments and levels. Ask employees what benefits they currently use, what they don’t, and what’s missing. Don’t assume—ask. Needs vary wildly between generations, roles, life stages, and even zip codes.

Step 2: Build a flexible benefits infrastructure

One-size-fits-all is out. Look for benefits providers that allow modular or à la carte options. You might offer a cafeteria-style plan with core essentials (health, dental, vision) and a set of “flex” benefits—like fertility care, pet insurance, or home office stipends—so employees can design their own experience.

Step 3: Introduce lifestyle spending accounts (LSAs)

LSAs are a powerful personalization tool. They empower employees to use their funds on whatever matters most—whether that’s a gym membership, mindfulness app, or a new standing desk. Set parameters that align with your values, but allow for choice within those bounds. This flexibility can fill gaps where traditional benefits fall short.

Step 4: Launch with clear communication and decision support

Even the most customizable benefits package won’t make an impact if employees don’t understand it. Use benefits platforms that show personalized dashboards, provide side-by-side plan comparisons, and highlight unused offerings. You can even embed AI-powered tools that guide employees based on their life stage, health history, or goals.

Step 5: Monitor, measure, and adapt

Track utilization by demographic group, department, and tenure. Which benefits are popular with Gen Z? Which ones are underused by new parents? Use this data to refine your offerings over time. Consider creating a “benefits advisory board” made up of employees to review feedback and co-create future options.

Trend 2: Holistic Wellbeing

Offering a gym membership is great, but it's not enough to cover all of aspects employee wellbeing. Today's workforce wants support for their whole selves — mind, body, and wallet. As revealed in Wellhub’s Return on Wellbeing 2024 report, 85% of workers think their workplace should help them improve their wellbeing. And more than half of all workers are even willing to change jobs to find employers who prioritize their wellbeing, according to a Maven report.

Here’s how to offer holistic wellbeing:

- Mental wellness support: Provide multiple ways to access mental health support, from counseling services through EAPs to subscriptions for meditation apps. Include stress management workshops and create quiet spaces for mindfulness practice during the workday.

- Financial wellness resources: You can help employees reduce money stress through financial planning tools and education. Consider offering student loan repayment assistance, financial advisors, and emergency savings programs that give your employees an extra safety net.

- Physical health programs: Working out can increase productivity in workers, according to a 2024 study published in the Journal of Modern Medicine. That’s why it’s so important to create comprehensive physical wellness programs that go beyond basic fitness. Include regular health screenings, ergonomic workspace assessments, and engaging fitness challenges that build team spirit while promoting health.

Building a Holistic Wellbeing Strategy: Your Step-by-Step Action Plan

Your employees are whole people—so your wellbeing programs should support their whole selves. That means going beyond fitness stipends and offering care for their minds, bodies, and financial lives. In fact, 85% of workers believe their employer should help them improve their wellbeing. And more than half say they’d leave for a company that does it better.

So how can you deliver on that expectation without overwhelming your HR team?

Here’s a practical path to building a holistic, integrated wellbeing program:

Step 1: Conduct a whole-self wellbeing audit

Start with a clear picture. Audit your current offerings across four key pillars: mental, physical, social, andfinancial wellbeing. Where are the gaps? Are you providing access to mental health resources—but nothing for financial literacy? Are your fitness offerings inclusive of all fitness levels and schedules? A well-rounded audit will highlight where your program needs to grow.

Step 2: Map offerings to employee life stages

Different employees have different wellbeing priorities. Your early-career staff may need budgeting tools or sleep support. Parents might be looking for stress management resources. Use internal data or employee surveys to segment your workforce and identify what matters most at each stage of life and career. Then map your benefits to support those needs.

Step 3: Integrate access through a single platform

To make a holistic program usable, it also needs to be simple. Use a centralized benefits platform—like Wellhub—that brings together fitness options, mindfulness tools, financial resources, and personalized coaching in one digital hub. This saves your team administrative time and helps employees easily explore everything available to them.

Step 4: Support behavior change with ongoing engagement

Offering great resources isn’t enough. You need to activate them. That means launching wellness challenges, hosting live sessions on stress management or budgeting, and sending out regular wellbeing campaigns. Consider offering incentives for participation or recognizing team members who prioritize their health.

Step 5: Measure impact beyond usage

Look beyond log-ins. Track wellbeing metrics like absenteeism, retention, employee satisfaction, and even biometric health data (where applicable). Supplement the numbers with qualitative feedback—ask employees how their lives are changing because of the support they’re receiving. This is where you’ll find your program’s true ROI.

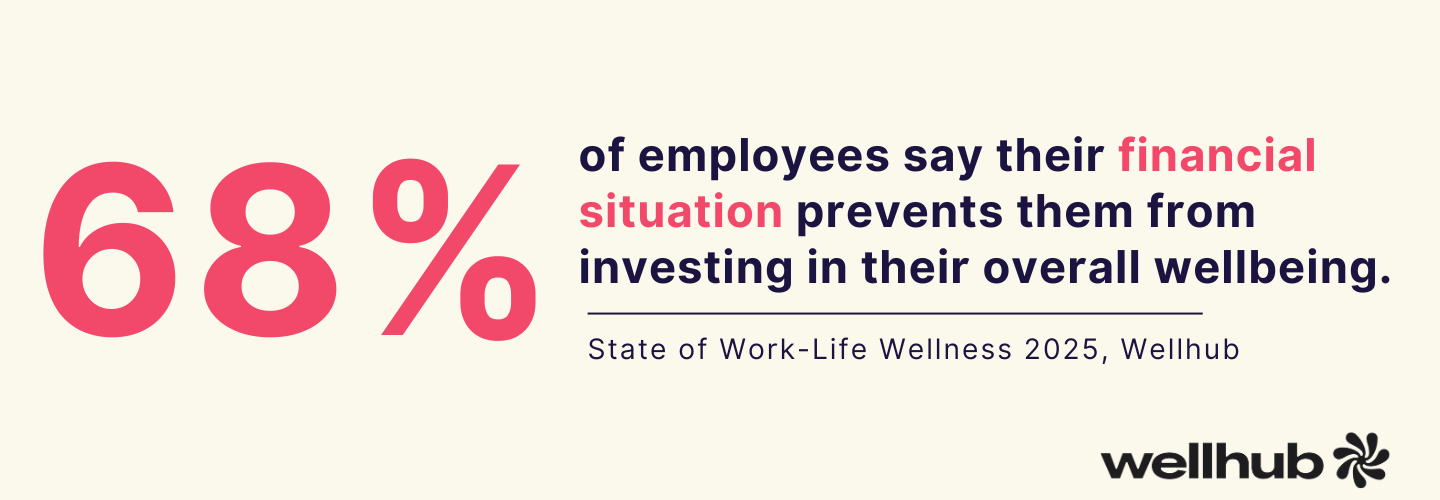

Trend 3: Financial Wellness

Financial stress affects everything from workplace productivity to mental wellness. In fact, about one-quarter of workers think that financial concerns affect their workplace productivity, according to a SoFi study. That’s why smart employers are expanding their financial wellness offerings beyond the basic 401(k) plan to help employees build real financial security.

Try offering some of these options to your employees:

- Financial literacy programs: Launch comprehensive financial literacy programs that meet employees where they are. Some might need basic budgeting strategies while others may benefit from advanced investment strategies. Give them the tools they need to make financial planning an exciting — not stressful — experience.

- Retirement planning support: Offering retirement accounts is just one part of the equation. Your employees also need the education and support to use them effectively, including workshops, financial counseling, and the right budgeting apps.

- Emergency savings funds: Help employees build financial resilience through emergency saving or disaster relief initiatives. You could implement programs that make saving automatic and easy, or even consider matching employee contributions to emergency funds.

- Employee assistance programs (EAPs)with financial counseling: Partner with financial professionals who can provide personalized guidance to your employees. Look for EAPs that include financial counseling and explore bringing financial advisors for regular office hours or consultation sessions.

- Student loan support: Many of your employees may be saddled with college debt, especially in your entry-level positions. These programs are designed to help workers tackle their student loans. This could include direct contribution programs where the company makes payments toward employee student loans, refinancing resources, or financial counseling specifically focused on debt management.

- Financial wellness technology: An easy win is to provide discounted or complimentary subscriptions to financial wellness apps and platforms. Look for tools that combine budgeting features, investment tracking, and educational resources in a user-friendly interface. These platforms can offer personalized recommendations based on individual financial goals and circumstances.

How to Launch Financial Wellness Support

Step 1: Evaluate current offerings and identify gaps

Start by looking at what you currently provide—retirement accounts, financial counseling,tuition reimbursement. Then assess how widely those benefits are used. Low engagement might point to low awareness, or it might mean they’re missing the mark. Compare your offerings with industry benchmarks and employee needs to spot opportunities for growth.

Step 2: Launch a tiered financial education program

Not everyone’s starting in the same place. Some employees need help understanding their paycheck. Others are trying to buy their first home. Build a financial literacy program with beginner, intermediate, and advanced tracks. Include topics like debt management, credit building, and investment planning, and make resources available on demand so employees can learn on their schedule.

Step 3: Automate access to savings tools

Saving money should be as easy as spending it. Offer payroll-integrated emergency savings accounts and allow employees to set automatic contributions. Consider providing employer match incentives to jumpstart savings goals. You’ll be building financial resilience across your workforce—especially for those who need it most.

Step 4: Make debt management a core focus

Student loans and credit card debt are major stressors, especially for early-career employees. Create programs that support student loan repayment—whether through direct contributions, refinancing support, or financial coaching. Offer workshops or 1:1 counseling to help employees understand their repayment options and build realistic payoff plans.

Step 5: Incorporate tech-based financial wellness solutions

Provide access to modern financial wellness platforms that offer budgeting tools, goal tracking, investment education, and AI-powered recommendations. Choose tools that are mobile-friendly and built for all levels of financial literacy. Bonus points if they integrate with your existing HR or payroll systems to streamline onboarding.

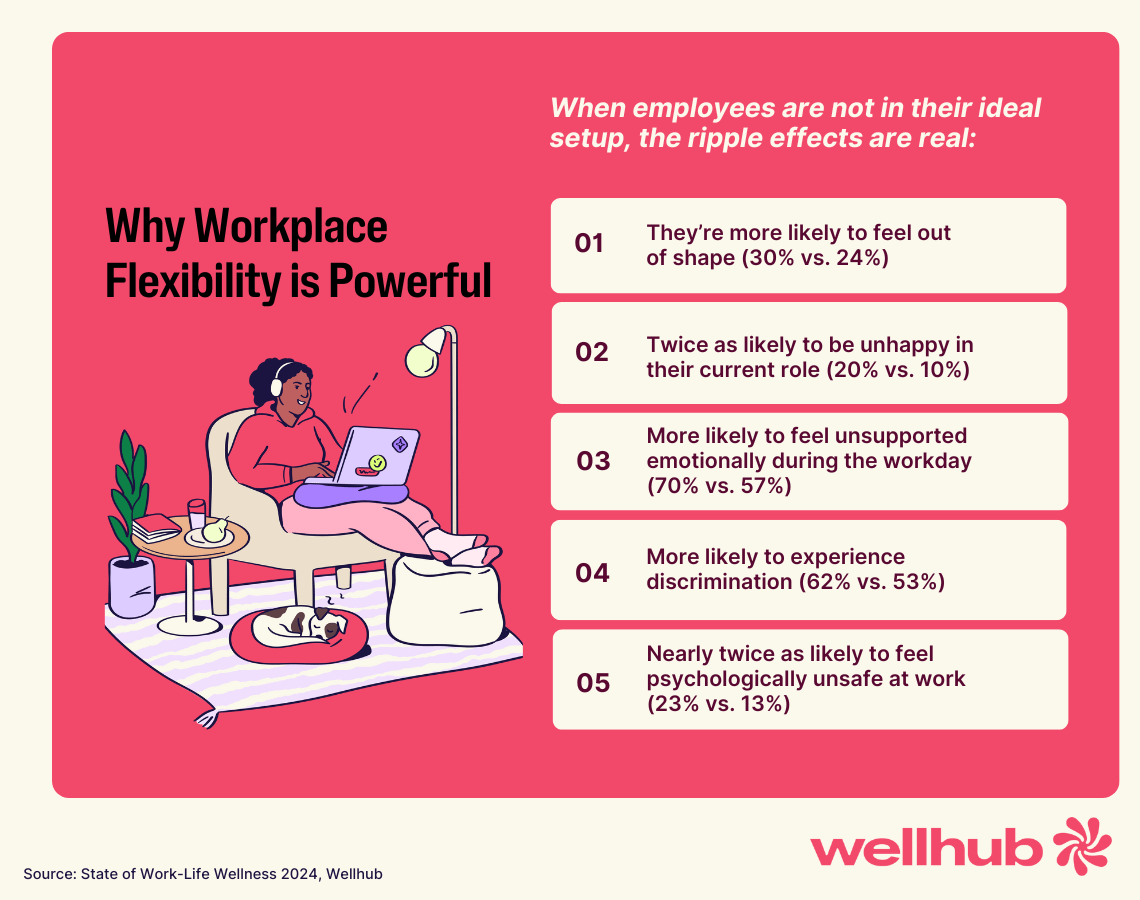

Trend 4: Flexibility

The traditional 9-to-5 office schedule is, perhaps shockingly, becoming obsolete. This shift represents a fundamental change in how workers think about work, moving away from the traditional requirement of working at an office to instead working where they work best.

Try some of these strategies for flexibility:

- Remote workoptions: Offer fully remote positions that let employees work from anywhere. To do this, you’ll want to have the necessary technology, set up clear communication protocols, and create virtual team-building opportunities that maintain connection across long distances.

- Hybrid workmodels: An easy way to dip your toes in the remote work world is to offer some hybrid opportunities that combine office and remote work. Some teams may need constant collaboration while others don’t. So, let your teams determine their optimal mix of in-office and at-home days.

- Flexible scheduling: You can support your employees by going beyond rigid workday structures to embrace models like flex time, compressed workweeks, or adjusted hours for different time zones. Create clear documentation practices, use virtual collaboration tools, and establish guidelines for when real-time interaction is necessary versus when work can flow independently.

- Unlimited PTO: Think about implementing unlimited paid time off policies that focus on results rather than hours worked. To do this, start by creating guidelines that prioritize actual results over simply spending time at the office.

- Job sharing: Create opportunities for two employees to split one full-time position temporarily or permanently. This can give workers the time to focus on other endeavors or tend to personal matters while staying productive at work.

How to Build a Flexible Culture of Work

Employees want more control over when and where they work, and companies that offer this flexibility are more likely to attract and retain top talent. The challenge? Making it work at scale, without losing consistency or collaboration.

Here’s how to put flexible work models into action—thoughtfully and sustainably:

Step 1: Survey your workforce

Before making any changes, ask your employees what flexibility actually means to them. Do they want remote options? Flex hours? Four-day weeks? Collect feedback through anonymous surveys and focus groups, and segment your responses by role, team, and location. This will help you avoid a one-size-fits-all approach.

Step 2: Align flexibility with job functions

Not every role can be remote or asynchronous—but many can be more flexible than they are today. Work with department heads to assess which roles are suited for remote work, which can support flexible hours, and which may require in-office time. Use this information to create role-based flexibility guidelines that are consistent, equitable, and realistic.

Step 3: Establish a flexible work policy framework

Document everything. Define expectations around communication, availability, response times, and results. Whether it’s a hybrid schedule, compressed workweek, or unlimited PTO, make sure your policy sets clear guardrails to keep teams aligned and productive.

Step 4: Equip managers to lead flexibly

Give your people leaders the training and tools they need to manage remote or hybrid teams. This includes setting performance goals based on outcomes, not hours. It also means fostering psychological safety, modeling healthy work-life wellness, and knowing how to build connection across distance.

Step 5: Pilot, evaluate, and refine

Don’t go all-in without a test drive. Start with a pilot program—maybe one department goes hybrid or tries out a four-day week. Track engagement, productivity, and team feedback. Use the insights to tweak your policies and expand what works.

Trend 5: Integrating DEI

Diversity, equity, and inclusion (DEI) can have a tremendous impact on your team’s emotional and mental wellbeing. This is evident in your team’s productivity, as employees who feel heard at work are more than three times as likely to be highly engaged, according to Forbes. That’s why it’s so important to understand and support the diverse needs of your workforce with offers such as:

- Inclusive parental leave policies: Implement gender-neutral parental leave policies that support all types of families. Include adoption, surrogacy, and foster care support to allow your employees to build their families in the way that works best for them. And don’t forget to include single parents and same-sex couples in your guidelines.

- Fertility benefits for LGBTQ+ employees: Expand fertility and family-building benefits to support LGBTQ+ employees and others pursuing non-traditional paths to parenthood. Include coverage for treatments like IVF, egg freezing, and surrogacy services.

- Culturally relevant benefits: As a diverse employer, your benefits should reflect and respect different practices and beliefs. This might include flexible holidays for different religious observances, mental health providers from diverse backgrounds, or benefits that cover alternative medicine practices.

- Disability support: Create comprehensive support systems for employees with disabilities. Include coverage for assistive technologies, workplace modifications, and specialized healthcare needs. Also, your benefits communications and platforms should be fully accessible to employees with disabilities.

Conducting a Benefits Equity Audit

Doing a benefits equity audit is a great way to see how your benefits measure up when it comes to diversity. A regular equity audit can help you change your offerings so that you can support all employees fairly, regardless of their background or circumstances. Here’s how to do one:

Step 1: Data collection

Start by gathering comprehensive data on benefits utilization across different employee demographics. Look at who’s using which benefits, identify any patterns in enrollment rates, and analyze participation across departments, levels, and locations. The more data you gather, the more accurate your audit will be.

Step 2: Review your current policies

Carefully comb through the language in your benefits documentation. Check for unintentionally exclusive terms or requirements that might create barriers for certain groups. Review eligibility criteria, waiting periods, and coverage definitions.

Step 3: Evaluate communications

Think about how your benefits information is currently being communicated. Maybe there are language barriers or your remote workers don’t have access to the healthcare brochures in the HR office. Look at ways employees may be getting left out of the benefits conversation.

Step 4: Financial impact

Analyze the out-of-pocket costs and coverage levels across salary bands. Keep an eye out for disparities that might make certain benefits effectively inaccessible to lower-paid employees.

Step 5: Collect feedback

Gather anonymous input from employees about their benefits experiences and needs. Pay special attention to feedback from underrepresented groups and employees with unique circumstances to get different perspectives of how others might be perceiving your benefits.

Trend 6: Leveraging Technology and Data

Technology is constantly changing how we deliver and manage employee benefits. Smart HR leaders are using tech solutions to create more personalized, efficient, and data-driven benefits programs.

Here’s how you can join them:

- Benefits administration platforms: Implement comprehensive platforms that simplify benefits selection and management. Look for solutions that offer mobile access, intuitive interfaces, and integration with existing HR systems. These platforms should make it easy for employees to understand, compare, and choose their benefits.

- AI-powered solutions: You can now use artificial intelligence to provide 24/7 benefits through chatbots and virtual assistance. These tools can answer common questions, guide employees through enrollment, and provide personal recommendations based on individual circumstances.

- Personalized benefits portals: Create customized digital experiences that show employees their total rewards package and help them make informed decisions. These portals can have advanced tools for comparing options, calculating costs, and modeling different scenarios, ultimately helping employees make the best choices for themselves.

- Data analytics tools: Take advantage of your analytics platforms to track benefits utilization, measure program effectiveness, and identify trends. You can then use this data to make informed decisions to change your programs and offer new ones.

Putting Your Data to Work: A Tech-Driven Action Plan

If you’re exploring technology as a lever for smarter benefits, you’re in great company. HR teams across the U.S. are using data and automation to make their programs more personal, effective, and easy to manage. But to make the most of these tools, you need a clear strategy.

Here’s a step-by-step plan to help you implement a more data-driven, tech-enabled benefits experience:

Step 1: Audit your current tech stack

Start by mapping all your existing tools. What’s powering your benefits enrollment? Do you have systems for claims, communications, and reporting? Identify what’s working and what’s not. Look for manual processes, duplicate data entry, or disconnected systems that could be slowing you down.

Step 2: Define your data goals

Think about what you want to track and improve. Are you trying to increase benefits utilization? Better understand employee preferences? Reduce administrative burdens? Get specific about your KPIs—then choose tools that help you measure them. Hint: Look for platforms that include real-time dashboards and exportable reports.

Step 3: Centralize and simplify

Consolidate your tools where you can. Unified benefits platforms can help eliminate confusion and boost employee engagement. Prioritize platforms that offer mobile access, seamless HRIS integration, and AI-powered assistance. This creates a better experience for employees—and for your team.

Step 4: Personalize the employee experience

Use your data to personalize benefits communications and recommendations. Platforms with AI or machine learning capabilities can highlight unused benefits or suggest new ones based on life events (like moving, marriage, or caregiving). This kind of personalization increases usage and satisfaction.

Step 5: Set a regular review cadence

Don’t let data gather dust on a dashboard. Use it for active decision-making. Schedule quarterly or biannual reviews of benefits engagement, claims trends, and employee feedback. Use these check-ins to identify underperforming programs, measure ROI, and make timely adjustments.

When technology and data work together, HR becomes more strategic and your benefits become more impactful. This approach doesn’t just streamline administration. It helps you design benefits programs that actually get used and deliver real value.

Trend 7: Elder Care and Caregiver Support

As America’s workforce ages, more employees are finding themselves part of the “sandwich generation”—juggling their careers while caring for both children and elderly loved ones. And they’re feeling the pressure.

According to Wellhub’s State of Work-Life Wellness 2025 report, 39% of employees say work has negatively impacted their ability to care for their family or children’s mental wellness. If your organization isn’t offering support here, you could be unintentionally pushing your top talent closer to burnout—or out the door.

That’s why elder care and caregiver support benefits are more critical than ever. Thoughtful programs can help employees manage stress, stay focused, and remain engaged. Consider introducing benefits like:

- Back-up elder care services: Life is unpredictable. Having access to emergency elder care—whether in-home or at a licensed facility—can help employees handle last-minute changes without sacrificing work obligations.

- Caregiving stipends: Whether it’s hiring a home health aide or purchasing medical equipment, the cost of elder care adds up fast. Offering a monthly or annual stipend allows employees to choose what support is most helpful for their situation.

- Flexible scheduling and leave options: Not all caregiving happens in regular 9–5 blocks. Flex hours, remote work accommodations, or additional caregiver leave can empower employees to meet personal responsibilities without burning PTO or feeling overwhelmed.

- Care coordination and planning services: Navigating healthcare, insurance, and legal documents for an aging parent can be complex. Provide access to elder care specialists who can guide employees through these decisions with confidence and care.

Conducting a Caregiver Needs Assessment

Understanding your workforce’s caregiving responsibilities is the first step toward building meaningful support systems. A needs assessment can help you pinpoint what your employees actually need.

Here's how to run one:

Step 1: Survey your team

Distribute an anonymous survey that asks employees about their caregiving responsibilities. Include questions about the time they spend caregiving, the type of care provided, and their biggest pain points. Be sure to include both multiple-choice and open-text fields for nuance.

Step 2: Analyze usage and feedback on current benefits

Are employees using any current elder care resources you offer? If not, why not? Is it because of awareness, eligibility, cost, or perceived relevance? Dig into the data and look for patterns in participation and feedback.

Step 3: Facilitate listening sessions

Invite a diverse group of employees—across roles, locations, and caregiving situations—to participate in small listening sessions. These intimate conversations can reveal emotional and logistical stressors that might not come through in a survey.

Step 4: Identify gaps and quick wins

Use your findings to identify gaps in support and opportunities to make an immediate difference. Maybe your team needs more flexibility, or maybe they’re craving a peer group to share caregiving experiences. Don’t underestimate the power of quick, visible changes.

Step 5: Align with wellbeing goals

Finally, connect the dots. Link your elder care support strategy to broader company values and wellbeing goals. When caregiving benefits are framed as tools for enhancing emotional health and productivity, they become part of your organization's wellness DNA instead of a fringe offering.

Trend 8: Pet-Friendly Benefits

For many employees, pets are more than companions—they’re family. And when you support employees in caring for their pets, you’re also supporting their emotional wellbeing, mental health, and work-life wellness. A growing number of companies are recognizing this: pet-friendly benefits are quickly becoming a powerful tool for boosting employee satisfaction, engagement, and loyalty.

Offering pet-related perks isn’t just a fun add-on. It’s a real differentiator in a competitive talent market—especially for Millennials and Gen Z, who are increasingly prioritizing pet care in their lifestyle choices.

Here’s how to turn your benefits program into a paw-sitive experience:

- Pet insurance coverage: Help your employees protect their furry family members by offering pet health insurance as a voluntary or employer-subsidized benefit. Choose plans that cover routine care, emergency services, and chronic conditions. This shows your care for employees' lives outside work while reducing unexpected financial stress as well.

- Pet adoption support: Consider offering paid time off or reimbursement for pet adoption fees. You can even create partnerships with local shelters to sponsor adoption events. Welcoming a new pet into the home is a major life event. Treating it like one creates lasting loyalty.

- Pet bereavement leave: Losing a pet can be heartbreaking. Providing a day or two of paid bereavement leave acknowledges the emotional toll and gives your employees space to grieve without guilt or pressure.

- Pet-friendly office policies: If your workplace has in-person components, explore making it pet-friendly. Establish clear guidelines around pet behavior, cleanliness, and employee comfort to ensure it’s a positive experience for everyone. Allowing pets in the office can boost morale and reduce stress, especially during high-pressure weeks.

- Discounts and perks for pet care: Offer stipends or discounts on pet food, grooming, daycare, and boarding services. Partner with national or local vendors to provide preferred pricing to employees. These small savings add up, especially for multi-pet households.

How to Identify the Most Impactful Pet Perks for Your Workforce

Before you roll out a new pet-friendly perk, it’s helpful to understand how much interest there is—and what kinds of support employees are most excited about.

Here’s how to assess that interest:

Step 1: Send out a short survey

Ask employees about their current pet ownership status, interest in pet-related benefits, and what kinds of support would be most meaningful to them. Keep it short and use a mix of multiple choice and open-ended questions.

Step 2: Analyze demographic and usage trends

Cross-reference survey data with generational trends and location-based needs. Younger employees might prefer pet insurance, while those in urban areas may value dog walking or daycare discounts more.

Step 3: Host a feedback session

If interest is high, invite a group of pet-loving employees to brainstorm and prioritize potential benefits. This gives your team rich insights while showing employees that you’re listening.

Step 4: Launch a pilot program

Test a single benefit—like pet insurance or a pet adoption stipend—for a few months. Track enrollment, usage, and employee satisfaction to measure its impact.

Step 5: Communicate and celebrate

Make it fun! Celebrate National Pet Day or host a pet photo contest to build excitement around your program. Use your internal comms channels to share benefit details and employee pet stories to increase visibility and engagement.

Stay Ahead of the Curve With Competitive Employee Benefits

Today’s employees expect more than a paycheck. They want flexibility, purpose, and support for their total wellbeing. That’s why leading HR teams are rethinking their benefits strategy to reflect what really matters.

A comprehensive employee wellbeing program can serve as the foundation for your benefits strategy. By integrating physical, mental, and financial wellness initiatives, you create a support system that helps employees thrive personally and professionally.

Wellhub can help you create a program that supports your employees’ total wellbeing while improving engagement and retention. Speak with a Wellhub Wellbeing Specialist to see how we can help you revolutionize your benefits offerings!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- What HR Can Do About These 6 TikTok Job Trends

- 11 Corporate Wellness Trends Shaping 2025

- Craft a Winning Benefits Strategy: An HR Guide to Attract & Retain Top Talent

References:

- Better Buys. (n.d.). The Impact of Professional Development: Exclusive Research. https://www.betterbuys.com/lms/professional-development-impact/

- Ceniza-Levine, C. (2021, June 23). New Survey Shows The Business Benefit Of Feeling Heard – 5 Ways To Build Inclusive Teams. Forbes. https://www.forbes.com/sites/carolinecenizalevine/2021/06/23/new-survey-shows-the-business-benefit-of-feeling-heard--5-ways-to-build-inclusive-teams/

- Deloitte United States. (n.d.). Workplace Flexibility Survey. https://www2.deloitte.com/us/en/pages/about-deloitte/articles/workplace-flexibility-survey.html

- Maven Clinic. (2024). Maven’s State of Women’s and Family Health Benefits 2024. Mavenclinic.com. https://info.mavenclinic.com/pdf/state-women-family-health-benefits-2024

- SoFi. (2024). Future of Workplace Financial Wellbeing. Sofiatwork.com. https://www2.sofiatwork.com/2024FutureofWorkplaceFinancialWellbeing

- Szarek, S., Edyta Bombiak, & Aneta Wysokińska. (2024). The Role of Physical Activity in the Improvement of Well-being — The Case of University Staff. Journal of Modern Science, 56(2), 263–284. https://doi.org/10.13166/jms/188741

- Wellhub (2024, October 16). The State of Work-Life Wellness 2025. https://wellhub.com/en-us/resources/research/work-life-wellness-report-2025/

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

By subscribing you agree Wellhub may use the information to contact you regarding relevant products and services. Questions? See our Privacy Policy.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

By subscribing you agree Wellhub may use the information to contact you regarding relevant products and services. Questions? See our Privacy Policy.

You May Also Like

How to Attract and Retain Top Millennial Talent | Wellhub

Millennials are the vast majority of today's workforce. These are the millennial characteristics you should know to attract and retain this generation of employees.

Rage Applying to #LazyGirlJob: What HR Can Do About These 6 TikTok Job Trends

From Quiet Quitting to Acting Your Wage, younger generations are shouting their workplace discontent on TikTok, which is a huge help for HR leaders.

How to Manage and Support Generation Z at Work | Wellhub

Generation Z is an ambitious, purpose-driven group of workers that strives for expression and connection. Here’s how you can best support them and their career goals.