How To Build a Benefits Strategy That Pulls and Retains Top Talent

Last Updated Nov 13, 2025

Key Takeaways

- A benefits strategy gives organizations a clear plan for supporting employees through thoughtful, high-impact offerings. It outlines what to offer, how much to invest, and how to keep improving based on employee feedback and business goals.

- Employee wellbeing has become a central force shaping modern benefits planning. Workers value mental, physical, and financial support, and a strong strategy reflects these needs with flexible work options, wellness tools, and programs that help people thrive.

- A successful strategy depends on understanding your workforce and aligning benefits to real preferences. Employers gather insights through surveys, interviews, and usage data to tailor offerings that create meaningful value across diverse demographics.

- Clear communication strengthens trust and ensures employees understand and use their benefits. Organizations keep documentation simple, share updates consistently, and engage employees in open conversations that guide ongoing improvements.

- Regular monitoring helps employers measure impact and adapt their strategy as needs evolve. Tracking KPIs, reviewing utilization, and responding to employee input allows HR teams to refine benefits and sustain long-term engagement and retention.

Free snacks are great, but they’re not a strategy. Today’s employees want more than ping-pong tables and pizza Fridays.

They’re asking deeper questions: Do my benefits reflect my real needs? Is my employer truly invested in my wellbeing? And with 93% of workers saying wellbeing is as important as pay, the stakes have never been higher for HR.

Yet many HR leaders are still building benefits packages on gut instinct or last year’s spreadsheet. That approach is costing more than budget—it’s costing talent. Turnover is rising, loyalty is shrinking, and top performers are walking away for organizations that get it.

A benefits strategy isn’t a perk list. It’s a plan. A roadmap for supporting your people and protecting your business. And when done right, it becomes one of your most powerful retention, recruitment, and culture-shaping tools.

Ready to build smarter? Discover how to design a benefits strategy that supports your people, strengthens your brand, and drives real ROI.

What Is a Benefits Strategy?

A benefits strategy is a comprehensive plan designed to provide employees with a range of perks and advantages. This blueprint encompasses every aspect of your benefits package: cost, ROI, implementation, eligibility, and more. It’s essentially a roadmap that guides your business in supporting your employees to the best of your ability, maximizing your employee value proposition.

A key element of your benefits strategy is determining which benefits employees value most. That includes major benefits like healthcare, of course, but you should also consider other perks that can significantly improve your employees’ work-life wellness. Around 86% of U.S. employees have access to health insurance through their employer, according to data from the U.S. Census Bureau. However, Wellhub’s latest State of Work-Life Wellness report shows that 88% of employees believe their wellbeing at work is just as important as their salary. That means healthcare alone won’t cut it.

On top of deciding which benefits are included in your package, your benefits strategy should also determine the cost and ROI of each benefit, plus a plan for implementation. A well-designed benefits strategy also incorporates steps to receive feedback and make changes depending on your employees’ responses.

Why a Benefits Strategy Is Important

Job loyalty is on the decline: Less than a quarter of workers 42 or younger are strongly interested in remaining with their current employers long term.

That’s a key part of why turnover costs companies so much right now. Voluntary turnover saps up to20% of payroll budgets each year, according to Workhuman. Those costs include time spent recruiting and training new hires. On top of that, high turnover rates harm team development and can create a less friendly work culture, as employees simply don’t have time to bond.

This makes smart employee benefits a crucial part of your HR strategy. A benefits package that includes wellness support will increase employee happiness and encourage your team members to stay and grow with the company. It also attracts skilled new hires when you need to grow your team.

A benefits strategy helps HR teams and company leaders plan ahead, providing the best possible benefits package without overspending.

Key Components of a Successful Benefits Strategy

What goes into your benefits strategy? That all depends on your resources, goals, and employees’ preferences, but here are a few key components of a winning benefits strategy.

Essential Benefits

A strong benefits strategy starts with the essentials — the benefits that offer protection, promote trust, and create long-term value. Some are required by law. Others are simply expected by today’s workforce. Together, they form the bedrock of a competitive total rewards package.

Let’s break it down.

Legally Required Benefits

These benefits help your business stay compliant and ensure employees are supported when it matters most.

- Health Insurance: If you have 50 or more full-time employees, federal law requires you to offer health insurance. But beyond compliance, health coverage is a top priority for workers — especially when paired with dental and vision options that show you’re thinking holistically.

- Unemployment Insurance: Funded through employer taxes, unemployment insurance provides temporary income for employees who lose their job through no fault of their own. It’s a built-in safety net, and a federal requirement in every state.

- Disability Insurance: Some states require short- or long-term disability insurance that protects workers who are unable to work due to illness or injury. Even where it’s optional, offering this benefit gives employees confidence they won’t be left without income during recovery.

- Social Security Contributions: All employers must contribute to Social Security and Medicare under the Federal Insurance Contributions Act (FICA). These programs support workers in retirement or if they become disabled — and are a critical part of your compensation obligations.

- Family and Medical Leave (FMLA): Businesses with 50+ employees must offer job-protected leave for eligible employees under the FMLA. It covers situations like childbirth, adoption, or caring for a seriously ill family member. Even unpaid, it helps workers feel secure when life demands their full attention.

Widely Expected Benefits

These may not be required by law, but employees increasingly expect them — and they can be key differentiators in a competitive talent market.

- Life Insurance: Basic life insurance helps employees safeguard their families financially. It’s a powerful symbol of care, and a low-cost way to support peace of mind — especially for those with dependents.

- Retirement Plans: From 401(k)s to other savings options, retirement benefits help employees build financial security. Employers who offer matching contributions or access to financial planning tools go even further, supporting wellbeing now and in the future.

- Paid Parental or Family Leave: While only unpaid leave is federally required, today’s employees expect more. Offering paid leave for new parents or family caregiving shows you support employees through major life transitions — not just while they’re at their desks.

- Stock Options or Equity: Equity-based benefits invite employees into a deeper connection with your company’s mission. They foster loyalty and incentivize long-term thinking, especially among high-potential contributors.

Wellness Benefits

Wellness benefits show your employees that their health, happiness, and balance matter. And when employees feel cared for, they bring their best to the table day after day.

Here’s what that can look like in action:

- Flexible Work Options: When employees have control over their schedules, they’re better able to care for themselves and their families. Offering flexible hours or hybrid work options supports work-life integration and helps reduce burnout before it begins.

- Mental Wellbeing Support: Wellness starts with the mind. Think therapy stipends, meditation apps, and access to professional counseling. These tools support resilience and reduce absenteeism (a big win for employees and organizations alike).

- Physical Wellness Perks: From subsidized gym memberships to on-site fitness classes, physical health benefits are a powerful motivator. They also help lower healthcare costs long term — and employees love them. In fact, 79% of employees with a wellness program say they use it.

- Small Touches with Big Impact: Healthy snacks in the breakroom. Weekly team walks. Monthly wellness challenges. These may seem simple, but they build connection and show employees you’re thinking about their wellbeing every day — not just during annual open enrollment.

Key Man Benefits

Executive benefits are tailored tools, built to support and retain the people making your company’s biggest decisions. These leaders face high stakes and long hours, and their impact reverberates across your entire organization. Executive benefits say, “We see you. We value you. We’ve got you.”

Let’s break down what that can look like:

- Supplemental Retirement Plans: When 401(k) limits cap out, supplemental retirement plans like deferred compensation offer a powerful incentive. These plans help your key players build long-term wealth, especially those who are nearing retirement or have already hit their max on traditional contributions. It’s financial security that keeps high performers focused, not distracted by what’s next.

- Personalized Financial Planning: Think fiduciary advisors. Tax strategists. Estate planners. When you give your leaders access to expert guidance, you’re investing in their peace of mind. This shows your commitment to their full wellbeing, both inside and outside of work.

- Concierge-Level Healthcare Access: Executive health programs do more than elevate the standard check-up. These benefits often include comprehensive annual physicals, on-demand specialist access, and white-glove care coordination. You’re supporting preventative health, reducing the risk of burnout or absenteeism, and keeping your most critical thinkers in the game.

- Key Person Insurance: This is both a retention tool and a risk management strategy. If a pivotal leader suddenly can’t work, your organization feels it. Key person insurance provides a financial safety net for your business and reassurance for the executives who care deeply about its future.

These benefits go beyond compensation. They send a message: We’re invested in you, because your impact is irreplaceable.

Yes, executive benefits often come with a higher price tag. But that investment pays dividends in leadership retention, loyalty, and long-term stability. According to Wellhub’s 2025 State of Work-Life Wellness Report, more than half of employees say they’d consider changing jobs for a better benefits package — and executives are no exception.

Open Communication

Open communication is a crucial element of any benefits strategy. After all, this strategy is designed to support your employees. Without their input and feedback, it won’t be as effective. Communicating with your team about the benefits they most value will help you optimize your strategy for current and future employees.

Communication in your benefits strategy may look like:

- Meeting with individual employees

- Sending company-wide surveys

- Evaluating existing benefits

- Asking current employees which benefits will help them feel most supported

- Asking about benefits in the interview process

While it’s impossible to satisfy all employees’ individual preferences, it’s important to consider every perspective. You can support a diverse workforce by including all team members in the strategizing process. Good communication can also be seen as a benefit itself. Your employees will feel more valued if they know their input makes a difference.

The Most Popular Employee Benefits in 2025

Employee benefit strategies need to evolve with employee expectations. And in 2025, personalization, flexibility, and holistic wellbeing are the secret sauce top companies are using. This pulls in new top talent and shows their existing workforce that they genuinely care.

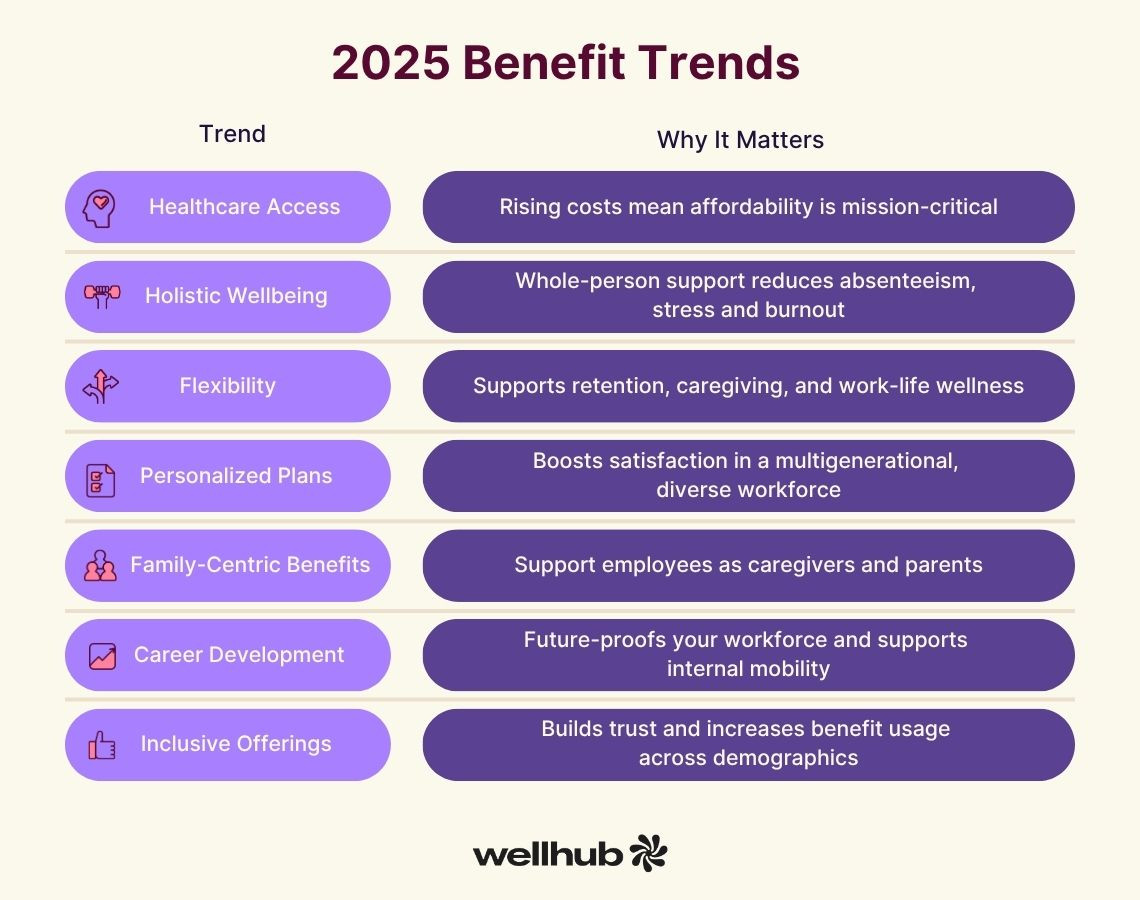

Here are the seven biggest benefits trends shaping the future of work:

- Healthcare That’s Affordable and Accessible

Rising costs have made affordability a top concern for employees and employers alike. In fact, 92% of employees use their employer’s health insurance, and 89% use dental coverage, showing just how essential these offerings are.

To stay competitive, organizations are:

- Expanding telehealth and virtual care

- Offering HSAs and FSAs

- Using wellbeing programs to lower overall healthcare costs — a strategy 91% of companies say works

- Holistic Wellbeing Takes Center Stage

Wellbeing isn’t just about physical health anymore. The most effective benefits plans support the whole person — mentally, physically, and financially.

Here’s why that matters:

- 47% of employees say work stress is harming their mental wellbeing

- 68% say financial strain keeps them from investing in their health

Forward-thinking companies are combining mental health tools, movement programs, and financial coaching to support every dimension of wellbeing.

- Flexibility Is the New Default

Hybrid and remote work aren’t fading away. They’re foundational. As a result, more companies are offering:

- Location flexibility

- Adjustable start/end times

- Core hours or compressed schedules

Flexible work improves retention, supports caregiving responsibilities, and allows employees to show up as their best selves.

- Benefits Built for Your Workforce

Cookie-cutter plans just don’t cut it anymore. Today’s workforce spans four generations and each has different needs and preferences.

That’s why employers are:

- Letting employees self-select benefits using digital tools

- Offering opt-in perks like gym access, fertility support, and pet insurance

- Embedding inclusivity into their offerings — think menopause support, neurodiverse coaching, and gender-affirming care

- Family Support That’s Actually Supportive

Employees want to work at a place that recognizes the full spectrum of their lives. That means benefits that support parenting, caregiving, and every stage in between.

Popular offerings in 2025 include:

- Paid parental leave and fertility treatment coverage

- Dependent care FSAs

- Menopause and elder care support

- DEI That Shows Up in Your Benefits

Inclusion isn’t just a hiring practice. It needs to live in your benefits, too.

This includes:

- Offering equitable access to high-impact benefits

- Listening to employee feedback across demographics

- Customizing benefits to support diverse needs, including cultural observances, family structures, and more

- Upskilling and Career Growth as a Benefit

More HR leaders are treating learning as a benefit, and for good reason.

Upskilling helps close talent gaps, prepares teams for tech changes, and strengthens retention. In a talent-tight market, offering professional development is a smart, sustainable strategy.

Employee Benefits Compliance Considerations

Employee benefits can be a powerful talent tool—but only if they’re compliant. From federal mandates like the ACA and FMLA to state-level variations in disability and paid leave, compliance is the baseline for building trust and protecting your organization. Here's what to keep in mind as you design (or refine) your benefits strategy.

Understand Federal Requirements

Start with the non-negotiables. These are the benefits and policies every U.S. employer must comply with:

- Affordable Care Act (ACA): If you have 50 or more full-time employees, you’re required to offer health insurance that meets minimum standards or face penalties.

- Family and Medical Leave Act (FMLA): Employers with 50+ employees must offer up to 12 weeks of job-protected, unpaid leave for qualifying family or medical reasons.

- COBRA: You must provide continuation of health coverage for eligible employees after they leave your organization.

- ERISA: The Employee Retirement Income Security Act sets standards for retirement and health plans. It requires disclosures, fiduciary responsibilities, and compliance with claims procedures.

- HIPAA: Protects sensitive health information and impacts how benefits information is shared.

- Social Security and Medicare (FICA): All employers must contribute to these federal programs through payroll taxes.

Know Your State and Local Laws

State and municipal laws vary widely, and sometimes go further than federal requirements. For example:

- Disability insurance is mandatory in states like California, New Jersey, and New York.

- Paid family leave laws exist in a growing number of states and often offer more generous coverage than the FMLA.

- Wage transparency and equity laws may influence how you structure or communicate certain benefits.

Always check your state’s Department of Labor or consult with employment counsel to stay current.

Keep Documentation Crystal Clear

Communication is a key part of compliance. Ensure your documentation is:

- Up to date and aligned with current laws

- Easily accessible to employees

- Written in plain language

- Updated annually and whenever benefits change

This includes your Summary Plan Descriptions (SPDs), eligibility criteria, enrollment procedures, and appeals processes.

Don’t Miss Filing Deadlines

Many benefits programs come with reporting requirements:

- Form 5500 must be filed annually for retirement and health plans covered under ERISA

- ACA reporting (Forms 1094-C and 1095-C) is due each year for applicable large employers

- Non-discrimination testing may be required to ensure benefits aren’t unfairly skewed toward highly compensated employees

Train Your HR and Benefits Teams

Compliance isn’t static. Your HR team should be trained regularly on:

- Changes to local and federal laws

- Handling benefits-related employee questions

- Recognizing red flags for discrimination or inequitable access

Communicate with Care

A compliant program that’s poorly explained can still lead to confusion or legal risk. To be on the safe side, sure your benefits communications are:

- Timely (especially during open enrollment or plan changes)

- Inclusive and accessible

- Transparent about eligibility, timelines, and how to take action

How To Create and Launch Your Benefits Strategy

Launching or revamping a benefits strategy doesn’t have to be complicated. However, this process definitely shouldn’t happen overnight. It takes time, communication, and careful planning to create the best strategy for both your employees and your business’s bottom line.

Every workplace is different, and no two benefits strategies will look exactly alike. Here are some basic steps you can take to create and implement a winning strategy that perfectly fits your business.

Step 1: Consider Your Long-Term Business Plan

Your benefits strategy must align with your overall business strategy. It should support rather than detract from long-term goals.

For example, if your business is focused on expansion, your benefits strategy should be geared toward attracting new talent. You’ll want to consider affordable benefits that will appeal to new hires at all levels.

If internal growth is more important, your strategy should include merit-based perks that encourage employees to work toward leadership roles. Companies on a restricted budget can plan their benefits strategy around reducing onboarding costs.

At this stage in the strategy process, you may want to meet with company leaders and stakeholders to better understand the company’s long-term growth plans. A benefits strategy that aligns with the big picture is more sustainable and more effective in the long run.

Step 2: Outline Your Goals

Before hammering out the exact details of your benefits strategy, you should know exactly what you want to accomplish. Examples of goals for a successful benefits strategy include:

- Implementing X wellness-focused benefits by the next quarter

- Receiving an average score of X on employee satisfaction surveys within X months

- Hiring X new employees by the end of the year

- Lowering turnover rates by X% within X years

Notice that each of these goals includes a measurable number or score and a timeline? That makes them as clear as possible. When outlining goals for your benefits strategy, consider the SMART goal method: every goal must be specific, measurable, achievable, relevant, and time-bound.

Step 3: Establish a Budget

Next, it’s time to set your budget. Although a comprehensive benefits package should produce a high ROI in the long run, it will come with an upfront cost. You should know exactly how much cash your business can spare for a benefits package before making any promises to your employees.

Benefits can cost up to 30% of an employee’s total compensation, according to 2024 data from the Bureau of Labor Statistics. Your budget should account for current employees as well as future hires if your business is currently expanding.

When planning your budget, remember that there are ways to cut costs without slashing benefits as some perks can save your company money in the long run. Wellness benefits can help reduce healthcare costs by keeping employees mentally and physically well, for example. And other attractive perks, such as flexible hours or work-from-home days, can boost hiring efforts at little or no cost to the company.

Step 4: Get To Know Your Team

Not all employee benefits are created equal. It’s important to spend your benefits budget on strategies that will most impact your employees, regardless of what’s currently popular. For example, if your business employs a lot of working parents, you may get a better ROI from on-site childcare services than an on-site gym. If your workforce trends young, value-based benefits such as volunteer days or charitable donations might attract more new hires.

At this stage, it’s vital to consider diversity and inclusion. Consider benefits that support neurodiversity in the workplace, empower women and people of color, and make your business appealing to a more diverse workforce. This will both expand your hiring opportunities and help your employees feel included.

You can collect data on your workplace through internal surveys and hiring data. To learn more about prospective hires, research demographics in your industry. Remember that your particular business model matters, too — if most employees work remotely, they’ll appreciate community-based perks like access to coworking spaces or local gift cards.

Step 5: Get Specific

Now it’s time to nail down the details. Plan the ins and outs of every potential benefit in your strategy, including:

- Cost: Determine the full cost of each benefit, including changes to working hours and productivity.

- Eligibility: Who is eligible for each benefit? How can employees access merit-based benefits?

- Providers: Compare potential benefits providers, such as insurance companies, corporate wellness programs, counselors, and food suppliers, to find the best fits.

- Distribution: How do you plan to distribute benefits? Can employees opt in to certain programs, or are they automatically enrolled?

- Long-term outlook: Estimate how long it will take to reach your ideal ROI for each benefit.

This is not an exhaustive list of factors to consider. Every organization is unique, so the exact details of your benefits strategy may look different from the company across the street. Be sure to consult with team leaders throughout your company to make sure you aren’t missing any potential challenges before you implement your plan.

Step 6: Launch Your Strategy (With Open Communication)

It can be helpful to launch your new benefits strategy at the start of a financial quarter or year — it gives you a date to benchmark your KPIs against that aligns with your company's fiscal reporting.

Be sure to maintain open communication before and after the launch. Explain the details of the new benefits to your employees and set aside time to answer questions so everyone knows exactly what to expect.

Step 7: Track Progress and Make Changes

To make sure you’re meeting your goals, track your progress and prepare to adapt. The most effective benefits strategies are flexible, designed to grow and change with your business.

There are two key ways to measure your strategy’s effectiveness:

- Key metrics: Remember those SMART goals you laid out? Track your progress toward each goal, whether it’s ROI, growth rates, or retention.

- Employee feedback: Ask your team for feedback at quarterly or annual milestones. Anonymous surveys are a great way to hear your employees’ honest opinions and spot opportunities for improvement.

External factors can impact your benefits strategy, too. For example, changing wellness trends might make new perks more attractive to your team. Economic changes might impact your budget. It’s important to reassess your strategy on a regular basis, ensuring your business’s and employees’ needs are still being met.

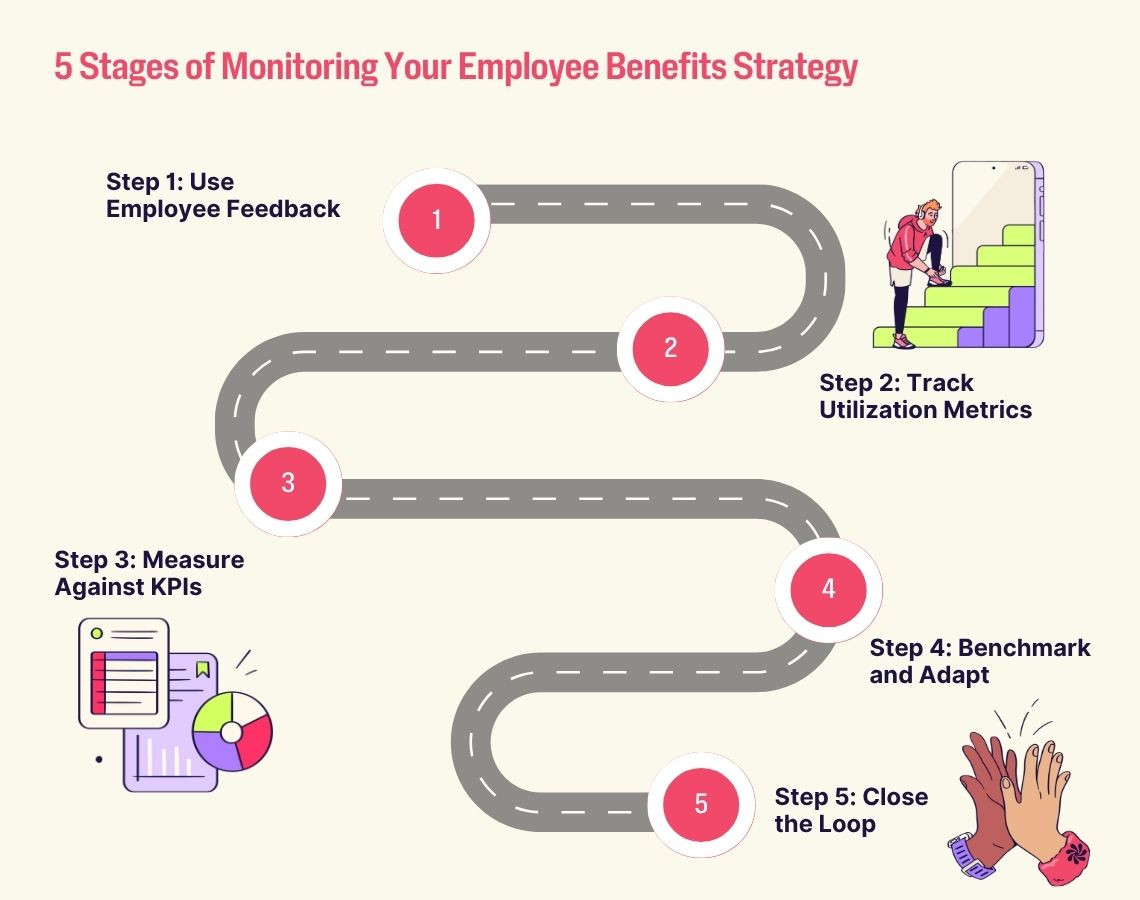

How to Monitor and Evaluate Your Benefits Strategy (Step by Step)

Once your benefits strategy is in motion, the next big step is to make sure it’s working. Monitoring and evaluation ensure your investment in employee wellbeing is paying off in real, tangible ways.

Here’s how to keep your strategy sharp, impactful, and aligned with what your workforce actually wants.

Step 1: Use Employee Feedback to Gauge Impact

Start by listening—really listening—to your people.

Create simple, recurring surveys to capture how employees feel about their benefits. You might ask:

- Which benefits do they use most?

- Are there gaps in coverage or access?

- How satisfied are they with what’s currently offered?

Keep your surveys short and sweet—no more than 5 minutes. And don’t forget focus groups or 1:1 interviews for deeper insights. This qualitative data adds context to the numbers and helps you uncover what might not show up in usage stats.

Step 2: Track Utilization Metrics

Understanding what benefits employees actually use is essential to knowing what’s working.

Look at:

- Enrollment rates

- Frequency of use

- Drop-off rates over time

For instance, you might see that 92% of employees are enrolled in your healthcare insurance, but only 12% are using your wellness program. That gap? It’s a signal that can guide you toward better communication or program redesign.

Compare usage against benchmarks and goals. This tells you whether low participation is due to lack of interest, lack of awareness, or access issues.

Step 3: Measure Against KPIs

Tie your benefits strategy to KPIs that matter. That could include:

- Retention and turnover rates

- Employee satisfaction scores

- Healthcare cost savings

- Wellness program ROI

You don’t have to track everything. Pick 3 to 5 KPIs that align with your HR and business goals, and track them over time. For example, 95% of HR leaders who track ROI on their wellness programs report positive returns. That’s the kind of evidence you want in your next budget conversation.

Step 4: Benchmark and Adapt

Your strategy shouldn’t sit still. Quarterly or biannual reviews allow you to:

- Compare KPIs with industry benchmarks

- Reallocate budget to better-performing benefits

- Sunset programs that no longer serve your workforce

This is also the moment to layer in external trends, such as shifting employee priorities or changes in healthcare regulations.

Step 5: Close the Loop

Finally, it’s time to share what you’ve learned with employees. Let them know you really listened. Highlight changes you’re making, and celebrate wins, like reduced sick days or improved satisfaction scores.

When employees know their feedback matters and see that their benefits are evolving, it builds trust and engagement. And trust? That’s one benefit money can’t buy.

A Benefits Strategy Is Only Strategic If It Supports Wellbeing

HR leaders face a common trap: building benefits packages based on old models or instinct. But today’s workforce demands more. Employees want benefits that reflect their real needs — and a roadmap that shows their employer genuinely cares. Without that, businesses risk higher turnover, lower engagement, and missed opportunities to drive culture and loyalty.

A strategic benefits plan must go beyond the basics. It needs to invest in work-life wellness, from emotional support to physical fitness. A wellbeing program like Wellhub offers exactly that. With access to thousands of fitness centers, nutrition tools, and mental wellbeing apps, helps companies lower healthcare costs and turnover.

Speak with a Wellhub Wellbeing Specialist to build a benefits strategy that supports your people and strengthens your business.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

References

- Employer Costs for Employee Compensation Summary - 2024 Q04 results. (n.d.). Bureau of Labor Statistics. https://www.bls.gov/news.release/ecec.nr0.htmWellable. (2023, January 9). 120 Employee Wellness Statistics for 2025. Wellable. https://www.wellable.co/blog/employee-wellness-statistics/

- Wellhub (2024, May 16). Return on Wellbeing 2024. https://wellhub.com/en-us/resources/research/return-on-wellbeing-2024/

- Wellhub (2024, October 16). The State of Work-Life Wellness 2025. https://wellhub.com/en-us/resources/research/work-life-wellness-report-2025/

- WorkProud. (2024, May 7). New research confirms that workplace loyalty is declining. PR Newswire. https://www.prnewswire.com/news-releases/new-research-confirms-that-workplace-loyalty-is-declining-302135068.html

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

FSA vs. HSA Strategy for HR Leaders | Wellhub

Compare FSA vs HSA rules, tax advantages, eligibility, and rollover differences to help employees choose the right account and avoid costly compliance issues.

Employee Wellness Programs: Key Components for Success | Wellhub

Transform your workplace wellness strategy by integrating physical, mental, financial, and social wellbeing into a comprehensive wellness program that works

FTO vs. PTO: What’s the Difference? | Wellhub

Strong time-off policies fuel wellbeing and performance. See how flex and paid time off help HR leaders improve retention, productivity, and business results.