Open Enrollment 2025: Key Dates and HR Strategies for a Seamless Benefits Season

Last Updated Sep 3, 2025

Open Enrollment 2025 is coming in hot — and your team’s already feeling the heat. You're managing plan changes, fielding nonstop employee questions, and staring down tight deadlines. It’s a pressure cooker, and if the process breaks down, employee trust and benefits participation can crumble fast.

When HR scrambles, employees tune out. And that makes it harder for them to make smart choices about benefits that shape their health, finances, and families for the year ahead.

OE doesn’t have to be chaos. With the right plan in place, you can lead a smooth, stress-free enrollment season that supports your people and strengthens confidence in your team.

Elevate your strategy with a smarter approach to Open Enrollment, turning confusion into clarity.

What You’ll Learn:

- Critical 2025 Dates & Deadlines: A rundown of key open enrollment periods and a reverse timeline to keep your team on track.

- Plan Changes & Employee Impact: How to decode new benefit offerings, rising costs, and regulatory updates – and explain them in plain language to employees.

- Communication Strategies: A multi-channel game plan (email, intranet, webinars, etc.) to inform and engage every employee, from Gen Z to Boomers.

- Tech Tools for Enrollment: Tips on using benefits platforms, self-service portals, and decision-support tools to streamline the process.

- Common Challenges & Solutions: Proactive fixes for low engagement, employee confusion, missed deadlines, and HR team burnout.

- Post-Enrollment and Beyond: Compliance checkpoints, data auditing, and how to continue benefits education year-round for a healthier, happier workforce.

Critical Open Enrollment Dates and Timelines for HR in 2025

Staying on top of timelines is half the battle for a successful open enrollment. Here are the key dates and a suggested timeline to keep your team organized:

Federal Marketplace Open Enrollment (2025 Plan Year): For the Affordable Care Act (ACA) marketplace, openenrollment starts November 1, 2024 and ends December 15, 2024 in most states. (Coverage elected during this window begins January 1, 2025.) A few state-run marketplaces may extend their deadlines into late December or January, so if you have employees using state exchanges, double-check those dates. While your company’s benefits enrollment might have different dates, it’s useful to know the federal timeframe – employees who miss your window might still have ACA options, or vice versa.

In addition, some states have deadlines that do not align with the federal window:

State Open Enrollment Period California Nov 1, 2024 – Jan 31, 2025 District of Columbia Nov 1, 2024 – Jan 31/Feb 7, 2025 Idaho Oct 15, 2024 – Dec 16, 2024 Maine Nov 1, 2024 – Jan 15, 2025 (but Dec 18 for Jan 1 coverage) Maryland Nov 1, 2024 – Jan 15, 2025 (but Dec 31 for Jan 1 coverage) Massachusetts Nov 1, 2024 – Jan 23, 2025 Minnesota Nov 1, 2024 – Jan 15, 2025 (but Dec 18 for Jan 1 coverage) Nevada Nov 1, 2024 – Jan 15, 2025 (but Dec 31 for Jan 1 coverage) New Jersey Nov 1, 2024 – Jan 31, 2025 New York Nov 1, 2024 – Jan 31, 2025 Rhode Island Nov 1, 2024 – Feb 28, 2025 Virginia Nov 1, 2024 – Jan 22, 2025 - Typical Employer Open Enrollment Period: Many U.S. employers hold open enrollment in the late fall (often anywhere from mid-October through mid-November) to align with a January 1 start for new benefits. For example, you might open enrollment on October 16 and close it by November 3. Plan ahead by deciding your company’s 2025 enrollment period as early as possible, and communicate those dates on all channels (intranet, email, breakroom posters, etc.) well in advance.

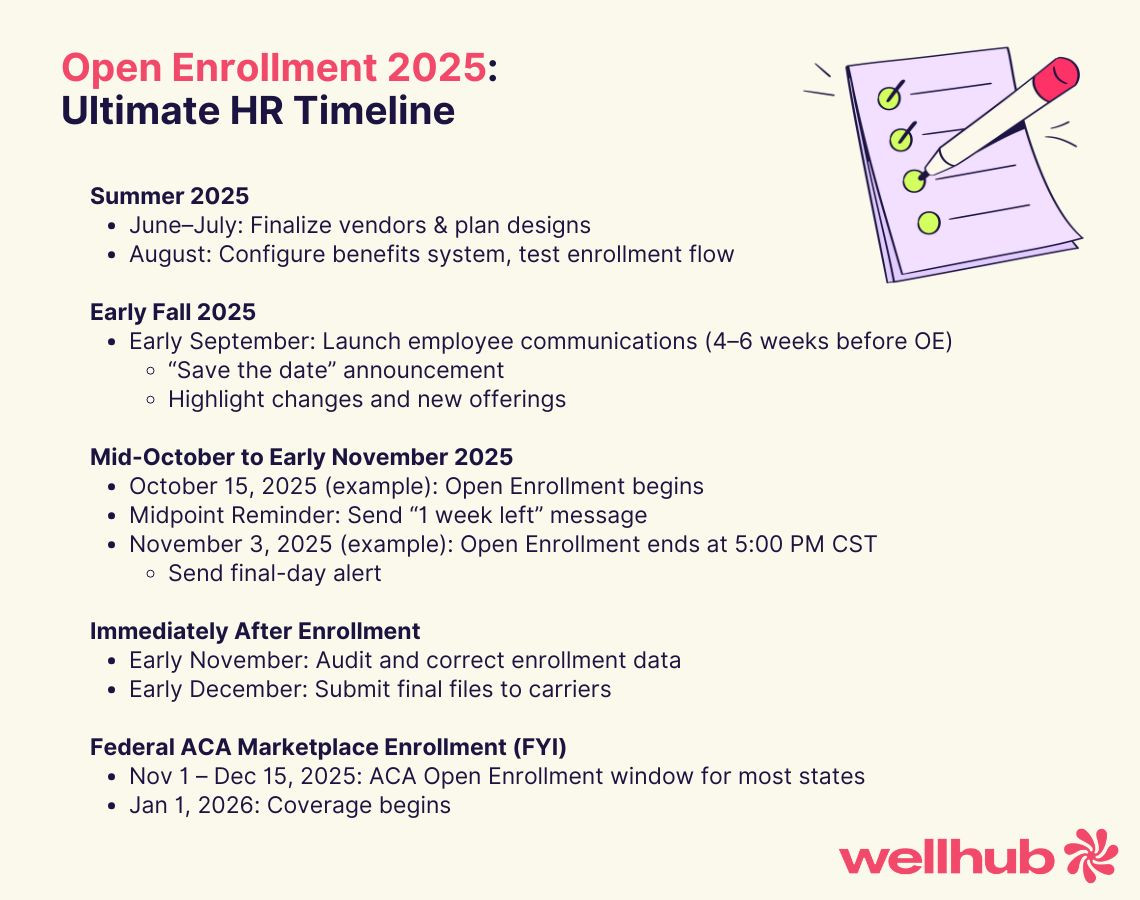

Internal HR Timeline & Deadlines

A great practice is to create a reverse timeline, starting from your enrollment end date and planning backwards. Here’s an example checklist of internal milestones to hit for Open Enrollment 2025:

- Finalize Vendors and Plan Designs (Summer 2024): Several months before enrollment, lock in your benefit offerings. Negotiate with insurance carriers and benefits vendors by mid-year so you know what’s changing (premiums, co-pays, new plan options, etc.). Many HR teams start laying the groundwork as early as June or July for a fall enrollment. This lead time gives you room to adjust plans or seek better options if costs come in too high.

- Configure Benefits Platform & Testing (Late Summer/Early Fall 2024): If you use a benefits administration system or HRIS, load the 2025 plan information and thoroughly test the enrollment process. Do a dry run in August or September with a small group (such as HR staff or a pilot group of employees) to catch any system glitches or confusing instructions. It’s much easier to fix errors before thousands of employees log in to enroll.

- Employee Communications Launch (4–6 Weeks Before OE Starts): Begin your communication campaign at least a month in advance. For example, if open enrollment begins in mid-October, start outreach by early September. Use a “save the date” announcement to inform employees of the upcoming enrollment window, any new benefits or changes to expect, and where to find resources. An early communications blitz helps employees get prepared and prevents the last-minute rush of questions. (See the dedicated Communication section below for more ideas.)

- Enrollment Kickoff (Day 1 of Open Enrollment): When the window opens, have all systems go. Ensure the online portal is live (with IT support on standby), and send a kickoff email highlighting what’s new this year and steps to take. This is also a great time to host a company-wide info session or webinar to walk employees through their choices and deadlines.

- Mid-Enrollment Reminders: During the enrollment period, send periodic reminders. For a two-week window, you might send a gentle nudge at the half-way point (“One week left!”) and a stronger call to action a couple of days before the deadline. Multiple touchpoints make sure procrastinators and busy employees don’t forget. Using varied channels – email, Slack/Teams messages, even text reminders – can increase the likelihood the message cuts through.

- Last-Day Deadline (Employee Election Deadline): Clearly communicate the final date and time for submissions (e.g., “Enroll by Friday, Nov 3 at 5:00 PM CST”). On the last day, consider a big bold email (and perhaps a text alert) marked “Last Chance: Open Enrollment Ends Today!” Emphasize consequences of missing out, like “No Election = No Benefits”, to drive urgency.

- Data Submission to Carriers (Immediately After OE): Once enrollment closes, HR must compile and send the election data to each insurance carrier and benefits provider. Build in a few days in your timeline for auditing the selections and resolving any errors (like an employee who chose an incompatible combination of benefits, or someone who missed a required field). Submit final enrollment files to carriers by their due dates – typically by early December for coverage beginning January 1. Timely, accurate submission prevents coverage delays or ID card issues come New Year.

Actionable Tip: Keep all these milestones in a simple “Open Enrollment Timeline” document or checklist. Many HR leaders find it helpful to work backwards: mark the employee deadline, then set internal deadlines 1 week before (for HR review), 2 weeks before (for communications), 4-6 weeks before (for prep and testing), etc. This reverse schedule becomes your project plan. By mapping out every step – from plan design to carrier feed uploads – you ensure nothing slips through the cracks.

Decoding 2025 Plan Changes and Their Employee Impact

Open Enrollment 2025 isn’t happening in a vacuum – healthcare costs and benefits trends are evolving rapidly. HR’s job is to anticipate what’s changing and translate that into plain English for your employees. Let’s break down a few key areas:

Regulatory Updates to Watch

Even if your benefit plans stay the same, external regulations can affect enrollment and plan administration. For 2025, keep an eye on:

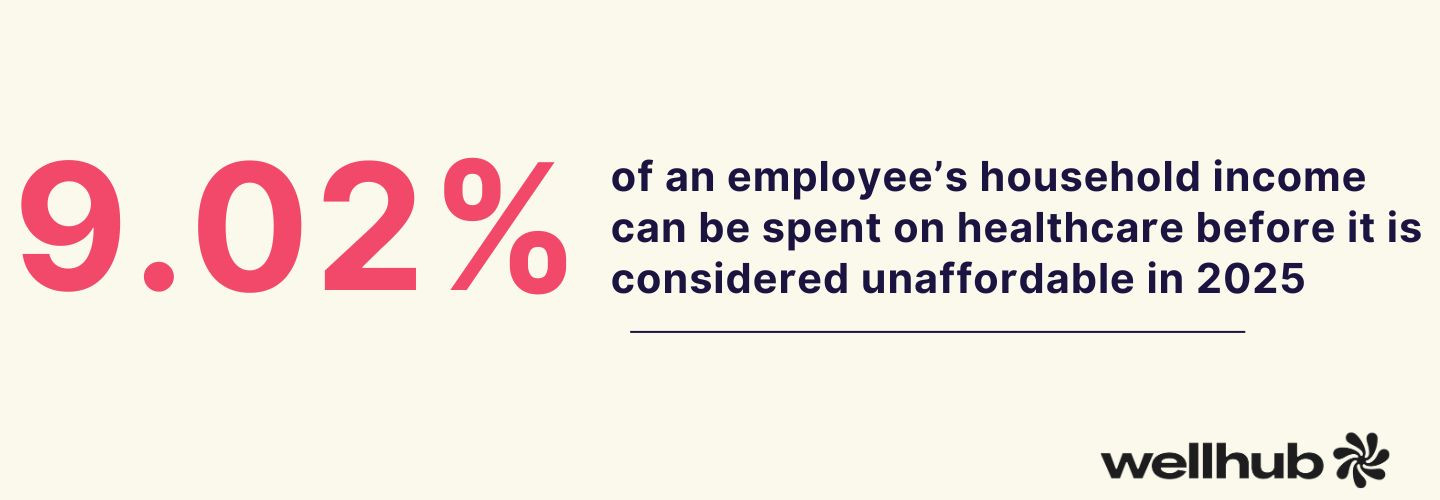

- ACA Affordability Threshold: The Affordable Care Act’s affordability test for employer coverage is changing. In 2025, the threshold for what’s considered “affordable” coverage rose to 9.02% of an employee’s household income (up from 8.39% in 2024). This means if any of your offered health plans cost an employee more than 9.02% of their pay (for single coverage), that plan could fail ACA affordability standards. HR should review premiums for your lowest-paid eligible employees to ensure at least one plan meets the threshold. If not, you may need to adjust employer contributions or plan options to stay compliant.

- Expanded HSA Limits: The IRS has increased how much employees can save in tax-free Health Savings Accounts. The 2025 annual HSA contribution limit will be $4,300 for individual coverage and $8,550 for family coverage (up from $4,150 and $8,300 in 2024). If you offer a High-Deductible Health Plan (HDHP) with an HSA, make sure to communicate these new limits – especially to employees who like to max out their HSA for tax savings. Higher limits are a great talking point to encourage participation in HDHPs, since they give employees more room to save for medical expenses.

- ACA Reporting & “Easy Election” Changes: The IRS is tightening enforcement of ACA employer reporting (Forms 1094-C/1095-C). Penalties for not filing or for filing incorrect information are steep – potentially $330 per form, with additional fines for failures to correct. On a brighter note, starting in 2025 the IRS will allow employers to forego mailing 1095-C forms to individuals if you instead provide a notice and make the form available online. This could slightly ease your administrative burden. Ensure you’re ready to meet any new reporting requirements or to take advantage of electronic furnishing if you choose.

In short, HR leaders should stay alert for compliance updates. Sign up for alerts from reputable sources (e.g., SHRM or your benefits broker) so you can adapt your plans or processes in advance. Then, distill what’s relevant for your employees.

For example, employees don’t need all the legalese about ACA thresholds – but they do need to know if you’re adding a more affordable plan option, or if new IRS rules mean they’ll receive their tax form in a different way.

New Plan Offerings and Cost Shifts for 2025

Beyond regulations, you likely face the annual puzzle of premiums, deductibles, and new benefit options. What’s the landscape for 2025?

- Rising Premiums and Shared Costs: Healthcare costs continue to climb — many organizations are bracing for a third straight year of above-normal cost growth. In fact, the average family health coverage premium jumped 7% for 2024, reaching $25,572 per family. Employers bore much of that increase to stay competitive – on average, employers cover about $19,300 of that premium, while workers contribute roughly $6,300 a year. And don't expect relief in 2026: Employers anticipate a median health care cost increase of 10% for 2026, according to new survey results from the International Foundation of Employee Benefit Plans.

"The 10% projected increase is attributed to a variety of factors impacting organizations’ medical plan costs, with catastrophic claims and specialty/costly prescription drugs topping the list," Julie Stich, vice president of content at the Foundation, said in a statement.

What it means for HR: Expect tough decisions on cost-sharing. Some employers will choose to absorb the increases to maintain employee goodwill; others will make cost-cutting plan changes. In fact, about 53% of employers plan to trim costs in 2025 by raising deductibles or co-pays and other cost-sharing – a jump from 44% doing so in 2024. If your company is adjusting contributions or plan design, prepare to clearly explain these changes. Employees might not love hearing “your deductible is increasing by $500” or “payroll contributions are going up 5%,” but they’ll handle it better if they understand the why. Frame it around balancing quality and affordability, and emphasize any new resources to help offset impacts (like an expanded HSA match or a wellness incentive to earn premium discounts).

| Year | Projected Increase (Employer plan costs) | Sample Family Premium (national average, estimated) |

|---|---|---|

| 2023 | 7% | ~$23,968 |

| 2024 | 7% | ~$25,572 |

| 2025 | 5–6% (projected) | ~$26,850–$27,150 |

| 2026 | 10% (projected) | ~$29,500–$29,900 |

- Deductibles, Co-pays, and Out-of-Pocket Maximums: Alongside premiums, review the plan usage and decide if changes are needed to in-network co-pays or out-of-pocket maximums. For instance, maybe your PPO plan’s out-of-pocket max is increasing by $1,000 to keep premiums stable. Translate these shifts into real examples: “Under Plan A, the most you’d pay out-of-pocket in a worst-case year will be $X (up from $Y). This could affect someone with a major surgery or condition. However, preventive care is still free and most people won’t reach this max.” Use simple scenarios to illustrate differences – numbers on a page don’t mean much until employees see how it works in practice.

- Provider Network Changes: Check if your insurance carrier made any network changes for 2025. Are there major hospitals or doctor groups being added or dropped? Network changes can catch employees by surprise (“What do you mean Dr. Smith isn’t covered next year?!”). If you know of significant provider network shifts, highlight them. Provide tools for employees to search for in-network providers in 2025 and encourage them to double-check their doctors, especially if you switched carriers or plan types.

- Introduction of New Benefits: Open Enrollment is prime time to roll out any new perks or programs your organization is adding. The trend for 2025 is toward holistic well-being. Many employers are expanding offerings in mental health support, financial wellness, and even weight management benefits. In fact, 93% of large employers plan to maintain or increase wellbeing programs in 2025, despite cost challenges, and 20% are boosting their investment in these areas. Consider whether you’ll introduce benefits like:

- Mental Health Resources: e.g., a new Employee Assistance Program provider, added teletherapy coverage (95% of big firms now offer teletherapy), or on-site meditation classes.

- Wellness Programs: e.g., incentives for completing wellness challenges, gym reimbursement, or programs addressing chronic conditions. Wellness is seen as key to curbing long-term costs, and many companies view it as central to their benefits strategy now.

- Voluntary Benefits: e.g., pet insurance, identity theft protection, or enhanced family-building benefits (like fertility or adoption assistance). These can be employee-paid but offered at group rates, giving your workforce more choices to fit their life stage.

- Mental Health Resources: e.g., a new Employee Assistance Program provider, added teletherapy coverage (95% of big firms now offer teletherapy), or on-site meditation classes.

How to communicate new options: Use spotlight communications for any new benefit. For example, if you’re adding a student loan repayment benefit or a Dependent Care FSA, send a dedicated email or intranet post explaining how it works and who it helps. People tend to tune out generic info, but if I’m a young employee with student debt and I see “New Student Loan Repayment Program – How to Lower Your Loan Balance,” I’m clicking that! Tailor the message: What is it? Why would I want it? How do I enroll? Even a short 1-page infographic or Q&A can make a new, complex benefit easier to digest.

Translating Complexities for Employees

Benefits can be bewildering. A SHRM survey found nearly 3 in 4 employees (73%) don’t feel completely educated about their company’s benefits — and that lack of understanding is a major barrier to engagement. HR’s role is to take the complex web of insurance jargon and make it simple. A few tactics:

- Use Plain Language & Examples: Swap out technical terms for everyday words. Instead of “annual out-of-pocket maximum,” say “the most you’d have to pay for health care in a year.” Instead of “formulary,” say “list of covered prescription drugs.” Provide examples: “If you choose Plan B and have an unexpected surgery, here’s how much you might pay...” Storytelling or real-life scenarios can be powerful. People remember stories about Jane’s knee surgery and how her plan choice saved her money far more than they remember a bullet list of plan features.

- Visual Aids: Leverage charts or infographics to compare plans. For instance, a side-by-side table showing “Plan A vs Plan B” with a few key differences (premium, deductible, typical co-pay) can help employees quickly identify which might suit them. Many employees spend only minutes on these decisions – 67% spend 30 minutes or less reviewing benefits, and a sizable number blow through it in under 20 minutes! That’s like speed-reading your insurance options during a coffee break. Given that reality, presenting information visually and concisely is critical. An attractive one-pager or FAQ can convey the highlights better than a 50-page benefits guide that few will read in detail.

- Emphasize What’s Changing: Employees who have been through open enrollment before will want to know what’s new or different this year. Always call out plan changes upfront – “This year, we have a new medical plan option with a lower premium and higher deductible. If you’re currently in Plan X, note that its deductible is increasing by $500 next year,” etc. A changes summary helps employees focus their attention where it matters (and it heads off the “I didn’t know it was changing!” complaints later).

- Provide Decision Support: Some employees don’t even know where to start, especially newer or younger workers. If possible, offer decision support tools or guidance. This could be an online questionnaire that suggests a plan based on their needs, or simply a flowchart: “If you prefer a lower paycheck deduction and can handle higher costs if you get sick, Plan A may be for you; if you want peace of mind with low out-of-pocket costs, Plan B may be better,” etc. Such tools reduce confusion and lead to more informed choices. Even a short quiz or checklist can steer people in the right direction.

Remember, when employees actually understand their benefits, they value them more. It’s worth the effort to simplify and clarify. Not only will employees make better choices, they’ll also feel more positively towards the company. You’re not just handing them a dense booklet – you’re empowering them to take care of their health and finances.

Crafting a Multi-Channel Employee Communication Strategy

If there’s one golden rule for Open Enrollment success, it’s this: communicate, communicate, communicate. Even the best benefits package means little if employees are too confused or uninformed to enroll in it properly. A strong communication strategy can dramatically boost engagement and reduce errors.

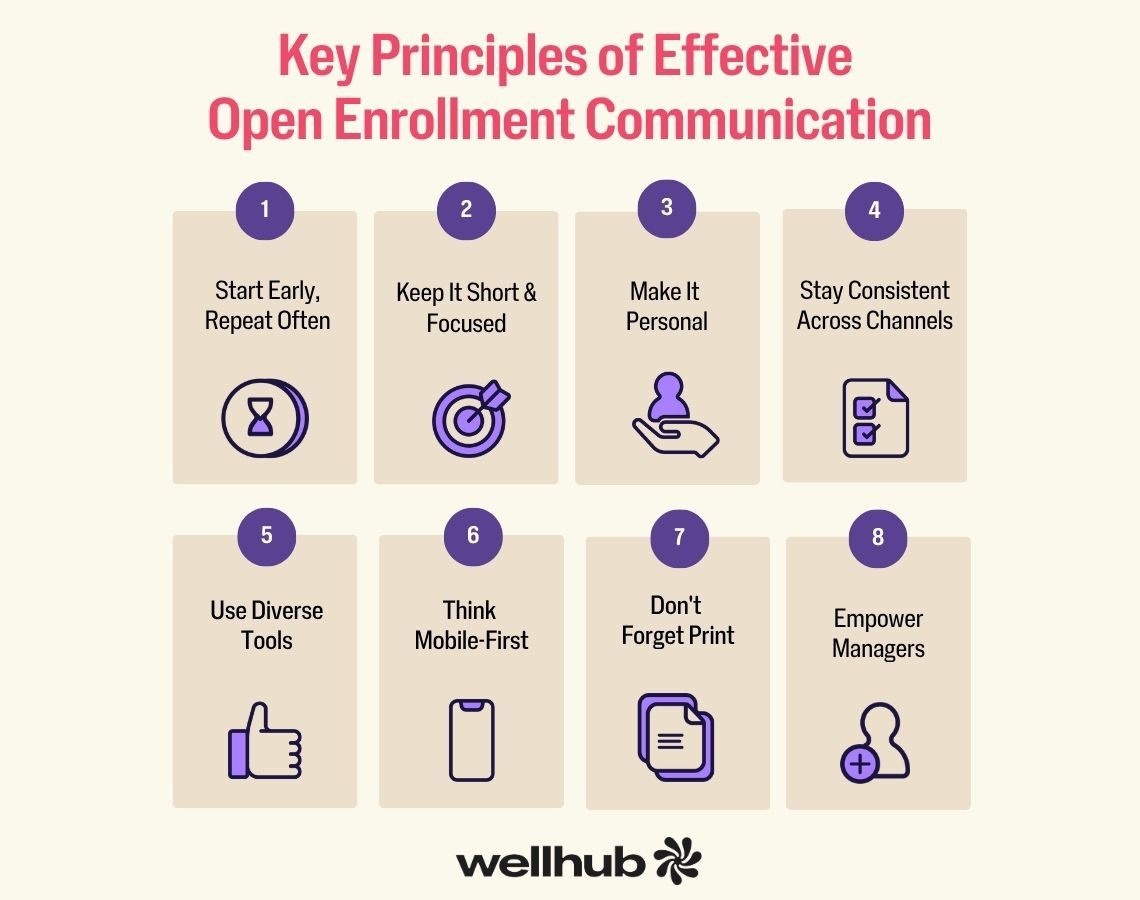

Let’s break down the key principles:

Why Effective Communication Matters

Many employees approach open enrollment with a mix of apathy and anxiety. They know it’s important, yet it’s complex and easy to put off. Consider that roughly 90% of employees simply stick with the same benefits choices as last year, often because they’re overwhelmed by the decisions. Lack of understanding is a big culprit: if the info is too dense or technical, people shut down.

This is why HR’s communication needs to do two things: educate and motivate. You’re answering the employee’s internal question, “What’s in it for me?”, and you’re doing it in a way that catches their attention. Effective communication can turn open enrollment from a dreaded chore into an approachable task.

Key Communication Principles

- Start Early & Communicate Often: As mentioned, begin your outreach well before the enrollment window. Build awareness incrementally. For example, 6 to 8 weeks out, post a news item on your intranet: “Open Enrollment is coming – stay tuned for new benefits updates.” Four weeks out, send an email outlining key dates and upcoming info sessions. Two weeks out, launch a reminder with a checklist (“Things to think about before you enroll…”). By the time enrollment opens, employees shouldn’t be hearing about it for the first time. Repetition is your friend – people need to hear messages multiple times. A living “campaign” approach (as opposed to a single announcement) keeps benefits top-of-mind.

- Keep It Simple & Concise: Avoid insurance jargon and keep each message focused. It’s better to send a series of short communications, each highlighting one aspect, than one gigantic memo that tries to explain everything. For instance, one week you might send a short infographic about “How an HSA works”, and the next week a quick FAQ about dental and vision benefits. Use bullet points, visuals, and clear calls to action. Something as simple as “Action Needed: Verify your dependents before Oct 20” in an email subject line can spur people to act.

- Personalize Where Possible: Not everyone in your workforce has the same needs. Tailor your messaging to different segments. For example, young single employees might respond to messages about saving money and paying off student loans (so emphasize the HSA, or a high-deductible plan’s lower premiums). Employees with families will care about provider networks and copays for pediatricians. One effective tactic is to segment your email lists by demographic or prior enrollment choices. Send targeted content like “Tips for Parents During Open Enrollment” or “Maximizing Benefits as a New Hire.” At minimum, ensure examples in communications cover a range of life situations (single, married with kids, mid-career with aging parents, etc.) so each employee sees something relevant to them.

- Consistency Across All Channels: While you should use multiple channels (see below), maintain a consistent tone and key messages throughout. It can confuse employees if the intranet says one thing but a manager’s talking points say another. Create a core messaging document for open enrollment that all HR team members and managers can reference – it should include the main dates, what’s changing, and the top 3-5 messages you want to reinforce (e.g., “Enroll by the deadline, consider the new Plan B option, use the online tool to compare costs,” etc.). Consistency builds trust that HR has its act together.

Diverse Communication Channels to Leverage

Meet employees where they are. A multi-channel approach ensures you reach everyone through their preferred medium. Here are channels to consider and how to use them effectively:

- Digital Hubs (Intranet or Benefits Portal): Dedicate a central online location to all open enrollment information. This could be a page on your intranet or a section within your HRIS/benefits portal. Populate it with key resources: the benefits guide, plan comparison charts, FAQs, contact info for help, and even short videos. Keep this hub updated. In emails and meetings, always point people to “Visit our Open Enrollment 2025 site for details.” Having a single source of truth reduces the barrage of repetitive questions, because you can answer with, “Check the intranet for the full FAQ.”

- Email Campaigns: Email is still the workhorse of corporate communication. Plan a series of emails rather than just one. Perhaps an “Open Enrollment Kickoff” email, followed by weekly spotlight emails (e.g., “This week: Understanding Your Medical Plans” and next “Don’t Forget Your FSAs – Free Money on the Table!”). Use segmented emails where appropriate – for example, one version of an email might go only to employees currently enrolled in a plan that’s changing, explaining their specific situation. Keep emails concise with clear subject lines and a prominent call-to-action button like “Enroll Now” or “Review Your 2025 Benefits.” And don’t shy away from automated reminders: many benefits systems can auto-trigger an email to employees who haven’t finished enrolling as the deadline nears.

- Interactive Sessions (Webinars, Q&As, Office Hours): Not everyone will read every email, so live communication is invaluable. Host a webinar or live presentation to walk through the benefits highlights and allow Q&A. Record it for those who can’t attend and post the video on your benefits hub. Additionally, consider scheduling virtual “office hours” – e.g., an hour each Tuesday where an HR team member is on a live chat or Zoom to answer one-off questions. In larger organizations, in-person benefit fairs or help desks (even if just a table in the break room during lunch) can personalize the experience. Some companies invite benefit providers or brokers to be on-site or on-call to handle the really tricky questions – take advantage of vendor support if available.

- Visual Aids (Infographics & Videos): We live in a world of short attention spans and information overload. Visual content can cut through the noise. Create infographics that explain key concepts (like a flowchart of “How to pick a health plan” or a pie chart of “Where your premium dollar goes”). A short video (even an animated explainer or a recorded slideshow with voiceover) can simplify something like how a high-deductible plan with HSA compares to a PPO. These don’t have to be Hollywood productions – even a 2-minute cell phone video of your HR director cheerfully explaining the new wellness program can resonate. People appreciate authenticity and clarity more than polish. Post these visuals on the intranet and share in emails (“Check out this 90-second video on our new mental health benefit!”).

- Mobile-First Approach: Many in today’s workforce – especially younger employees or those always on the go (like retail or field staff) – will interact with benefits info on their smartphones. Ensure that all your communications are mobile-friendly. This means emails with clean, single-column layouts and big tappable buttons, intranet pages that load on a phone, and perhaps texts for critical alerts. Text messages (SMS) can be powerful for short, urgent communications: “Reminder: 3 days left to enroll in your benefits – complete your selections by Oct 30!”. Of course, use texting thoughtfully and sparingly (nobody wants to be spammed), but it can dramatically increase visibility for key reminders.

- Print Materials (for hard-to-reach employees): Yes, print is still alive! If you have portions of your workforce who aren’t desk-bound or computer-tied (manufacturing workers, facilities staff, etc.), you can’t rely on email alone. Distribute paper packets or at least a one-page enrollment announcement. Put posters in common areas like break rooms or elevators (“Open Enrollment ends Friday – Don’t Forget!”). Some companies mail a postcard or packet to employees’ homes – this can be effective because spouses or family members often partake in benefits decisions. A tangible mailer saying “It’s time to choose your 2025 benefits” might prompt a dinner-table conversation that leads the employee to take action.

- Manager Involvement: Don’t overlook the role of managers in communication. Arm your people managers with the information they need to encourage their teams. Provide a short “manager briefing” or talking points guide about open enrollment. When messages come not just from HR, but also from direct supervisors (“Hey team, I’ve checked out our new benefits and it looks like the dental plan improved – be sure to enroll by next week”), it reinforces importance. Managers can also help chase down stragglers who haven’t enrolled as deadline nears, especially if you give them gentle nudges like a report of their team’s completion status.

Throughout all channels, always address the “What’s in it for me?” for employees. Every message should connect the dots between benefits jargon and personal value. For example, instead of saying “We offer voluntary critical illness insurance,” say “What’s in it for you: financial protection – critical illness insurance pays you a lump sum if you suffer a serious health condition, which can help with expenses that medical insurance doesn’t fully cover.” Frame communications in terms of how the benefit improves their lives, saves them money, or provides peace of mind. When employees see the value, they’re far more likely to tune in and take action.

Leveraging Technology for a Seamless Enrollment Experience

Technology can be an HR hero during open enrollment – automating tedious tasks, reducing errors, and empowering employees to self-serve. If you’re still drowning in paper forms or juggling spreadsheets, 2025 is the year to embrace some tech upgrades. Let’s explore how to use technology to make enrollment easier for everyone:

Benefits Administration Platforms (HRIS)

A modern Benefits Administration System (often part of your HRIS) is the command center for open enrollment. These platforms allow employees to log in, view their options, and make elections digitally – no paper forms needed. Key advantages include:

- Centralized Data Management: All elections are stored in one system, which can then generate reports and files to send to insurers. This eliminates the nightmare of manual data entry (and typos). For HR, it means less time spent on administrative processing and more time on strategy and employee support.

- Employee Self-Service: Employees can compare plans side by side, see their current elections, and make changes with a few clicks. Good systems have built-in info pop-ups (e.g., hover over a plan name to see a summary of benefits) so employees have information at their fingertips 24/7. Self-service puts the power (and responsibility) in employees’ hands, which many appreciate – especially those who prefer to enroll after hours with a spouse at home.

- Automated Workflows & Checks: Tech can enforce the rules so you don’t have to. For example, the system can prevent an employee from accidentally enrolling in two medical plans or forgetting to select a coverage level. It can also prompt required steps (like “Please name a beneficiary for your life insurance before proceeding”). These built-in checks greatly reduce the chance of incorrect or incomplete enrollments.

- Notifications and Progress Tracking: Most platforms can send automated confirmation emails (“Your benefits enrollment is complete!”) and reminders (“You still have items in your cart – don’t forget to check out”). HR can often monitor a dashboard of enrollment progress (e.g., 78% of employees completed enrollment so far). This real-time insight lets you know if you need to ramp up reminders or target certain groups who are lagging.

- Reporting and Analytics: After enrollment, the system can produce reports on who chose what, cost projections, etc. This data is gold for strategic planning – you can identify trends (e.g., an uptick in high-deductible plan adoption or lots of interest in a new voluntary benefit) that inform future benefits strategy.

If you already have an HRIS or ben-admin system, make sure you’re leveraging all its features. If you’re smaller or currently using manual methods, know that there are affordable solutions in the market – including some that are free or low-cost for businesses via insurance brokers. The ROI in reduced HR time and improved accuracy is usually well worth it.

Decision Support Tools

Beyond the core enrollment system, consider layering in decision support tools to help employees make choices. These can be standalone tools or built into some platforms:

- Plan Comparison Calculators: These tools allow employees to input some personal data or assumptions (like “I typically see the doctor 3-4 times a year, I take these prescriptions, I want to minimize worst-case costs” or even just expected usage level: low/medium/high). The tool then spits out a comparison of total estimated costs for each plan option, or recommends the most cost-effective plan for their situation. This kind of personalized math can illuminate the best choice. For example, an employee might be surprised that even though Plan A has higher premiums, their specific medical needs would make Plan B (with lower premiums but higher out-of-pocket) cost more overall. A support tool can make that clear.

- Benefit Avatar/Chatbot: Some employers (or vendors) offer interactive Q&A chatbots that guide employees through enrollment. It’s like having a virtual benefits counselor available 24/7. An employee might type, “What’s the difference between the HMO and PPO?” and get a straightforward answer, or “How much should I contribute to my FSA?” and get guidance. These tools make the process feel more conversational and less intimidating, especially for those who might be shy to ask HR or who are enrolling outside of business hours.

- Educational Modules: Short modules or interactive guides embedded in the enrollment portal can help employees understand concepts. Think of a quick slide show or animation explaining “Insurance 101” (deductibles vs. copays, etc.) before they proceed to choose. Given that employees – particularly Gen Z – often feel overwhelmed by benefits (79% of Gen Z spend under 30 minutes on it), a little education boost at decision-time can increase confidence.

Implementing decision support not only helps employees but also takes some pressure off HR. The more employees can self-serve answers to “Which plan is right for me?” the fewer one-on-one hand-holding sessions you’ll need to do (though you should still be available for those who need extra help).

Automated Communication & Reminders

Leverage technology to automate your communication flow. Many benefits systems or third-party tools allow you to set up targeted emails or texts based on certain triggers:

- Schedule emails in advance (for example, one to go out every Monday during open enrollment with a tip of the week).

- Set triggers like “if an employee has not logged in to enroll by Day 7, send a reminder email.” This targeted nudge ensures your outreach is efficient and not everyone gets spammed with the same messages. You can also trigger confirmations, like an email immediately after an employee completes enrollment summarizing their choices (this also serves as a chance for them to review and catch any mistakes while there’s still time).

If your HRIS doesn’t support this, you can use email marketing tools or even mail merge via Outlook to personalize and send batches of reminders. The key is to take advantage of any tools that reduce manual work. Automation ensures no one “falls through the cracks” simply because you forgot to email Joe in the field who never opened the first announcement.

Testing Your Systems

We touched on this in the timeline, but it’s worth reiterating from a technology perspective: test, test, test! Before D-Day (or rather, O-Day), do end-to-end testing of all tech components:

- Make sure login credentials for the benefits portal are working, and reset processes are in place (you don’t want a flood of “I can’t log in” on day one).

- If adding new plans or decision tools, simulate an enrollment as a dummy employee to verify that all options display correctly, premiums calculate right, and confirmation statements reflect the correct information.

- Test the data export to carriers if you can (even if with dummy data) – ensure that file formats match what the carriers expect.

- It can be helpful to have a few non-HR employees (maybe a friendly group of folks from IT or an employee resource group) volunteer to do a pilot enrollment. Their fresh eyes might catch user experience issues you overlooked.

Catching a tech issue early can save dozens of panicked helpdesk tickets later. Your goal is a seamless user experience: the technology should feel intuitive and reliable so that employees can focus on the content of their decisions, not the mechanics of the system.

In summary, a combination of the right platform and support tools can dramatically streamline open enrollment. It reduces paperwork for HR, gives employees confidence to self-serve, and cuts down on errors that cause headaches in January. Technology is not meant to replace the human touch – rather, it frees up your HR team from data drudgery so you can spend more time being that human touch where it matters (explaining nuanced scenarios, comforting the anxious first-time enrollee, etc.). Embrace the tech, and open enrollment will feel less like a yearly storm and more like a well-oiled machine.

Proactive Solutions for Common HR Challenges During OE

Even with great planning, open enrollment can throw some curveballs. HR teams often encounter similar pain points year after year.

The good news is, you can anticipate these challenges and have solutions ready before they become headaches. Let’s tackle some of the most common open enrollment challenges and how to solve them:

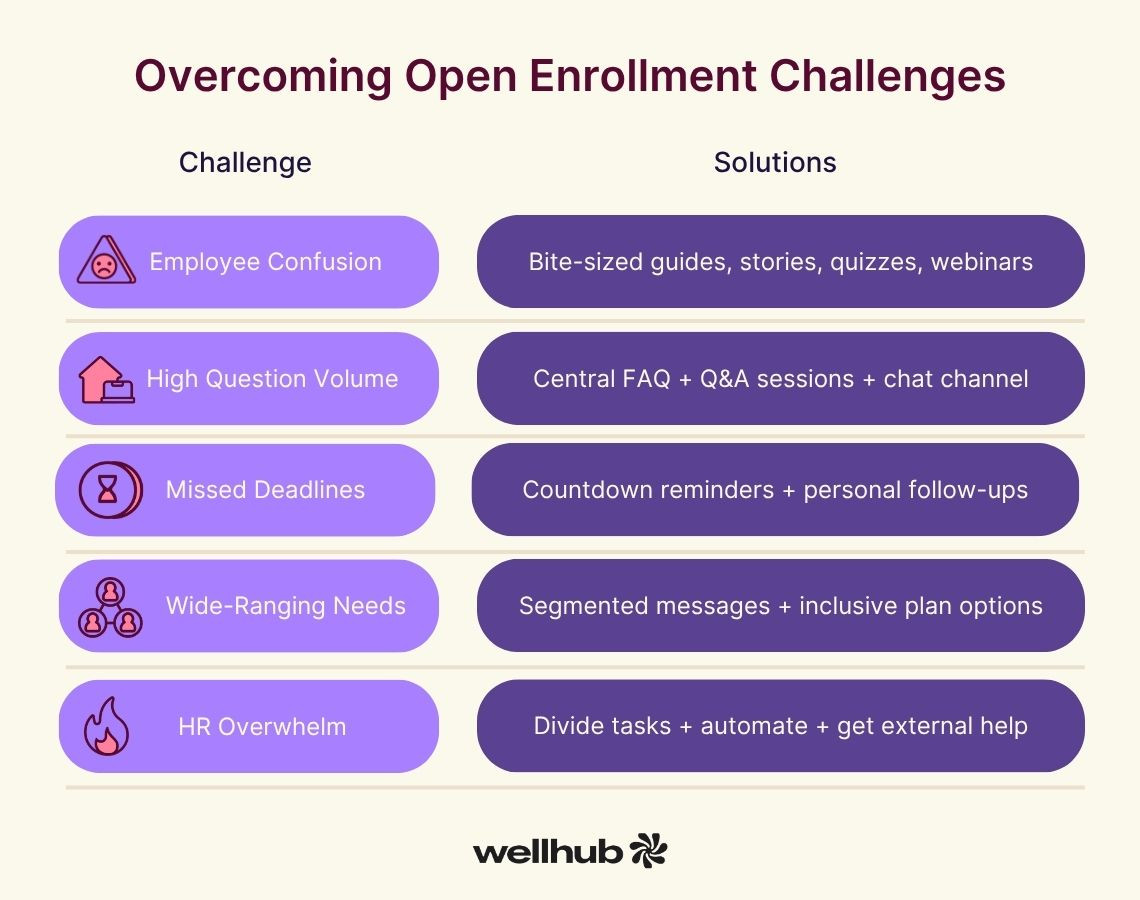

Challenge: Employee Confusion & Low Engagement

Problem: Employees might not read the materials, don’t understand their options, or approach enrollment with a “ugh, I’ll just do what I did last year” mindset. This can lead to suboptimal choices (and complaints later when they realize they enrolled in the “wrong” plan). When employees are confused or checked-out, enrollment rates for voluntary benefits may be low, and some might even miss enrolling entirely.

Solution: Simplify and Educate in Fun Ways. We discussed a lot under communications about simplicity – that’s the first step. Provide clear, bite-sized guides.

For example, a “2025 Benefits Cheat Sheet” that on one page lists each plan and the key points (in plain language) can be stuck to someone’s cubicle or saved on their phone. Use storytelling to illustrate the value of benefits—sharing real-life examples (like an employee’s testimonial of how the critical illness insurance helped them during a health scare) makes benefits more relatable.

Some companies gamify the education process: perhaps a short quiz after reading the benefits guide, with those who complete it entered into a prize drawing. Interactive benefits “quizzes” or scavenger hunts (find answers to questions by exploring the benefits site) can turn learning into a game. If confusion persists on certain topics, host a quick “Benefits 101” refresher webinar or create a mini glossary of insurance terms.

The friendlier and more accessible the education, the more likely employees will engage. Remember: Nearly 73% of employees feel they need more education on benefits – so meeting that need will directly boost their confidence and participation.

Challenge: High Volume of Employee Questions

Problem: Despite all the communications, HR inboxes often overflow with individual questions: “Is my doctor in the new network?” “How do I add my newborn?” “What’s the difference between the HSA and FSA again?” It can be overwhelming for your team, especially in the thick of enrollment when you’re multitasking. Questions can also come repetitively on the same topics.

Solution: Centralize FAQs and Leverage Support from Others. First, track the common questions and publish answers for everyone. If three people ask about urgent care vs. emergency copays, blast an FAQ answer to all employees or add it prominently to your FAQ page. Preemptively, have a comprehensive FAQ document covering everything from eligibility to plan specifics. Many HR teams publish a “Top 10 Open Enrollment Questions” list each year. Also, use dedicated Q&A sessions to funnel questions – for instance, hold a live Q&A (virtual or in-person) where employees can ask anything. Sometimes hearing answers to others’ questions helps people who didn’t know to ask that.

Don’t hesitate to lean on external partners: Your benefits broker or carriers often are willing to help answer employee questions (they may even staff a hotline or chat during OE for you). Some companies set up a temporary call center or utilize their vendor’s customer service for complex inquiries about claims, networks, or medications. If privacy allows, create an internal chat channel (like a Slack channel) named #benefits-questions where employees can ask and HR can answer for all to see – this builds a living knowledge base and reduces duplicate questions. By being proactive and collaborative in addressing questions, you prevent HR team burnout and ensure employees get timely answers.

Challenge: Missed Deadlines & Late Enrollments

Problem: Inevitably, a handful of employees procrastinate or forget to enroll by the deadline. This creates extra work in extending deadlines or handling exceptions, and in worst cases, employees might go uninsured until the next year (or you have to scramble with carrier grace periods to get them in). It’s frustrating for everyone.

Solution: Relentless (and Creative) Reminders + Clear Consequences. We can’t overemphasize reminders – send them in multiple formats and channels, as discussed. Some companies have success with weekly countdowns: e.g., T-minus 3 weeks, 2 weeks, 1 week, 3 days, 1 day. Vary the tone from friendly (“Still need to enroll? We’re here to help!”) to urgent (“Final reminder: If you don’t enroll by tomorrow, your current benefits will carry over or you may lose certain coverages”). One effective tactic is the “No Election = No Benefits” warning in subject lines or text – it grabs attention because it spells out the risk of inaction.

Also, track who hasn’t enrolled and get personal: as the deadline approaches, have HR team members or managers personally reach out to those individuals. A quick call or direct message like, “Hi Alex, I noticed you haven’t completed your benefits enrollment. Do you need any help?” can spur action or uncover if they had an issue. Involve managers to nudge their team members; employees are less likely to ignore their boss reminding them than a generic HR email.

Lastly, be very clear about consequences: If your policy is that non-responders will be defaulted to a certain plan or dropped to no coverage (depending on how your company handles it), say that explicitly. For example: “If you do not submit your elections by Nov 3, you will not have health coverage in 2025.” It may sound tough, but it’s better for an employee to be momentarily alarmed into action than for them to truly end up with no coverage. (Of course, always follow any required default rules – some employers auto-renew current coverage if allowed. Even so, remind employees that failing to actively enroll could mean missing out on new benefits or changes.)

Challenge: Widespread Workforce Needs

Problem: Your workforce isn’t homogenous. You likely have a mix of generations, income levels, family situations, and even language or cultural differences. One-size-fits-all communication or plan offerings may leave some groups under-served. For instance, younger employees might ignore retirement or insurance topics, while older employees might be very concerned about health coverage. Remote workers might feel out of the loop compared to on-site staff. If communications or plan choices don’t resonate with these varied needs, engagement suffers.

Solution: Segmented Outreach and a Range of Plan Options. On the communication side, we covered personalization – tailor messaging and use varied channels to reach different groups (emails, texts, social media for tech-savvy folks; print and face-to-face for others). Also consider offering meetings at different times (some after hours webinars for those who have busy workdays, etc.) to accommodate schedules. If you have non-English-speaking populations, translate key materials or provide bilingual benefits counselors for those employees – inclusion means everyone can understand their benefits. On the plan design side, ensure your benefits package has a little something for everyone.

For example, include a high-deductible plan with HSA for the cost-conscious or those who prefer to save, and a PPO plan for those willing to pay more for broader coverage. Offer voluntary benefits that cater to different interests: young singles might love pet insurance or tuition reimbursement; families might value extra life insurance or disability coverage; near-retirees might appreciate long-term care insurance or financial planning services. The goal is to make each employee feel “These benefits were designed for someone like me.”

Solicit feedback from employee resource groups if you have them – they can provide insight into what certain demographics value. In communications, explicitly address different life stages: e.g., “New to the workforce? Here’s how to start off right with your benefits,” vs. “Growing your family? Here are benefits that can support you,” vs. “Preparing for retirement? Don’t overlook these options,”. When employees see themselves reflected in the messaging and the benefits menu, they are more likely to engage and appreciate the offerings.

Challenge: HR Team Overwhelm

Problem: Let’s not forget about you, the HR hero behind the scenes. Open enrollment can mean long hours, pressure to avoid mistakes, and constant multitasking between employee service and administrative duties. It’s easy for the HR team to burn out during this season – which can lead to errors or frayed tempers, and that helps no one. If your HR department is small, the challenge is even greater, as you wear many hats.

Solution: Divide and Conquer, Automate, and Get Help. Start by assigning clear roles within the team. Who will handle employee inquiries? Who will manage the data file prep? Who is double-checking carrier confirmations? A divide-and-conquer approach ensures each aspect gets proper attention and no single person carries the whole load. Encourage teamwork – a daily huddle during open enrollment can help the team stay on top of issues and support each other.

Automation (as discussed in the tech section) is your friend: use systems to do the heavy lifting of data processing and scheduled communications. Also, consider temporarily expanding help: This could mean training other HR staff (who might not normally work on benefits) to assist for these few weeks, or even bringing in an intern or temporary hire to handle hotline calls or data entry. Remember that external resources like brokers or benefits vendors often have services included – e.g., some brokers will conduct employee meetings for you, or carriers might have customer service that your employees can call directly with coverage questions (taking that off your plate). Don’t be afraid to tap into those; you’re likely paying for it as part of your contracts. Additionally, invest in training for your HR team well before OE.

Ensure everyone on the team fully understands the new benefits and processes – a well-prepared team feels more confident and less stressed when questions start pouring in. Finally, take care of yourselves: If possible, schedule the team’s time so everyone gets some breather – e.g., rotate who stays late on closing day or who monitors after-hours emails. Open enrollment is a marathon, not a sprint, and supporting your HR staff’s well-being will lead to a smoother experience for all.

By proactively addressing these challenges, you’ll prevent a lot of fire-fighting during open enrollment. Think of it like having a contingency plan: you already know the common pitfalls, so put the guardrails and supports in place now. This way, when problems arise, you can say, “We’ve got this – here’s the plan,” instead of scrambling. Your HR team and your employees will thank you.

Ensuring Compliance and Mitigating Risks

Amid the rush of open enrollment, it’s crucial not to overlook the compliance side of benefits administration. There are numerous laws and regulations – ACA, ERISA, HIPAA, COBRA, and more – that intersect with your open enrollment process. A misstep can lead to penalties or legal headaches. Let’s review some compliance must-dos and risk mitigations to keep your enrollment season on the right side of the law:

ACA Reporting and Requirements

As discussed earlier, the Affordable Care Act imposes certain requirements on applicable large employers. During open enrollment, double-check that your plan offerings meet ACA standards – chiefly that you offer minimum essential coverage that is affordable and provides minimum value to full-time employees. For 2025, affordability is defined as the employee’s cost for single coverage not exceeding 9.02% of their household income. If you only offer high-cost plans that don’t meet that threshold for lower-wage workers, consider adding a base plan or adjusting contributions to remain compliant.

Also, be mindful of ACA Section 6056 reporting (Forms 1094-C and 1095-C). Open enrollment elections in 2025 will be reported in early 2026. Ensure you have systems capturing who was offered coverage, what they elected, etc. Many HRIS platforms help generate these forms. The IRS is increasing enforcement, and starting in 2025 there are some changes like the option to furnish 1095-Cs electronically with proper notice. Keep your payroll or benefits admin vendor in the loop about any changes so that your 1095-Cs will be accurate. Tip: After OE, run a report of any full-time employees who waived coverage – you’ll need to confirm they had an offer (and possibly why they waived) for ACA reporting.

ERISA, COBRA, and HIPAA Considerations

If you’re a private sector employer, most of your benefit plans (medical, dental, vision, 401k, etc.) are governed by ERISA (Employee Retirement Income Security Act). Open enrollment is a good time to ensure you’re meeting ERISA’s requirements for plan documentation and disclosures. Key items:

- Summary Plan Descriptions (SPDs): Every ERISA-covered benefit plan needs an SPD that is up-to-date and has been distributed to participants. If you made plan changes for 2025, you may need to issue an updated SPD or a Summary of Material Modifications (SMM) describing the changes. For example, if your health plan’s deductible increased or you added a new tier of coverage, that’s material info to communicate. SPDs should be given to new plan enrollees within 90 days of coverage, but many employers include them as part of the open enrollment packet or online resources, which is a great practice for transparency.

- Required Annual Notices: Open enrollment often serves as a convenient time to distribute various required notices. These may include the Medicare Part D Creditable Coverage Notice (due before October 15 each year, informing Medicare-eligible folks whether your Rx plan is creditable), HIPAA Privacy Notice (if your health plan is self-insured or if you haven’t provided it in a while, you must notify participants of their rights under HIPAA), CHIPRA Notice (outlining state premium assistance opportunities), Women’s Health and Cancer Rights Act (WHCRA) Notice, and Newborns’ and Mothers’ Health Protection Act Notice, among others. Many employers bundle these into one “Annual Notices” booklet or email. Ensure these go out to all eligible employees (often included in OE communications) – it checks the compliance box and educates employees on their rights.

- COBRA: For any employees who waive coverage or drop certain benefits during open enrollment, remember that could be a qualifying event for COBRA if it’s due to, say, dropping coverage for a spouse (though open enrollment itself is not a COBRA event unless it’s accompanied by a loss of other coverage). More commonly, shortly after open enrollment, you might have employees who didn’t enroll and then terminate employment in January – they’ll need timely COBRA offers. Have a process to notify your COBRA administrator (or to send COBRA notices) whenever someone loses coverage. Typically, active employees who simply decline coverage aren’t offered COBRA, but anyone who had coverage and loses it due to a job status change should be handled per COBRA rules (e.g., if an employee reduces hours and is no longer eligible for the plan in 2025, they’d get COBRA rights).

Data Privacy and Security (HIPAA)

Open enrollment involves handling a lot of personal data – from dependent information (like spouses’ and kids’ names, birthdates, possibly Social Security numbers) to health plan selections that could imply medical conditions or needs. It’s vital to safeguard this information. Under HIPAA, if you’re dealing with health plan enrollment data, you likely are considered a covered entity or at least need to follow the privacy and security rules (particularly if it’s a self-insured health plan).

Practical steps:

- Ensure that enrollment forms or data are transmitted securely (encrypted emails or secure portals rather than open email).

- Limit access to enrollment data to only those HR staff who need it.

- If you print any forms with personal info, don’t leave them lying around; shred any paper worksheets once done.

- Remind your team about confidentiality – discussing who’s enrolling in what plan in public or joking about someone choosing a high medical plan (which could imply they have health issues) is a no-no.

- If using electronic systems, verify that your vendors have proper data protection measures (you might have business associate agreements in place with them under HIPAA).

Documentation and Recordkeeping

Keep thorough records of the entire open enrollment process. This is both a protection for the company and a service to employees:

- Document Employee Elections: Most online systems will keep this automatically; if you’re using paper, archive the signed forms. You want to be able to pull up, for example, “John Doe’s 2025 benefit elections form dated Nov 2, 2024” if there’s ever a dispute. Retain these records for several years (at least 3-4 years, generally, for ERISA purposes).

- Beneficiary and Dependent Info: Ensure any new beneficiary designations (for life insurance, etc.) are properly recorded and stored. If someone added a new baby or spouse, make sure you have the supporting documents if your plan requires (like a marriage or birth certificate) – and keep those in a secure file.

- Audit Trail: After enrollment, perform an audit. Cross-check a sample of confirmations: does the payroll deduction for health match what the enrollment system says? Do the carrier enrollment lists match your final HR list? Auditing now catches issues before they affect someone’s coverage or paycheck. Document that you did an audit and what the outcomes were (e.g., “Found 2 corrections needed: fixed an employee’s coverage tier and a misspelled name with the carrier”).

- Compliance Checklist: It may be helpful to maintain a simple checklist covering all compliance tasks accomplished during open enrollment: SPD distributed? Annual notices sent on X date? ACA measurement periods updated in system? And so on. This not only helps you ensure nothing is missed, but also serves as evidence of compliance if ever questioned.

Mitigating risks is also about clear communication of policies. For example, remind employees about any flexible spending account (FSA) use-it-or-lose-it provisions as year-end approaches so they don’t accidentally forfeit money – that’s a courtesy that also prevents complaints later. Clarify any waiting periods or evidence of insurability rules (e.g., “If you elect supplemental life insurance above $X, you’ll need to submit an EOI form”). By setting proper expectations, you reduce the risk of misunderstanding or litigation.

Finally, don’t forget non-health benefits compliance: if you offer a 401(k), open enrollment might be a time people change contributions – ensure you have the updated deferral election forms or confirmations in place and update payroll accordingly by the first paycheck of the new year. For any voluntary benefits like life or disability, ensure any required beneficiary or coverage evidence is collected.

In essence, treat compliance as an integral part of your open enrollment project plan. Dotting the i’s and crossing the t’s might not be glamorous, but it will keep you out of hot water and give you peace of mind. A well-documented, compliant open enrollment also sends employees the message that the company is organized and cares about doing things right – which boosts overall trust in the HR function.

Post-Enrollment: What’s Next for HR?

You’ve reached the finish line of open enrollment – congratulations! But the work isn’t completely over once that enrollment window closes. The post-enrollment period is critical to ensure everything was done correctly and to set the stage for an even better experience next year.

Here’s what HR should focus on after the enrollment deadline:

Auditing and Verification

Double-check the data. It’s worth taking a pause to audit the results of open enrollment before the new plan year kicks in. Some key post-enrollment audits:

- Verify Elections: Randomly sample some enrollment records or run reports to make sure the elections make sense. For instance, if an employee elected family coverage but has no dependents listed, that’s a red flag to investigate. Or if someone’s coverage level changed dramatically, verify it was intentional. Ensuring accuracy now prevents headaches later (like retroactively fixing enrollments or premium deductions). As a best practice, have at least two pairs of eyes review the final enrollment data file before it goes out to each carrier.

- Check Deductions vs. Choices: Compare the benefit payroll deductions that are set to start in January 2025 against what each employee should be paying. If your system integrates payroll and benefits, this might be automatic. If not, do an export of new deductions and spot-check. For example, if Monique chose the low medical plan, is she set to have the lower premium deducted, not the high plan premium? Catching any inconsistencies in December means you won’t have to do retroactive payroll adjustments later.

- Dependent and Beneficiary Audit: Ensure any new dependents added during OE have the proper documentation on file (if your plan requires it). Some employers do a full dependent eligibility audit periodically – post-enrollment could be a time to flag any unusual entries (like an “adult child” dependent who might be over age 26, etc.). Also, compile any beneficiary changes and make sure those are updated with the life insurance carrier or retirement plan administrator as applicable.

Data Submission to Carriers

Once you’re confident in the enrollment data, transmit it to your benefit providers. Each insurance carrier or vendor typically has its own process and deadline for receiving open enrollment changes:

- For medical, dental, vision, life, disability insurers: send the eligibility file through your secure channel (often via an electronic data interchange (EDI) feed or through the carrier’s employer portal). Aim to send files as early as possible – many carriers appreciate getting the data by early to mid-December for a Jan 1 start, so they have time to produce ID cards and set up accounts. If you’re managing this via an automated EDI, verify that the file was accepted with no errors. If manual, keep confirmation emails or reference numbers from the carriers confirming receipt.

- For 401(k) or other retirement plans if changes were allowed (like changing contribution rates during OE), ensure those elections flow to the retirement plan provider so the January payroll contributions reflect the new percentages.

- For any new vendors or programs (like a new wellness platform or EAP vendor starting in 2025), send them the eligibility roster so they can onboard employees into their system.

Maintain a checklist of which carriers/partners you’ve sent final data to, and get acknowledgments. A quick follow-up with major carriers by late December, like “Do you have all our enrollments for Jan 1 active?”, can save you from discovering on Jan 2 that a batch got missed.

Employee Confirmation and Documentation

After enrollment, it’s a great idea to provide each employee with a confirmation of what they elected. Many systems do this automatically via email or a downloadable PDF. If not, you can generate confirmation statements to email or mail out.

This serves multiple purposes: it lets employees verify that their choices were recorded correctly (e.g., “I meant to enroll in Plan A but I’m seeing Plan B on my confirmation – better fix that immediately.”). It also reinforces the commitment – people are less likely to later claim “I thought I enrolled in something else” if they saw and acknowledged a confirmation.

Encourage employees to review these confirmations and speak up quickly if something looks wrong. There’s often a brief window where minor corrections can be made (before data is locked or sent to carriers). Better to clean up now than deal with upset employees later.

Also, consider sending out a “Thank You for Participating” note. Open enrollment requires effort on employees’ part too – acknowledging that (“Thanks for your prompt attention to our Open Enrollment. We had a 98% on-time completion rate!”) closes the loop on a positive note. In that same note (or separate), summarize any next steps: for example, “What’s Next: Look for new insurance ID cards in the mail by late December. Your new payroll deductions will start on January 5 paycheck. If you enrolled in the FSA, don’t forget to use up 2024 funds by Dec 31,” etc. Setting expectations helps prevent confusion when changes take effect.

Gathering Feedback

One hallmark of continuous improvement is getting feedback while the experience is fresh. Conduct a post-enrollment survey for your employees and managers. Keep it short – a few rating-scale questions and an open comment or two. For example:

- “How would you rate the overall open enrollment experience this year? (1 = very difficult, 5 = very easy)”

- “Did you feel you had the information needed to make informed decisions? (Yes/No)”

- “What was the most useful resource we provided? What was the least useful or most confusing part of the process?”

- “Do you have any suggestions to improve open enrollment for next year?”

Make the survey anonymous to encourage honesty. You might be surprised by the insights. Maybe employees loved the new comparison tool (pat on back!) but found the enrollment website clunky – now you know what to address. Or you might find out a significant number didn’t see the emails (perhaps they went to spam) – which tells you to adjust your communication channel strategy. Use this feedback to identify areas for improvement. Share key findings with leadership if relevant, and definitely use them in your planning meetings for next year’s OE.

Additionally, debrief internally with the HR team: What went well from our perspective? Where did we struggle? Did any deadlines get tight? Capture those lessons learned now, while fresh, and keep notes for next year’s planning file.

Year-Round Benefits Education and Engagement

One of the best ways to make next year’s open enrollment easier is to not “shelve” benefits until next fall. Instead, adopt a mindset of year-round benefits education. As experts note, consistent communication about benefits throughout the year means employees will be more prepared and informed when open enrollment comes around. Some ideas:

- Quarterly Benefits Spotlight: Each quarter (or month), highlight a particular benefit or wellness topic. For example, in February, send a reminder about using their preventive healthcare benefits (annual checkups, etc.). In spring, highlight mental health resources (maybe around Mental Health Awareness Month). In summer, push use of gym reimbursements or financial wellness tools. In fall, as deductibles reset approaches, remind how to maximize any remaining FSA funds or do year-end retirement catch-ups. By cycling through topics, employees learn to see benefits as a year-round asset, not just a once-a-year decision.

- New Hire Orientation: Make sure every new employee who joins mid-year gets a thorough orientation on the benefits (and is walked through enrollment for their initial eligibility). The more new hires understand their benefits when they come in, the less re-education is needed during open enrollment. And they might spread positive feedback – a new employee who raves, “The HR team really helped me understand my benefits when I started,” can influence their coworkers to approach open enrollment with a better attitude.

- Promote Benefits Utilization: Open enrollment may be done, but ensure employees actually use the great benefits you’ve enrolled them in! Throughout the year, send reminders of specific programs. E.g., “Feeling stressed? Don’t forget we have a free counseling benefit via our EAP – here’s how to access it.” Or “It’s flu season – your health plan covers flu shots 100% at in-network providers.” When people use benefits and see value, they’re more likely to engage next enrollment. It also improves health outcomes and satisfaction (win-win).

- Life Events Education: People’s benefits needs spike during certain life moments (having a baby, getting married, etc.). Consider creating resource packets or workshops for those events. For instance, a “Having a Baby 101” session that explains how to add a newborn to insurance, how the FSA can help with daycare (if you offer dependent care FSA), etc. Or a “Retirement Ready” seminar for those nearing retirement age explaining Medicare vs. company insurance, 401k catch-up contributions, etc. These targeted interventions improve literacy and again underscore that HR cares about their well-being beyond just a once-yearly transaction.

- Benefit Champions: Some organizations cultivate a network of benefit champions or ambassadors – employees in various departments who are particularly knowledgeable or enthusiastic about the wellness and benefits offerings. They can informally help spread the word and assist peers with questions. If you have such employees (maybe folks who serve on a wellness committee or so), keep them engaged year-round to promote initiatives, gather grassroots feedback, and drum up excitement when open enrollment rolls around again.

By ensuring open enrollment ends on a note of clarity and appreciation, and by continuing the conversation about benefits through the year, you set yourself up for an even smoother cycle next time. Post-enrollment isn’t an afterthought – it’s the bridge between this year’s efforts and next year’s improvements. With everything verified, compliant, and communicated, you can close the book on Open Enrollment 2025 knowing you’ve taken care of your people and your company’s obligations, and then give yourself (and your HR team) a well-deserved pat on the back for a job well done!

Open Enrollment Success Starts with Supporting Employee Wellbeing

Open enrollment brings a lot of moving parts — tight deadlines, rising healthcare costs, and a mountain of employee questions. HR teams face pressure to get everything right while employees often feel overwhelmed by their options and uncertain about how benefits impact their daily lives.

A strong employee wellbeing program helps cut through that noise. It gives employees tools to make smarter benefits decisions, reduces stress, and improves overall engagement. Wellhub connects employees to mental wealth support, physical activity, nutrition, and more — helping them feel confident and cared for during and after open enrollment.

Speak with a Wellhub Wellbeing Specialist to reduce benefits confusion and support your workforce.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

FSA vs. HSA Strategy for HR Leaders | Wellhub

Compare FSA vs HSA rules, tax advantages, eligibility, and rollover differences to help employees choose the right account and avoid costly compliance issues.

Employee Wellness Programs: Key Components for Success | Wellhub

Transform your workplace wellness strategy by integrating physical, mental, financial, and social wellbeing into a comprehensive wellness program that works

Benefits Strategy Roadmap: Pull and Retain Top Talent | Wellhub

Support wellbeing, reduce turnover, and maximize ROI with a benefits strategy built for today’s workforce—not yesterday’s spreadsheet.