Demystifying Form 5498-SA: What HR Leaders Need to Know

Last Updated Jan 28, 2025

An apple a day keeps the doctor away most days — but when it doesn’t, healthcare costs can add up fast.

That’s where health savings accounts (HSAs) come in. These offer employees a way to manage out-of-pocket expenses through their benefits package.

But when tax season hits, navigating forms like the 5498-SA can leave employees scratching their heads. Even though HR professionals don't fill out Form 5498-SA, it's still important to understand its purpose and how it impacts your employees so you can help them through tax season.

Let’s break down everything HR leaders need to know about this essential document.

What Is Form 5498-SA?

Form 5498-SA is a tax document used to report contributions, including rollover contributions, made to health savings accounts in a tax year. The IRS considers each of the following as a health savings account, which means they should be included on Form 5498-SA:

- HSAs: These accounts can be used by self-employed individuals and others who work for companies that offer high-deductible health insurance plans. Typically, both employees and employers will contribute funds.

- Archer MSAs: Established before HSAs, Archer MSAs are also available to self-employed individuals and those with high-deductible health insurance plans. The difference is that these are only for companies with 50 employees or less.

- Medicare Advantage MSAs: Individuals enrolled in a Medicare Advantage plan are eligible for these MSAs. They have nothing to do with employment status and are not usually offered through employers.

HR professionals don’t have to report HSA contributions to the IRS — that’s handled by account trustees, like banks or insurance companies. They provide copies of the 5498-SA to the IRS and your employees, so direct staffers their way if they ask you for a copy of this form.

Contributions and Distributions: What HR Needs to Know

Employer HSA contributions are a key part of many compensation strategies, helping employees manage their healthcare costs. By contributing to your employees’ HSAs, you’re helping them take control of their healthcare costs. Right now, the federal contribution limits are $4,150 for a single coverage HSA and $8,300 for families, including both employer and worker contributions, and all of that information will be displayed on Form 5498-SA.

Once there's money in the account, your workers are able to withdraw at any point for qualifying medical expenses. The tricky thing is these distributions aren't shown on the 5498-SA. Instead, your workers will also receive Form 1099-SA from the account trustees, which reports anything they took out of an HSA, Archer MSA, or MA MSA. That is another valuable resource that empowers your employees to stay on top of how they are using their healthcare benefits.

How Form 5498-SA Impacts Employee Benefits

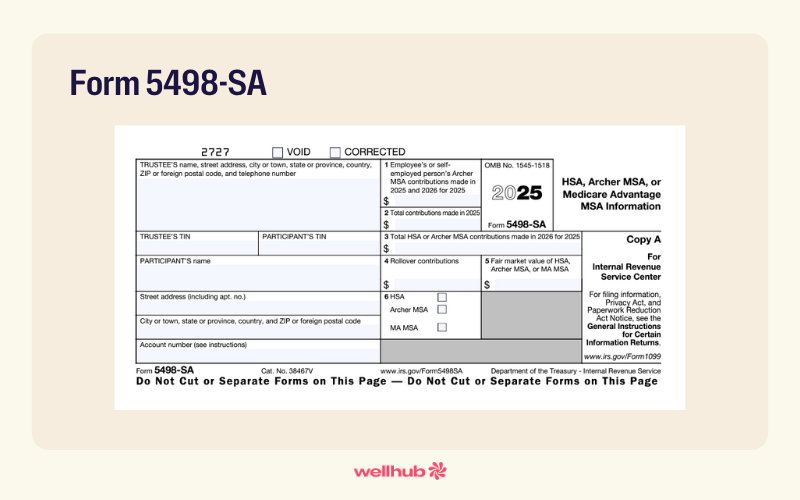

Form 5498-SA may only report contributions to a healthcare savings account for the tax year, but it also highlights how much your organization supports its employees. The form clearly separates employee contributions from employer contributions, offering a tangible reminder of the value you're adding to their benefits package. Here's what the blank Form 5498-SA looks like:

Box one is how much money your workers have added to their own accounts, while boxes two and three show the totals, which will include the total of your contributions. This form can be a way for your workers to visualize their healthcare perks and one of the advantages they have working for your company, which can give power to your employee benefits strategy.

Consider hosting a seminar during tax season to help employees interpret forms like the 5498-SA and 1099-SA, and to better understand their total compensation. For employees, this transparency can reinforce their appreciation for your company’s commitment to their health. That can in turn boost your retention rates, as 78% of employees say that a strong benefits package influences their decision to stay with an employer.

The Role of HR in Managing Form 5498-SA

While filling out Form 5498-SA isn't a direct HR responsibility, there are ways you can help ensure a smoother process for employees:

- Ensure Compliance: Although trustees handle this form, HR plays a role in making sure all HSA contributions are accurately reported on employees' W-2 forms. Your team reports HSA and other health account contributions in Box 12 of the W-2 form using Code W. To keep things running smoothly, consider conducting an annual quick check of your W-2s to catch errors early, saving time and hassle. And if you spot a mistake, don’t worry — you have until April 15 to make a missed HSA contribution without needing to adjust the W-2. Being proactive helps keep tax season stress-free!

- Communicate with Employees: Employees might have questions about Form 5498-SA. HR can clarify that the form doesn’t need to be filed with their taxes and is simply for informational purposes. It also helps to explain that contributions made up until the tax filing deadline may be reported.

- Coordinate with Account Trustees: For deeper questions about Form 5498-SA, ensure that your HR team has direct lines of communication with HSA or MSA trustees to resolve any employee concerns.

Special Circumstances Affecting Form 5498-SA

While Form 5498-SA is generally straightforward, there are a few situations that will impact what’s shown up on an employee’s 5498-SA form:

- Rollovers: If your company is switching account providers, your team members will need to move their funds to the new one. Rollovers are allowed between Archer MSAs, between Archer MSAs and HSAs, and between HSAs. If funds aren’t rolled over by year’s end, employees could face up to a 20% tax charge.

- Transfers: Most trustee-to-trustee transfers are not considered contributions or rollovers and do not require reporting on Form 5498-SA. (The exception is transfers from an individual retirement account (IRA) to an HSA.)

- Total Distribution with No Contributions: If no contributions are made to an HSA or Archer MSA in a given year and the remaining balance is distributed, the trustee generally doesn't need to file Form 5498-SA, and the employee won’t receive a copy.

HR plays a crucial role in guiding employees through these scenarios, even if the account trustees push the paperwork. If you’re overseeing a provider switch, for example, offer training on rollovers to help employees avoid that 20% tax hit. While you may not directly handle transfers or distributions, understanding these nuances means you can answer employee questions and ease concerns quickly.

HR Best Practices for Managing Form 5498-SA

Tax forms like Form 5498-SA might seem outside HR’s core duties, but taxes often intersect with employee benefits — making your guidance essential. By adopting these best practices, HR can help streamline the process and set employees up for success during tax season:

Tips for Effective Communication with Employees

- Start with Clear, Simple Language: When discussing Form 5498-SA, use plain language that's easy for employees to understand. Avoid jargon and complex tax terminologies.

- Provide Educational Resources: Offer resources like guides, FAQs, or webinars to help employees better understand the purpose and implications of Form 5498-SA. Break down the key sections of the form and what information is reported in each, such as employee and employer contributions.

- Highlight the Benefits and Implications for Tax Filing: Clearly communicate how Form 5498-SA relates to employees' tax filings and the benefits of accurately reporting HSA contributions. Explain how employees should use the information from Form 5498-SA when preparing their tax returns and advise them to keep a copy with their tax records in case of future audits or questions from the IRS.

- Utilize Multiple Communication Channels: Use various channels like email, intranet, and in-person meetings to ensure your message reaches all employees. Clarify how employees can obtain a copy of their Form 5498-SA, whether through an online account portal or by mail from the HSA trustee.

- Tailor Communication Based on Employee Needs: Consider segmenting your communication based on factors like job level, location, or HSA participation to provide more targeted and relevant information. Encourage employees to review their Form 5498-SA each year to understand their HSA contributions and adjust their financial planning or HSA saving strategies if needed.

Strategies for Ensuring Compliance and Accuracy

- Conduct Regular Internal Audits: Implement a schedule of internal audits to review your HSA contribution reporting process and catch any potential errors or discrepancies.

- Stay Up to Date on IRS Regulations: Regularly monitor for updates to IRS rules and regulations related to Form 5498-SA and HSA contributions to ensure ongoing compliance.

- Verify Data Before Submission: Establish a process for verifying the accuracy of HSA contribution data before submitting it to the IRS or account trustees to minimize the need for corrections. While HR doesn't complete Form 5498-SA, offering guidance on how employees can verify the information and report any discrepancies can be helpful.

HR might not be the trustee for this tax document, but by clearly communicating how it works and checking internal compliance, your department can help make the most of this form.

Beyond Form 5498-SA: Additional HSA Considerations for HR

Managing Form 5498-SA is just one piece of the larger task of overseeing health savings accounts (HSAs). While the form itself is handled by account trustees, HR plays a critical role in maximizing the value of HSAs for employees. Here are a few ways HR can enhance its approach to managing these accounts:

- Promote HSA Enrollment: Encourage employees to take advantage of the tax benefits and long-term savings that HSAs offer. Consider hosting informational sessions to highlight the advantages of enrolling and contributing to these accounts.

- Provide Ongoing Education: Set up regular workshops or resources that explain how to make the most of HSA contributions and how employees can use these accounts to cover future healthcare expenses.

- Stay Informed on Regulations: Keep your team up to date with the latest IRS rules on contribution limits and eligible expenses to ensure compliance and avoid any surprises during tax season.

Enhancing Your Benefits Strategy with Wellness Programs

As employees navigate tax season, Form 5498-SA offers a clear view of their HSA contributions and reminds them of the health support your company provides. While healthcare savings accounts are a valuable benefit, they’re just one part of a comprehensive benefits strategy that shows employees you care about their wellbeing.

Incorporating wellness programs into your benefits package goes a step further. These initiatives foster holistic employee wellbeing, addressing not just physical health but mental and emotional wellness too. According to Wellhub research, 99% of HR leaders report that wellness programs boost employee productivity, while 98% say they help reduce turnover. A strong wellbeing program shows employees that your organization is invested in supporting them in every aspect of their lives, leading to higher satisfaction and engagement.

Ready to get started with wellness? Talk to a Wellhub Wellbeing Specialist today!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- The HR Manager’s Guide to Navigating HSA Qualified Expenses

- HSA vs. FSA: Which is Better to Have in an Employee Benefits Package?

- How to Reduce Healthcare Cost: Tips for Employers

Resources:

- Fidelity. (2024, August 29). HSA contribution limits and eligibility rules for 2024 and 2025. Retrieved October 8, 2024 from https://www.fidelity.com/learning-center/smart-money/hsa-contribution-limits.

- United Insurance. (n.d.). 5 Critical Statistics about Benefits and Employee Retention. Retrieved October 8, 2024 from https://unitedinsurance.net/publications/5-critical-statistics-about-benefits-and-employee-retention/.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

FSA vs. HSA Strategy for HR Leaders | Wellhub

Compare FSA vs HSA rules, tax advantages, eligibility, and rollover differences to help employees choose the right account and avoid costly compliance issues.

Employee Wellness Programs: Key Components for Success | Wellhub

Transform your workplace wellness strategy by integrating physical, mental, financial, and social wellbeing into a comprehensive wellness program that works

Benefits Strategy Roadmap: Pull and Retain Top Talent | Wellhub

Support wellbeing, reduce turnover, and maximize ROI with a benefits strategy built for today’s workforce—not yesterday’s spreadsheet.