Wellness Dollars - What They Are and How to Utilize Them

Last Updated Jul 3, 2025

Are you missing out on free money?

If your company offers health insurance, there’s a good chance your HR team is leaving funds on the table—real dollars that could fund mental health support, gym memberships, financial coaching, and more.

They’re called wellness dollars. And they don’t come out of your HR budget. They’re provided by insurers to help you build a healthier, more engaged workforce.

Many HR leaders don’t know they exist. Others miss the window to use them.

These funds expire fast, come with fine print, and often require upfront planning. But when used right, they can stretch your wellness budget by tens of thousands—without asking finance for more.

Unlock the secrets to finding, using, and maximizing wellness dollars before they disappear.

What You'll Learn

- Wellness Dollars Are Untapped Budget Boosters: Many insurance plans include wellness dollars—funds that HR teams can use to support wellbeing initiatives without increasing internal spend. These dollars can boost your wellness budget by 40% or more but often expire quickly if not used.

- Strategic Use of Wellness Dollars Drives Business Impact: When invested in physical, mental, and financial wellbeing programs, wellness dollars reduce healthcare costs, lower absenteeism, and improve retention—delivering up to 2x ROI and measurable productivity gains.

- Eligible Programs Span Wellness Domains: Wellness dollars can fund gym memberships, fitness trackers, mental health services, sleep and nutrition programs, financial coaching, and more—offering meaningful support for diverse employee needs.

- Compliance and Timing Are Crucial: Each insurer has specific rules around fund allocation, eligible expenses, and reimbursement processes. To maximize usage, HR must confirm allocations early, understand deadlines, and track documentation requirements closely.

- Collaboration Unlocks Full Potential: Working with brokers, vendors, and wellness partners like Wellhub ensures alignment with insurer guidelines, simplifies program design, and helps secure matching incentives or engagement bonuses for even greater value.

What are Wellness Dollars?

Wellness dollars are funds provided by health insurance companies to employers to support employee wellness initiatives. Think of them as a built-in budget line for wellbeing, included in your organization's benefits plan.

They’re designed to go beyond traditional coverage. While your insurance plan might pay for doctor visits and prescriptions, wellness dollars give your organization the power to support physical, mental, and even financial wellbeing in proactive, lifestyle-oriented ways.

Wellness dollars are allocated by your health insurer, and you can use them to fund or offset the cost of wellness programs and resources for your employees. These dollars often have an expiration date and must be used within a specific plan year.

For example: Let’s say you have a $50,000 internal budget for wellness. Your insurance provider offers an additional $20,000 in wellness dollars.

Now you’re working with $70,000 in program funding—without touching other budget categories. That gives you a 40% increase in spending power, simply by activating a benefit you already have access to.

Why are Wellness Dollars Valuable?

When employees thrive, business does too. It's that simple—and that powerful. A well-designed wellness program isn’t just about perks or morale. It’s a proven strategy that reduces costs, boosts productivity, and helps organizations retain their best people.

- Lower Healthcare Costs

The logic here is straightforward: healthier employees file fewer insurance claims. Preventive wellness programs—from stress reduction workshops to fitness access—can keep chronic conditions at bay and help catch health issues early.

And the data? It backs it up: 91% of HR leaders say their wellness program reduces healthcare costs.

In other words, every dollar you spend on wellness today could mean less spending on treatments, hospitalizations, and medications tomorrow.

- Increased Productivity

Wellness isn’t just about feeling good. It’s about functioning better.

Whether it’s better sleep, lower stress, or more movement, employees who prioritize their wellness are sharper, more focused, and more engaged at work. That’s why 99% of HR leaders report productivity improvements from wellness programs.

And we’re not talking small gains—nearly half say the increase in productivity is major.

- Fewer Sick Days and Absenteeism

When wellness improves, absenteeism drops. Employees are less likely to call out sick and more likely to bounce back quickly from illness or burnout: 89% of HR leaders see a reduction in sick days from wellness investments. Some companies report up to five fewer sick days per employee, per year. That’s a full extra week of work — meaning there’s more consistency, more momentum, and less operational friction.

- Better Recruitment, Lower Turnover

Wellness is no longer a differentiator—it’s an expectation. Candidates are actively seeking companies that prioritize their wellbeing: 89% of employees will only consider employers that emphasize wellness in their next job hunt. And 83% of employees would consider leaving a company that does not focus on employee wellbeing.

That means wellness is key to creating and keeping your workforce.

Wellness Dollar Program Examples

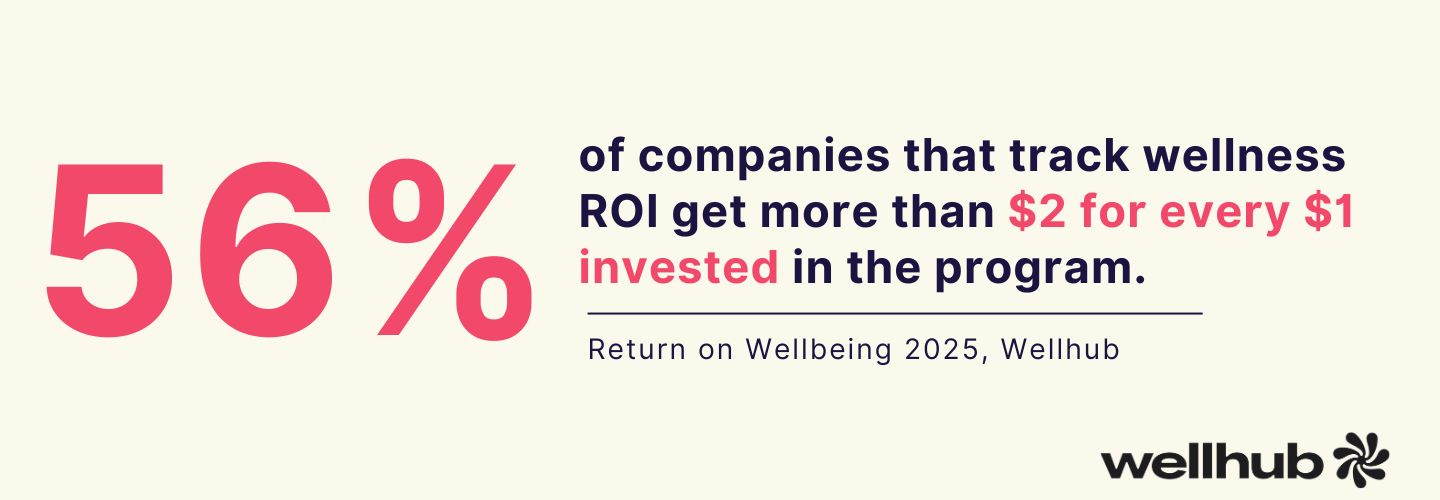

Budgets can be a limiting factor for any HR department looking to roll out a new wellbeing initiative. Even though 9 out of 10 companies see a positive return on investment from employee wellness programs, it can be difficult to convince leadership to set aside money for gym subscriptions when just continuing to operate is getting more and more expensive.

This is where the magic of wellness dollars comes into play.

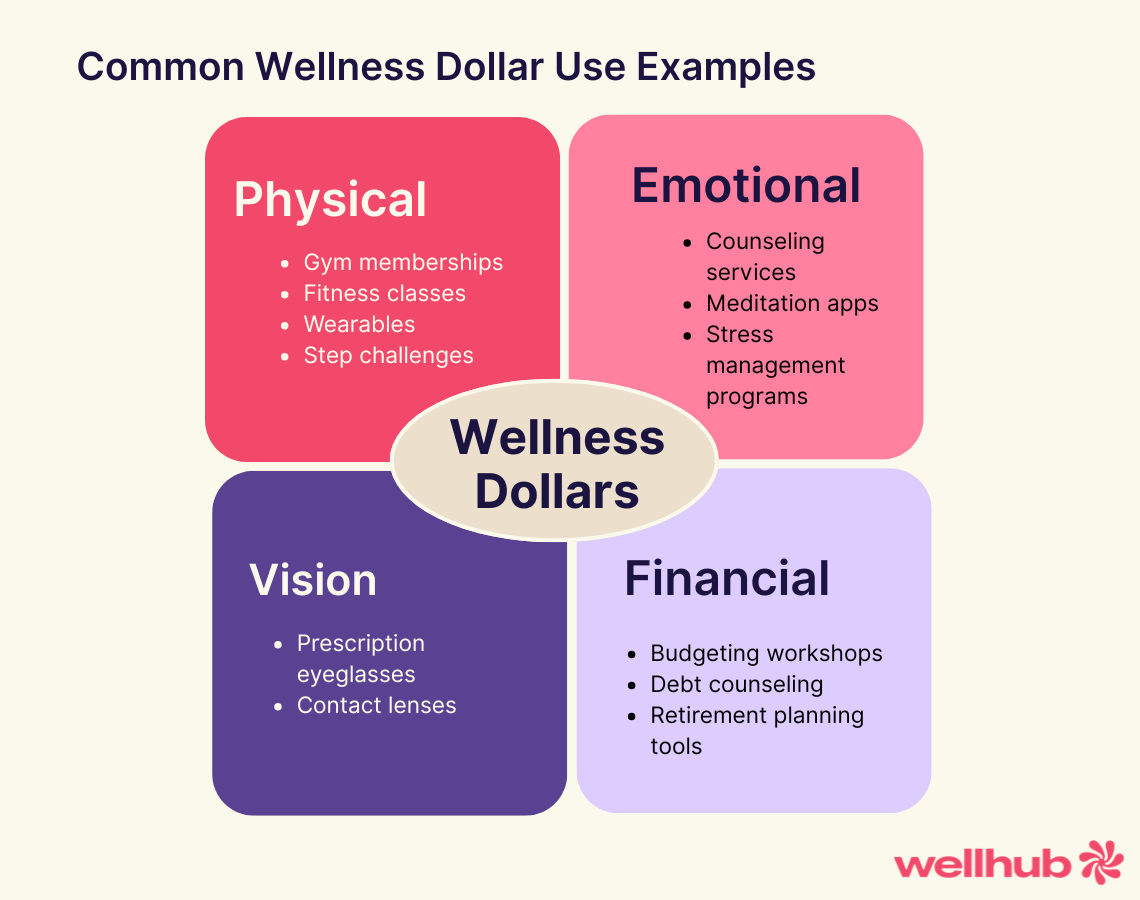

Physical Wellbeing

Physical wellness is a foundational part of overall employee health. With wellness dollars, you can empower your team to move more, build strength, and boost their energy.

- Gym memberships: Offer your team access to fitness centers in your community, or nationwide through platforms like Wellhub.

- Fitness classes (live or virtual): Whether it’s lunchtime yoga, HIIT bootcamps, or a subscription to on-demand workouts, classes help people find a routine they love.

- Weight management programs: From step challenges to coaching and seminars, wellness dollars can help your team maintain a healthy weight.

- Health and wellness challenges: Launch team-wide initiatives like hydration, step-count, or “movement minutes” competitions to keep participation high and spirits lifted.

Mental Wellness Support

Mental and emotional wellbeing are no longer optional workplace concerns—they’re essential. Fortunately, wellness dollars can support many programs that promote psychological safety and mental strength.

- Therapy and counseling services: Offset or cover sessions with licensed professionals or digital mental health platforms.

- Mindfulness and meditation classes: Offer guided meditation, breathing workshops, or app subscriptions.

- Stress management programs: Host seminars or bring in coaches to help your team manage pressure in healthier ways.

- Resilience and burnout prevention workshops: Use wellness dollars to teach sustainable coping strategies that help employees navigate tough moments with confidence.

Lifestyle and Holistic Wellness

Wellbeing is about more than fitness. It’s also about the everyday habits that shape a person’s life—what they eat, how they connect, and how they find balance.

- Nutrition seminars or healthy cooking classes: Help employees build sustainable eating habits through expert-led workshops.

- Sleep health programs: Use funds to offer sleep coaching or tools like sleep trackers that help employees build better rest routines.

- Volunteer opportunities: Fund group volunteer days to promote community connection and purpose.

- Holistic wellness programs: This might include acupuncture, massages, or energy therapy—services that go beyond what traditional health plans typically cover.

Tech and Tracking

Wellness dollars can also help you equip employees with tools to take control of their health in a data-driven, engaging way.

- Fitness trackers (like Apple Watches): Provide wearable devices to support wellness initiatives like walking challenges or heart-rate-based fitness goals.

- Sleep trackers: Help employees monitor and improve rest quality as part of a sleep health program.

- Mobile health apps: Subsidize tools that encourage habit-building, mindfulness, movement, or hydration.

- Accountability tech: Offer access to virtual wellness coaches or platforms that help employees stay on track.

Financial Wellness

Money stress doesn’t stay at home—it comes to work. Nearly 70% of employees say their financial situation prevents them from investing in their wellbeing. With wellness dollars, you can support financial fitness too.

- Financial literacy workshops: Host live or virtual sessions covering budgeting, credit management, or debt reduction.

- Retirement planning education: Bring in experts to help employees plan for long-term security.

- Access to financial coaches or counselors: Partner with certified financial planners for one-on-one support.

- Money management apps: Offset the cost of platforms that track expenses, provide education, and reduce financial stress.

How Wellness Dollars Can Expand Your Benefits Budget

- They let you offer more without increasing your spend

If you’ve ever hesitated to launch a new wellness initiative due to budget constraints, wellness dollars can unlock those opportunities. You can use them to fund:

- Access to Wellhub or fitness memberships

- Mental health platforms or counseling stipends

- Financial wellness workshops

- Sleep and stress management programs

Each of these adds tangible value to your benefits offering without requiring additional spend from your HR budget.

- They offset costs you’re already covering

Already offering meditation classes or a step challenge? Running an internal health campaign? Wellness dollars can help cover those costs. That means you can recoup part of your existing investment and reinvest it in other employee experience priorities—like flexible work options, recognition programs, or manager development.

- They help reduce long-term costs

Investing in wellness pays off. When employees feel supported and stay healthy, companies typically see lower healthcare claims, improved productivity, and better retention.

According to the Return on Wellbeing 2024 study, 91% of companies say their wellbeing program reduces healthcare costs, while 98% report reduced turnover and 99% see a boost in productivity. When wellness dollars fund the right programs, that value compounds.

Key Wellness Dollar Considerations for HR Teams

Before you launch any initiative using wellness dollars, it’s important to get grounded in the details. These funds can make a big impact—but only if you understand the guardrails that come with them.

Every insurer structures their program a little differently, so clarity upfront helps you avoid compliance hiccups and ensures you get the most from your allocation.

Here’s exactly what to confirm before you start spending:

- Understand your total allocation

Your annual wellness dollar allocation is typically set by your health insurance provider and may vary based on:

- The number of enrolled employees

- Your group size or premium tier

- Prior year claim history or engagement metrics

Ask your broker or insurance account manager:

- What is our total allocation for this plan year?

- Can the amount be increased through plan design changes or renewal negotiations?

- Is there a minimum participation rate we need to meet to unlock the funds?

💡Pro tip: If your company is close to a tier threshold, a small enrollment change could unlock thousands more in funding.

- Confirm your spend-by deadlines and rollover policies

Most wellness dollar programs operate on a “use it or lose it” basis. This means:

- Funds typically expire at the end of your plan year

- Unused funds do not roll over into the next year (unless explicitly allowed)

Ask:

- What is the official start and end date for this year’s wellness dollar allocation?

- Is there a grace period for submitting expenses?

- Can any funds be carried over or banked?

💡Pro tip: Set internal checkpoints each quarter to monitor usage and avoid a last-minute scramble in Q4.

- Review eligible expenses and restrictions

Wellness dollars don’t cover just anything. Most insurers provide a list of pre-approved categories and may require you to use specific vendors.

Commonly approved expenses include:

- Fitness classes or memberships

- Mental health support (apps, workshops, EAP enhancements)

- Financial wellbeing programs

- Health risk assessments and biometric screenings

- Ergonomic equipment or onsite massage therapy

Fewer plans will allow dollars to be used for:

- Swag, apparel, or food

- General HR software

- Events that aren’t health-focused

Ask:

- Do we need to submit a proposal for each expense?

- Are vendor invoices required before or after the event/purchase?

- Is Wellhub an eligible vendor under our plan?

- Know your documentation and reimbursement process

Every plan will have specific paperwork and proof-of-spend requirements. Some may require:

- Itemized invoices

- Receipts tied to specific program outcomes

- A wellness plan proposal in advance

Ask:

- Do we need to pre-approve purchases with our insurer?

- What documentation is required to process reimbursement?

- What’s the turnaround time for reimbursement?

💡Pro tip: Assign one internal owner to manage submission timelines and paperwork. Better yet, build a quick internal checklist for every approved expense to keep things simple.

- Ask about incentive matching and engagement bonuses

Some insurers offer matching programs or engagement incentives to encourage meaningful wellness investments. You may be able to double your available funds or unlock bonus dollars for:

- Hitting biometric screening targets

- Launching multi-week wellness campaigns

- Partnering with evidence-backed vendors

Ask:

- Are any matching funds or bonus programs available this year?

- What outcomes do we need to hit to qualify?

- Are digital or hybrid programs eligible?

Work with your broker and vendor partners

You don’t have to go it alone. Your broker or insurance account manager can walk you through eligible expenses, deadlines, and setup steps. And if you're working with a wellness vendor like Wellhub, we can help you structure a plan that aligns with your insurer’s guidelines—maximizing your impact while minimizing red tape.

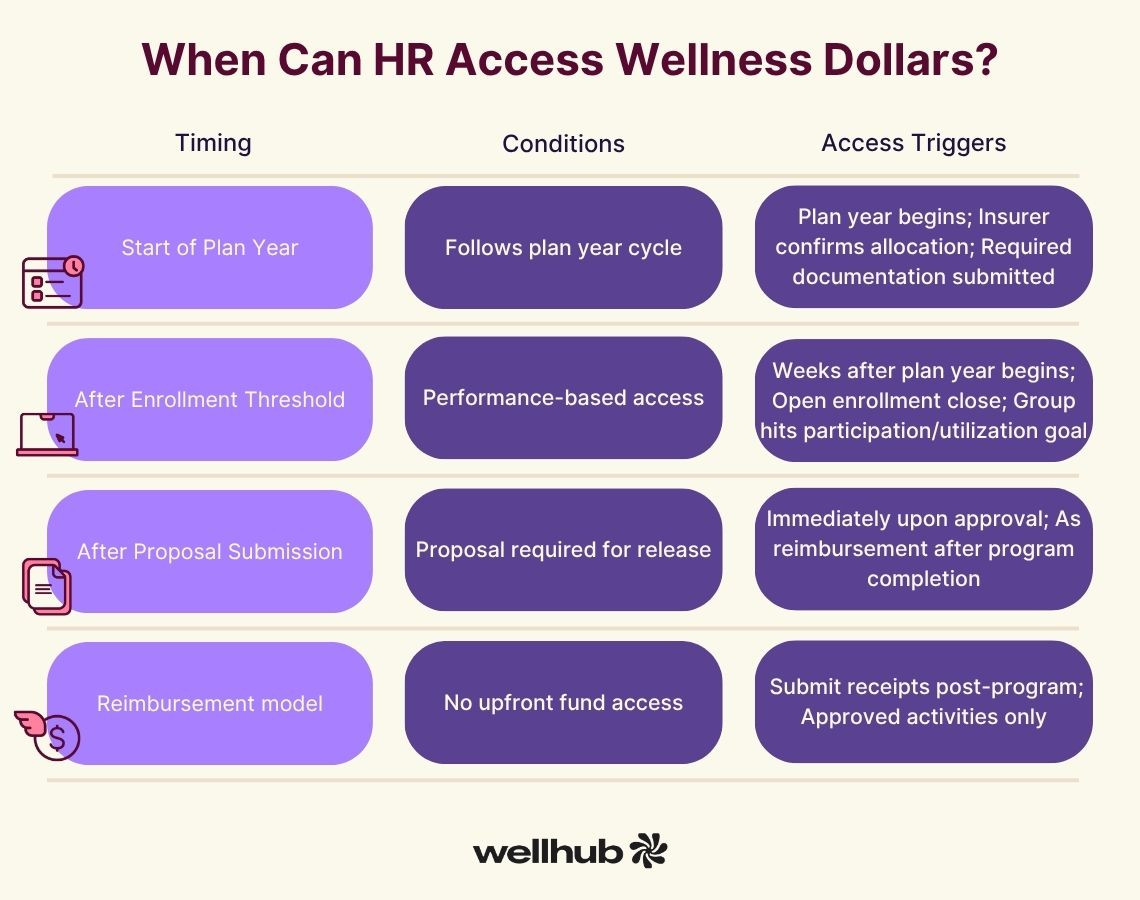

When Can HR Access Wellness Dollars?

The ability to use wellness dollars depends on your health insurance plan’s structure. Most wellness dollar programs follow your group plan year and become available either:

- At the Start of Your Plan Year

For most employers, wellness dollars become available on the first day of the benefits plan year. That means if your health plan renews on January 1, your wellness dollars reset and are accessible from that date.

In this case, you can begin using funds as soon as:

- Your plan year begins

- Your insurer has confirmed your wellness dollar allocation

- You’ve submitted any required documentation or program proposals

🏃🏿♀️Action tip: If your plan renews January 1, meet with your broker in Q4 to confirm your allocation and pre-plan how you’ll spend it.

- After a Minimum Enrollment Threshold Is Met

Some wellness dollar programs are performance-based. They require a certain percentage of employees to be enrolled in the health plan before you gain access to funds. This ensures insurers are supporting engaged groups.

In these cases, funds might be released:

- A few weeks into the plan year

- After open enrollment closes and enrollment data is finalized

- Only once your group reaches a certain utilization or participation rate

🏃🏾♂️Action tip: Work with your broker or account manager to understand what criteria—if any—must be met before your wellness dollars are available.

- After Submitting a Program Proposal

A few insurers require HR teams to submit a spending plan or proposal before releasing funds. You’ll outline how you intend to use the dollars, which vendors you’ll work with, and expected outcomes (e.g., improved engagement, increased screenings, or attendance targets).

After approval, wellness dollars become available either:

- Immediately upon approval

- As reimbursements after programming is completed

🏃🏻♀️Action tip: Get proposal templates from your insurer ahead of time so you can plan programming in sync with your plan year.

- Via Reimbursement (Post-Program)

If your plan uses a reimbursement model, you may not see funds “in-hand.” Instead, you pay upfront for an approved wellness activity or vendor, then submit receipts to get reimbursed from your wellness dollar pool.

🏃🏼♂️Action tip: Set internal reminders for reimbursement deadlines and keep close records of all receipts and invoices.

Timing Summary: What to Ask Your Broker

To avoid confusion or delays, reach out to your broker or insurance account manager with these key questions:

- When do our wellness dollars become available?

- Are funds pre-loaded, matched, or reimbursed?

- Are there any usage conditions we need to meet first?

- What’s the deadline for spending or submitting expenses?

Make the Most of Your Timing

Wellness dollars often operate on a use-it-or-lose-it basis. If you wait too long to confirm access or plan spending, you risk leaving funds on the table. Many HR teams use the first 30–60 days of the plan year to:

- Confirm access and eligibility

- Draft a wellness calendar

- Schedule campaigns and vendors

- Submit pre-approvals (if needed)

Maximize the Power of Wellness Dollars with a Wellbeing Program

Wellness dollars create an exciting opportunity to expand your benefits without stretching your budget. But too often, HR teams leave funds untouched simply because the path forward isn’t clear. With the right strategy, these dollars can bring real change to your workplace.

A wellbeing program helps you turn that potential into impact. By supporting physical, mental, and financial wellness, you create a healthier, more energized workforce. Companies with Wellhub programs save up to 35% on healthcare costs and see up to 40% lower turnover.

Speak with a Wellhub Wellbeing Specialist to unlock the full value of your wellness dollars!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

References

- Wellhub (2024, May 16). Return on Wellbeing 2024. https://wellhub.com/en-us/resources/research/return-on-wellbeing-2024

- Wellhub (2024, October 16). The State of Work-Life Wellness 2025. https://wellhub.com/en-us/resources/research/work-life-wellness-report-2025/

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Corporate Wellness Trends HR Must Know for 2026 | Wellhub

See the top 2026 wellness trends shaping performance, retention, and culture—plus how HR can build a unified, ROI-driven wellbeing strategy.

Wellness Points Programs: Boost Employee Health & Engagement | Wellhub

Turn your workplace wellness strategy around with a points program that rewards healthy behavior with perks, from extra time off to gift cards.

Employee Financial Wellness Programs: Ultimate HR Guide | Wellhub

Create an effective financial wellness program that supports your employees in their financial needs, boosting productivity and retention.