Employee Benefits Guide for HR Leaders

Last Updated Jul 25, 2025

Your employees are people living full lives that spill into work and back again. And the benefits you offer to make those lives better? They make all the difference.

From fertility care to financial coaching, today’s workforce wants more than the basics. In fact, 55% say they’d switch jobs for a better benefits package. That’s not just a stat—it’s a wake-up call.

Building a competitive benefits strategy means understanding what people really need across generations, lifestyles, and life stages. It’s not just about checking legal boxes. It’s about creating a culture where people feel seen, supported, and motivated to stay.

Want to turn your benefits program into a magnet for top talent and a powerhouse for retention?

Uncover the benefits employees actually value and how to deliver them with impact.

What are Employee Benefits?

Employee benefits are non-wage compensation offered by employers in addition to a worker’s regular salary. These can include traditional offerings like health insurance, retirement plans, and paid time off—as well as modern perks like mental health support, wellness programs, tuition reimbursement, and flexible work arrangements.

At their core, benefits are about supporting the whole employee. They’re designed to help people thrive inside and outside of work—physically, mentally, and financially. When thoughtfully designed and well-communicated, a strong benefits package boosts retention, attracts top talent, and improves productivity.

Why are Employee Benefits Important?

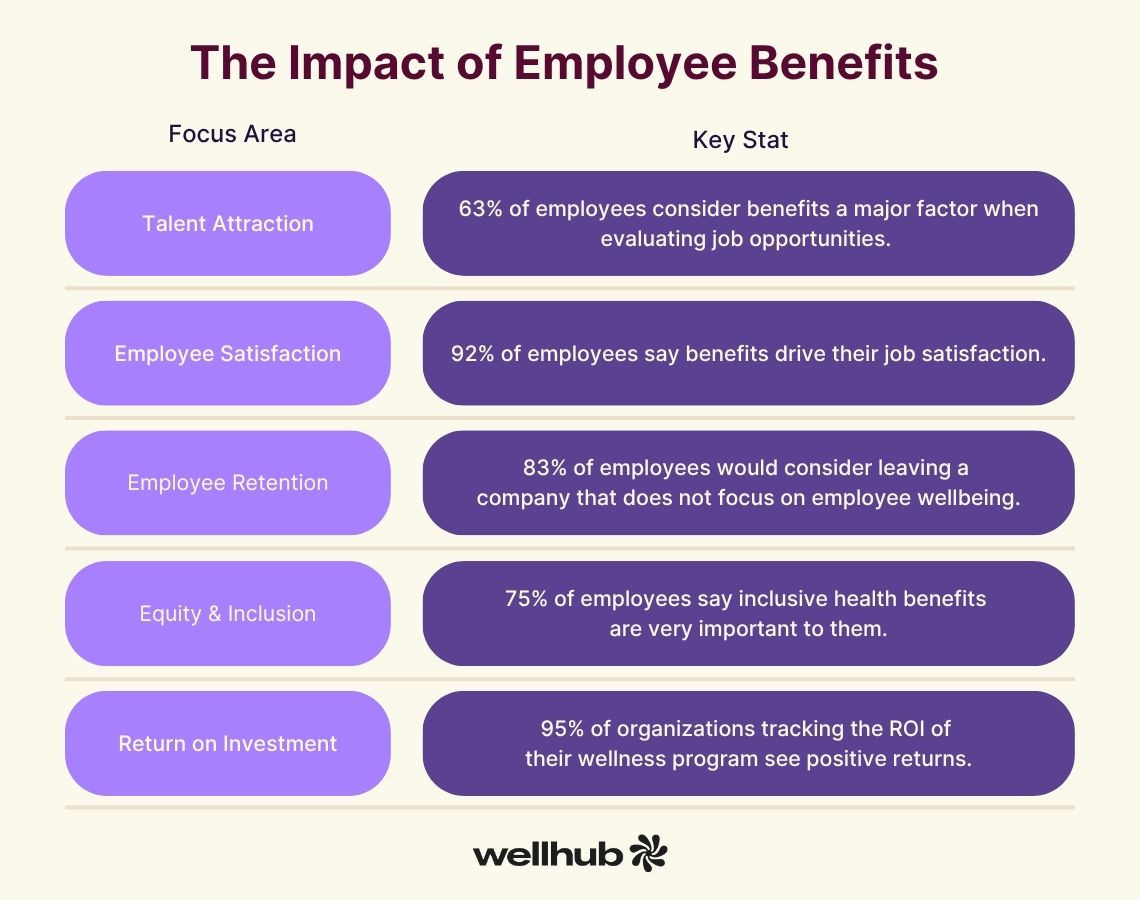

Employee benefits shape the employee experience and drive key business outcomes, as documented by multiple reputable studies:

Talent Attraction

- 63% of job seekers prioritize benefits when evaluating job opportunities—benefits rank just behind salary.

- 68% of job seekers consider wellbeing benefits (e.g. mental health, wellness programs) a crucial factor when evaluating roles

- 92% of all workers rank mental health support as important to their employer and job choice.

Employee Satisfaction

- 92% of employees say benefits significantly contribute to their overall job satisfaction.

- 91% of HR professionals report that wellness initiatives reduce health‑related absence and boost satisfaction.

- 61% of employees with a wellness program say they’re happy at their company compared to 36% without.

Employee Retention

- 83% of employees would consider leaving a company that does not focus on employee wellbeing.

- Workers with limited flexibility are 2.5× more likely to look for a new job within a year, highlighting retention risk tied to poor benefit design.

Equity & Inclusion

- 70% of LGBTQ+ employees specifically seek inclusive offerings like gender‑affirming care, inclusive parental leave, and spouse‑inclusive health plans—and report higher satisfaction when they’re provided.

- 75% of employees say inclusive health benefits (like fertility and gender‑affirming care) are very important.

- 86% of employers consider offering inclusive health care benefits "very important", and 75% of employees agree these benefits are crucial.

Return on Investment

- $1 invested in mental health programs yields an estimated $4 in benefits through improved productivity and reduced healthcare costs.

- 95% of organizations tracking wellness ROI reported positive returns, with nearly two‑thirds seeing at least $2 returned per $1 spent.

- 58% of CEOs strongly agree that wellbeing is critical to their organization's financial success

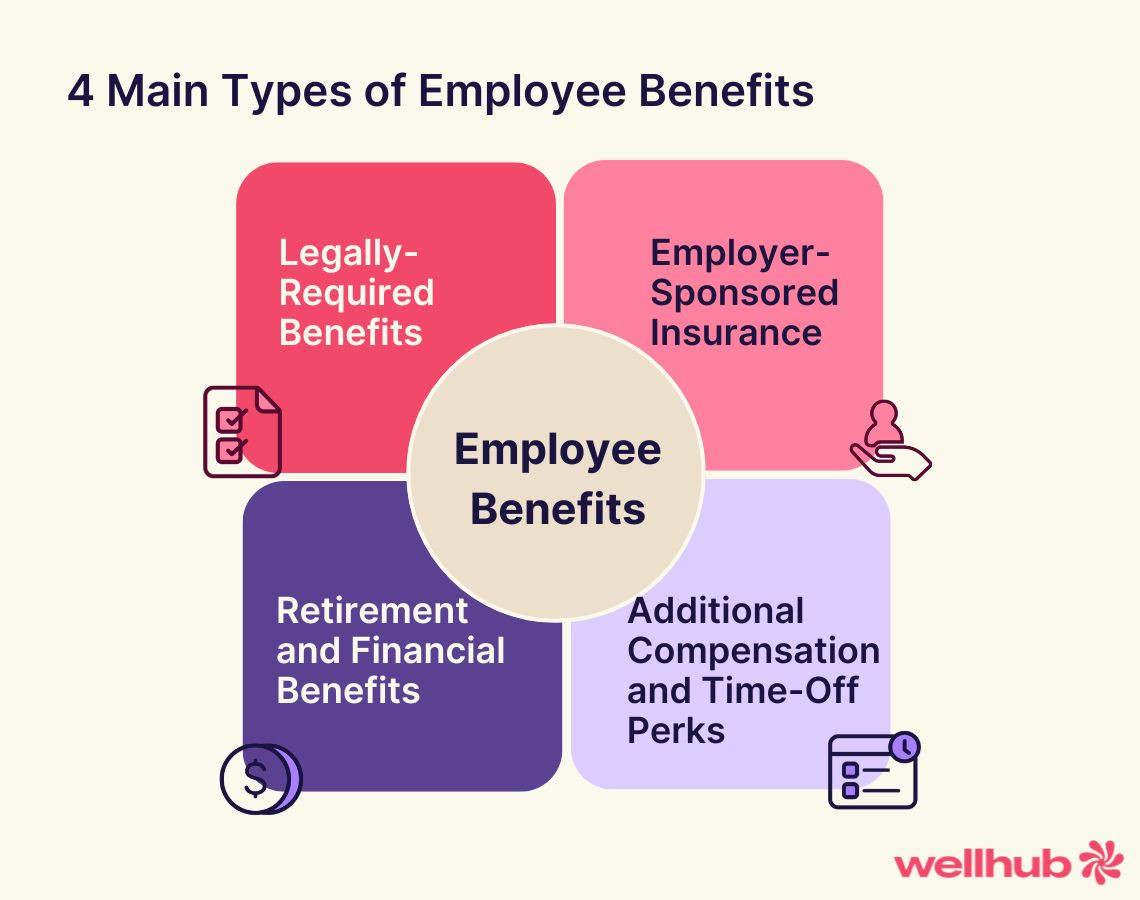

The 4 Main Types of Employee Benefits

When you hear the word “benefits,” your mind might jump straight to health insurance or PTO—and you’re not wrong! But that’s just the tip of the iceberg. Today’s workforce expects a much broader package that reflects who they are and how they live.

Whether you're building your first benefits strategy or evolving an existing one, it’s helpful to understand how benefits are typically categorized. Most employer offerings fall into four main buckets:

- Legally Required Benefits

These are the must-haves. In the U.S., federal and state laws require most employers to provide certain baseline benefits. These often include:

- Social Security and Medicare contributions

- Workers' compensation

- Unemployment insurance

- Short-term disability (in some states)

While these benefits aren’t flashy, they form the bedrock of any responsible employment package. They also set the stage for your broader employer value proposition: if your team sees you meeting requirements with care and consistency, they’re more likely to trust your optional offerings too.

- Employer-Sponsored Insurance

This is where most benefits strategies begin to differentiate. According to Wellhub’s 2025 State of Work-Life Wellness report, 92% of employees use their company’s health care insurance, 89% use dental, and 84% use vision.

While not federally required for companies with fewer than 50 full-time employees, most competitive employers offer some mix of medical, dental, vision, or life insurance. And increasingly, these offerings go beyond the basics to include:

- Mental health support

- Fertility and family planning assistance

- Pet insurance

- Supplemental accident or illness coverage

If you want to stand out, think holistically. Consider how you can reinforce your company’s culture of care with wellbeing-forward additions—like gym stipends, nutrition programs, or access to therapy. When these offerings work in concert, they tell a powerful story: “We care about you—mind and body.”

- Retirement and Financial Benefits

Helping your team plan for their financial future is one of the most meaningful forms of support you can provide.

Most employers offer some form of defined contribution plan (like a 401(k) or 403(b)), which allows employees to contribute pre-tax income toward retirement. Many companies match a portion of these contributions—an investment in long-term loyalty and peace of mind.

For organizations with the resources, defined benefit plans (or pensions) offer guaranteed income after retirement. These are less common today, but deeply valued where they exist.

You can also broaden your impact by offering financial wellness programs, such as:

- One-on-one financial counseling

- Student loan repayment support

- Emergency savings funds

Support here helps employees thrive at work and at home.

- Additional Compensation and Time-Off Perks

This is where your benefits strategy gets personal—and powerful.

Compensation extras can take many forms:

- Paid time off (PTO) and sick leave

- Parental leave (both maternity and paternity)

- Sales commissions and performance bonuses

- Equity or profit-sharing opportunities

And here’s the kicker: 100% of employees use paid time off. It’s one of the most widely used—and most widely appreciated—benefits you can offer.

Don’t stop at the basics. Today’s employees care about how they feel at work. Think about creative extras that reward performance, build community, or align with your mission. Volunteer days, wellness stipends, or even company retreats can do wonders for morale and engagement.

Examples of Employee Benefits

Employee benefits are so much more than a checkbox on a job listing — they’re one of the most powerful tools you have to attract, retain, and engage your people. And today’s employees are paying close attention. In fact, 55% of workers say they’d consider leaving for a better benefits package. Here’s a snapshot of some common (and some emerging!) employee benefits.

Health and Wellness Employee Benefits

Health and wellness benefits are where HR can truly shine. These programs don’t just support employees — they drive meaningful business outcomes. In fact, 82% of CEOs say wellness programs generate positive ROI and 68% say these programs help reduce healthcare costs.

Here are some impactful health and wellness benefits to consider:

| Type | Examples |

|---|---|

| Physical Wellness | On-site gyms, fitness memberships, ergonomic workspaces, step challenges |

| Mental Health | Therapy stipends, mindfulness classes, meditation app subscriptions |

| Preventive Care | Annual physicals, flu shots, biometric screenings |

| Nutrition Support | Healthy office snacks, meal planning tools, access to nutritionists |

| Sleep Support | Sleep tracking apps, flexible start times, educational resources |

Financial and Retirement Employee Benefits

Financial security fuels employee focus — and it's a key part of overall wellbeing. Yet 68% of employees say their financial situation prevents them from investing in their wellbeing. That’s a call to action.

When you offer robust financial and retirement benefits, you're telling your employees: “We see you, and we want your future to be as secure as your present.”

Here are common — and highly valued — financial benefits:

| Type | Examples |

|---|---|

| Retirement Planning | 401(k) plans with employer match, Roth IRA options, retirement planning workshops |

| Financial Education | One-on-one coaching, budgeting tools, debt management support |

| Emergency Assistance | Employee hardship funds, short-term loan programs, emergency savings accounts |

| Wealth-Building Tools | Stock options, ESPPs, equity grants |

| Student Loan Support | Monthly repayment contributions, refinancing partnerships |

When employees feel financially stable, they can show up fully at work. And that stability is a major differentiator in talent attraction and retention strategies.

Time-Off and Leave Employee Benefits

Let’s be honest — rest isn't a luxury. It's a requirement. And 100% of employees use paid time off, making it one of the most valued benefits you can offer.

But modern time-off benefits are going beyond just vacation days. They're acknowledging the full scope of life’s responsibilities to empower employees take the time they need to show up at their best.

| Type | Examples |

|---|---|

| Paid Time Off (PTO) | Vacation, sick leave, personal days, floating holidays |

| Family Leave | Parental leave (birthing and non-birthing), caregiver leave, adoption leave |

| Sabbaticals | Paid or unpaid time off after a certain tenure |

| Bereavement Leave | Extended time for grieving and healing |

| Volunteer Days | PTO to engage in community service or mission-driven projects |

And here’s the business case: 66% of CEOs agree their employees would consider leaving if their company didn’t prioritize wellbeing. Providing generous, inclusive leave policies is one of the most direct ways to show employees that their wellbeing — physical, emotional, and familial — matters to your organization.

When people have the time and space to recover, care for others, and live life fully, they bring more energy, resilience, and purpose back to work.

Work-Life Wellness Employee Benefits

Work-life wellness isn't just a buzzword — it's a business imperative. Employees aren’t just asking for balance anymore. They're making decisions based on it. In fact, 56% of employees say time constraints are their biggest blocker to physical fitness. And that’s just one ripple effect of a life that feels out of balance.

When you invest in work-life balance benefits, you empower your people to thrive at work and at home. Here are some powerful work-life balance benefits to consider:

| Type | Examples |

|---|---|

| Flexible Scheduling | Flextime, compressed workweeks, asynchronous work hours |

| Remote & Hybrid Work Options | Work-from-home policies, coworking space stipends, home office setup support |

| Family-Friendly Benefits | Backup childcare, family support programs, tutoring stipends |

| Life Admin Perks | Errand support, concierge services, dry cleaning pickup |

| Digital Boundaries | No-meeting Fridays, enforced PTO, email curfews |

This is effective because employees who can manage their time and responsibilities more effectively are less stressed, more focused, and way more likely to stay. And here’s the data to back it up: 61% of employees with access to a wellness program report being happy at their company, compared to just 36% without one.

The bottom line is work-life wellness isn’t about working less. It’s about helping your people live more — and bring their best selves to work in the process.

Caregiver Employee Benefits

Caregivers are everywhere in your workforce — raising kids, supporting aging parents, helping spouses recover from surgery, or navigating special needs care. And they’re under pressure. These responsibilities don’t pause during the 9 to 5, and employees are looking to their employers for support.

That’s where caregiver benefits come in. They’re not just compassionate — they’re strategic. Because when caregivers are supported, they can show up more present, more focused, and more loyal.

| Type | Examples |

|---|---|

| Parental Support | Paid parental leave, adoption assistance, lactation support |

| Backup Care Services | On-demand childcare and eldercare coverage |

| Long-Term Care Planning | Education and resources for eldercare, estate planning support |

| Flexible Scheduling | Modified hours, part-time return after leave, caregiver PTO |

| Dependent Care FSA | Pre-tax savings accounts for child or eldercare expenses |

| Care Concierge Services | Case managers to help locate care providers or manage logistics |

Why it matters: Employees in the “sandwich generation” — those caring for both kids and parents — are under unique stress. But employee wellbeing programs can help alleviate that pressure, offering access to resources like meditation, gym memberships, or even local caregiver networks.

Supporting caregivers also supports your culture. When caregiving employees feel seen, they’re more likely to stay. They’re more likely to advocate for your company. And they’re more likely to thrive.

Trending Employee Benefits

Today’s employees want more than standard health insurance and two weeks of vacation. They want benefits that reflect who they are — and what they need to thrive. The best HR teams are meeting that demand head-on with bold, creative, and data-driven strategies. Here are some of the top trends shaping the future of benefits, and how you can bring them to life in your organization.

Flexible Employee Benefits

The workplace isn’t a place anymore — it’s a mindset. Flexibility gives employees control over when, where, and how they work best. It’s not just about convenience. It’s about making work fit into life, not the other way around.

| What to Offer | Why It Works |

|---|---|

| Remote and hybrid options | Supports productivity, reduces commute-related stress |

| Flexible scheduling | Empowers employees across time zones and caregiving roles |

| Unlimited PTO | Shifts focus from hours worked to outcomes delivered |

| Job sharing | Helps retain talent through creative arrangements |

Inclusive Employee Benefits

A truly inclusive benefits strategy ensures every employee feels seen and supported regardless of their background, identity, or family structure. These offerings reflect your values and build a sense of belonging across your workforce.

| What to Offer | Why It Works |

|---|---|

| Inclusive family leave | Supports all family structures, including LGBTQ+ and single parents |

| Fertility support | Helps everyone access reproductive care, regardless of identity or orientation |

| Culturally relevant benefits | Honors religious observances, alternative healthcare, and diverse mental health |

| Disability-friendly support | Makes the workplace and benefits more accessible to all employees |

Personalized Employee Benefits

One-size-fits-all is over. Employees want — and expect — benefits they can shape around their lifestyle. Personalized benefits drive satisfaction, boost engagement, and show employees you really understand them.

| What to Offer | Why It Works |

|---|---|

| Flexible schedules | Employees get to work when and where they’re most productive |

| Choice-based benefits plans | Let employees customize their benefits package to suit their lifestyle |

| Lifestyle spending accounts | Offer freedom to use funds on fitness, wellness, learning, or hobbies |

| Customizable health plans | Tiered health coverage ensures people get what they actually need |

| Professional development funds | 90% of employees value growth opportunities — don’t leave that off the table |

What Benefits do Employees Value Most?

Employees today value benefits that support their whole-person wellbeing—physically, mentally, emotionally, and financially. It’s no longer just about health insurance and retirement plans. The most valued benefits are ones that help employees thrive in every part of their lives.

Here's a breakdown of how employees value their benefits based on the results of Wellhub's State of Work-Life Wellness 2025 report:

| Benefit Type | What Employees Want | Usage/Importance |

|---|---|---|

| Paid Time Off | Time to rest and recharge | 100% of employees use it |

| Healthcare Insurance | Reliable access to medical care | 92% of employees use it |

| Dental Insurance | Preventive care for overall health | 89% use this benefit |

| Vision Insurance | Visual health matters, especially for desk workers | 84% use it |

| Mental Health Support | Therapy and counseling access | 51% say it's very or extremely important to their wellbeing |

| Wellness Programs | Support for fitness, mindfulness, nutrition | 79% of those with access use them |

| Financial Wellness Support | Help navigating inflation and debt | 68% say finances prevent them from investing in their wellness |

What Benefits Matter Most to Different Generations?

Each generation is balancing different life pressures:

- Gen Z is building habits and wants to feel emotionally safe.

- Millennials are parenting, caregiving, and burning out.

- Gen X is sandwiched between raising kids and supporting aging parents.

- Boomers are eyeing retirement and cost-of-living stability.

Ignoring these differences? That’s a recipe for disengagement. But tailoring your benefits by generation? That’s how you boost satisfaction, retention, and trust.

When Wellhub surveyed thousands of employees around the world for their employee benefit priorities, here's what they said:

| Generation | Top Priorities | Key Barriers | How to Support Them |

|---|---|---|---|

| Gen Z (ages ~18–28) | Mental health support (50% in therapy) Mindfulness tools (apps, classes) Flexibility & hybrid work | Cost of therapy Inflation stress | Affordable or free therapy access Meditation & mindfulness apps Make wellbeing a part of company culture |

| Millennials (ages ~29–43) | Mental health support (45% in therapy) Work-life balance Fitness and nutrition support | Cost/time barriers to healthy eating and therapy | Offer therapy stipends Give time flexibility to manage care needs |

| Gen X (ages ~44–59) | Financial wellness support Sleep health Flexible scheduling for caregiving | Time scarcity Lack of mindfulness engagement | Provide financial planning tools Promote sleep-focused wellness content Offer backup care or dependent support |

| Baby Boomers (ages ~60–75) | Healthcare and inflation protection Dental/vision insurance Pension or retirement planning | Inflation stress | Focus on affordability and security Offer education on Medicare navigation Include proactive health screenings |

How Much do Employee Benefits Cost per Employee?

Employee benefits represent a significant portion of overall compensation—typically about 30% of an employee’s total compensation package. According to the U.S. Bureau of Labor Statistics (BLS), as of March 2025, the average private-industry compensation was $45.38 per hour, with $31.89 going toward wages and $13.49 toward benefits. That means nearly 29.7% of total compensation costs are devoted to benefits. For public sector roles, the number is even higher: 38.4% of total compensation goes toward benefits, with government employers averaging $24.58 per hour in benefits compared to $39.42 in wages.

For HR teams planning budgets, a good rule of thumb is that benefits cost 30%–40% of an employee’s salary. So if your employee earns $60,000 annually, expect to spend an additional $18,000 to $24,000 on their benefits. That puts the total compensation package somewhere between $78,000 and $84,000.

Now, let’s break those numbers down. For private-sector employers, legally required benefits—like Social Security, Medicare, unemployment insurance, and workers’ comp—make up about 8% of total compensation. Insurance benefits (health, life, dental) typically account for another 7–8%, and paid leave (vacation, sick time, holidays) adds another 6 to 7% to the bill. These categories are foundational, but the specifics can vary depending on company size, location, and employee needs.

Among all benefits, health insurance is the biggest expense—and it’s getting bigger. In 2025, employers projected an average 5.8% increase in health plan costs, even after making changes to plan design. Without cost control measures, that figure could climb closer to7%. Aon forecasted even steeper rises, estimating a 9.2% increase before plan adjustments, or 7.3% after employers made tweaks like raising employee contributions.

Bottom line: while benefits come at a high cost, they are not just a legal obligation—they’re a strategic investment. They play a crucial role in attracting talent, improving retention, and boosting employee satisfaction. In fact, 68% of CEOs say their wellness programs help reduce healthcare costs, and 78% report returns greater than 50%, with nearly a third seeing ROI over 100% on wellness investments. That’s money well spent.

| Compensation Type | Benefits Cost (% of Total) | Hourly Average | Breakdown Highlights |

|---|---|---|---|

| Private‑industry | ~29.7% | Benefits ≈ $13.49/hr | Wages ≈ $31.89/hr; benefits ~8% legal, ~7.5% insurance, ~6.5% paid leave |

| State & local government | ~38.4% | Benefits ≈ $24.58/hr | Benefits share considerably higher |

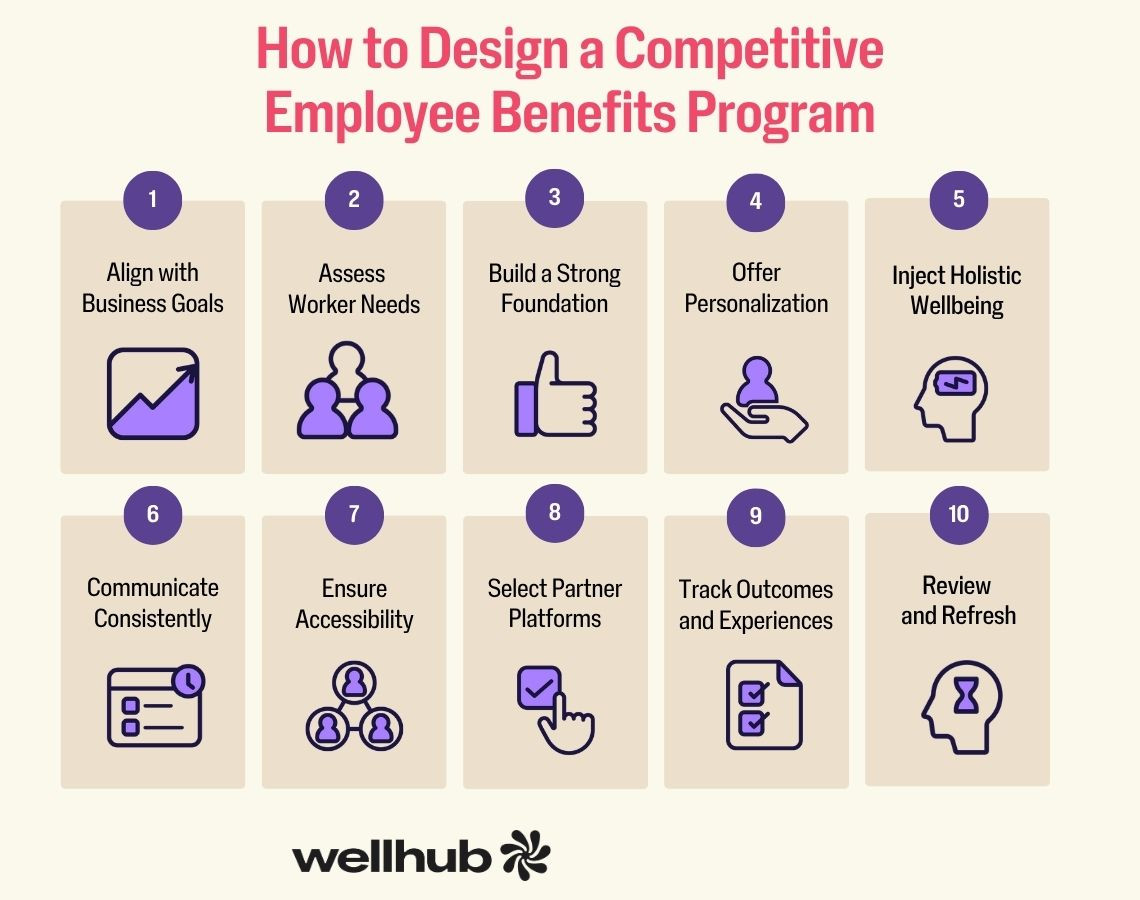

Action Plan: How to Design a Competitive Employee Benefits Program

A competitive benefits program is more than a retention tool — it’s a reflection of your culture, your values, and your long-term business strategy. The right mix of benefits helps you attract top talent, support employee wellbeing, and demonstrate that your organization truly cares. This action plan will walk you through each step to design a program that delivers value to both your employees and your business.

Step 1: Align Benefits Strategy with Business Goals

Start by identifying your organization’s short- and long-term goals — then define how benefits can support them.

Your benefits strategy should serve your business strategy. Whether your organization is focused on rapid growth, reducing turnover, or boosting productivity, your benefits offerings should help move the needle. For example, if you’re expanding your workforce, consider benefits that appeal to diverse demographics. If you're investing in retention, double down on wellness, flexibility, and learning stipends. Grounding your benefits program in business objectives ensures you're building a system that’s not just nice to have — it’s essential to your success.

Step 2: Understand Your Workforce’s Needs

Conduct employee surveys, focus groups, and demographic analysis to identify what your employees value most.

You can’t design a competitive program without knowing what your employees actually want. Use pulse surveys, listening sessions, and anonymized data to uncover benefit gaps and emerging needs. Segment your workforce by generation, life stage, department, or geography — because a new college grad has different needs than a mid-career parent. Listening first helps you prioritize the benefits that will have the greatest impact and ensures you're investing in areas that truly matter to your team.

Step 3: Build a Strong Benefits Foundation

Ensure your core benefits (health, dental, vision, retirement) are competitive and inclusive before layering in extras.

Start with the essentials. These foundational benefits are still top of mind for job seekers and employees alike. Benchmark your offerings against industry standards and competitors. Ensure your health plans include mental wellness support, your retirement plans offer matching or education, and your policies are inclusive of all employees, including LGBTQ+ families and people with disabilities. Without a solid foundation, flashy perks won’t matter.

Step 4: Offer Personalization and Flexibility

Create modular or flexible benefits plans that let employees choose what fits their life.

A modern workforce needs modern options. Employees want the ability to personalize their benefits — from choosing a high-deductible health plan with an HSA to applying a lifestyle spending account toward fitness, learning, or pet care. Consider a cafeteria-style benefits plan that lets employees allocate a set budget across core and optional benefits. Flexibility builds loyalty, drives usage, and sends a clear message: “We trust you to know what’s best for you.”

Step 5: Prioritize Holistic Wellbeing

Expand your offerings to support physical, mental, and financial health.

Today’s employees expect support for their whole selves. That means including mental health resources (like therapy stipends or meditation apps), physical wellness options (fitness memberships, ergonomic tools), and financial wellness programs (emergency savings, student loan repayment). These benefits don’t just boost morale — they drive engagement, reduce burnout, and contribute to long-term retention. And with 85% of employees saying their employer should support their wellbeing, this step is no longer optional.

Step 6: Communicate with Clarity and Consistency

Build a year-round communication plan that makes benefits easy to understand and use.

Even the best benefits program won’t matter if employees don’t know how to access it. Use simple, jargon-free language and visuals. Offer live Q&As, personalized dashboards, and decision support tools that guide employees through enrollment and usage. Highlight underused benefits in newsletters, onboarding, and team meetings. Communication shouldn’t just happen during open enrollment — it should be baked into your culture year-round.

Step 7: Ensure Equity and Accessibility

Conduct a benefits equity audit to identify any barriers to access or inclusion.

Equitable benefits mean everyone has access to the support they need — regardless of income, ability, or background. Review plan eligibility, out-of-pocket costs, and communications through a DEI lens. Are part-time or lower-wage employees effectively excluded from key benefits? Are your materials accessible to people with visual, cognitive, or language barriers? Making benefits equitable is one of the clearest ways to build a more inclusive, caring workplace.

Step 8: Choose the Right Partners and Platforms

Evaluate vendors, tech platforms, and brokers to ensure they support your goals and scale with your needs.

Your partners make a big difference. Look for benefits providers who offer responsive customer service, robust employee education tools, and tech platforms that streamline administration. Choose vendors who prioritize innovation — especially around personalization, mobile access, and AI-powered decision support. A strong ecosystem behind your benefits program makes it easier to manage, easier to scale, and more impactful for employees.

Step 9: Track Outcomes and Employee Experience

Define key metrics and track both quantitative and qualitative results over time.

You can’t improve what you don’t measure. Monitor enrollment rates, usage, and costs — but also track employee satisfaction, retention, and productivity. Send post-enrollment surveys. Ask employees how their benefits are impacting their lives. Over time, connect your data to business performance — and use these insights to refine and improve your offerings year over year.

Step 10: Review and Refresh Annually

Conduct a formal benefits review every year and adjust to meet changing needs.

What worked last year might not work next year. Annual reviews help you stay current with trends, respond to employee feedback, and keep your program aligned with your evolving workforce and business strategy. Revisit benchmarks, audit vendor performance, and re-engage with employees to understand what’s working — and what’s not. A competitive benefits program is never static. It’s a living, breathing strategy that evolves with your organization.

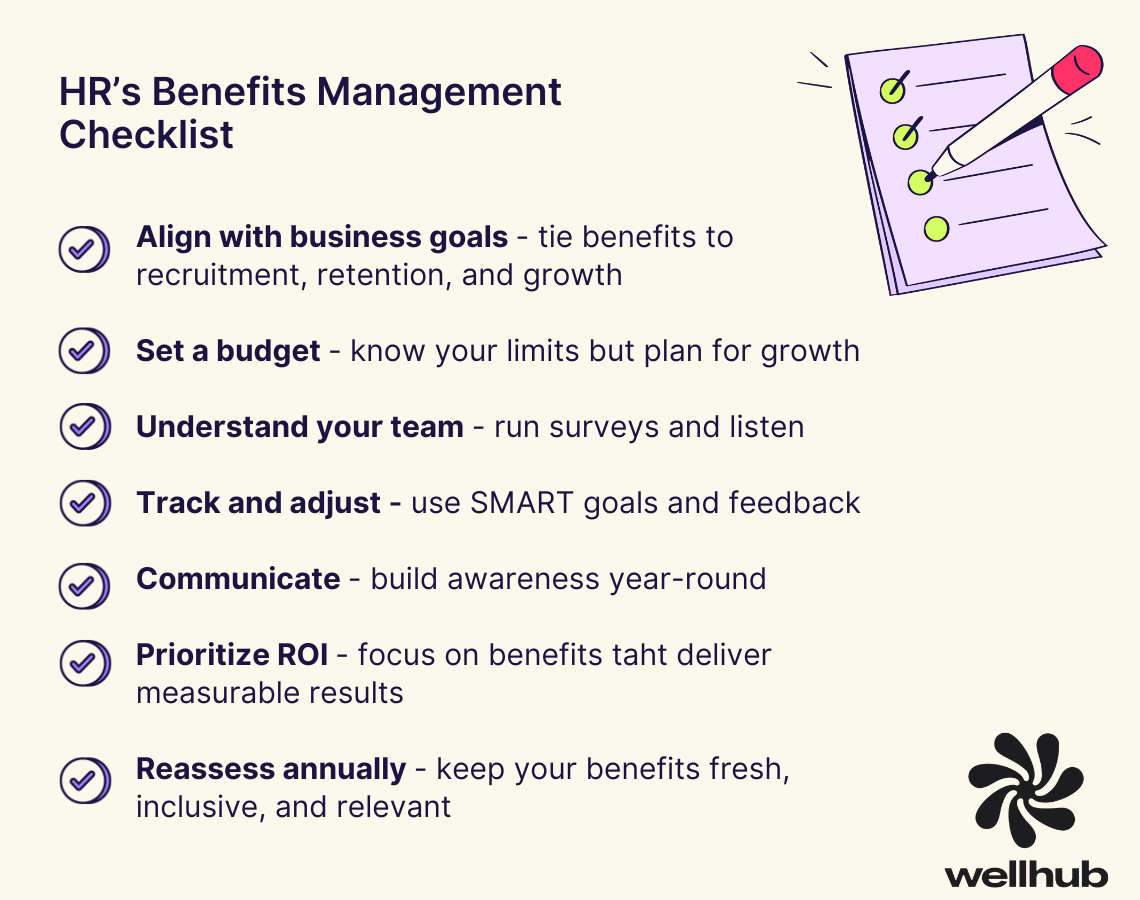

How HR Can Effectively Manage Employee Benefits

Building, implementing, and maintaining an effective employee benefits program takes time and effort. If you don't already have someone to take ownership of these programs, and HR doesn't have the bandwidth or expertise, we recommend hiring an employee benefits consultant. This can reduce HR's administrative burden and improve the employee experience as well.

Align Benefits with Business Strategy

Start by zooming out: your benefits strategy should align with your company’s long-term goals. If your company is scaling fast, focus on benefits that attract top talent across different life stages. If you’re prioritizing retention, think about programs that build loyalty—like career development stipends or mental health support.

Every benefit should serve a purpose, whether that’s reducing absenteeism, boosting morale, or strengthening your employer brand.

Establish a Clear Budget (and Stick to It)

Benefits can cost up to 30% of total compensation—so budgeting is essential. Outline exactly what your company can afford before making any benefit commitments. Make sure your budget accounts for both current employees and anticipated new hires.

And remember, you can stretch your budget with smart choices. Some high-impact benefits—like flexible work hours, wellness programs, or local gym access—are low-cost but high-return.

Listen to What Employees Actually Want

Too often, companies invest in benefits that don’t match employee needs. So before you build your package, ask your people what they value. Use pulse surveys or focus groups to learn what really matters—whether that’s fertility support, pet insurance, or meditation apps.

This is especially crucial for building an inclusive benefits strategy. Different demographics have different priorities. Parents may want childcare support. Gen Z may prefer mental health resources. Tailoring your benefits to your team ensures higher satisfaction and engagement.

Measure ROI Early and Often

Set clear, measurable goals using the SMART method (Specific, Measurable, Achievable, Relevant, Time-bound). Examples include:

- Increase wellness program participation by 15% in six months

- Reduce healthcare claims by 10% this year

- Boost employee satisfaction scores to 85% in the next pulse survey

Track your progress and adjust. Collect both qualitative feedback and hard data. This is how you demonstrate value to the C-suite and protect your budget during tight quarters.

Communicate Benefits Clearly and Often

Even the best benefits won’t help if your team doesn’t know about them. So roll them out with fanfare! Host info sessions, send engaging emails, and create a benefits portal that’s easy to navigate.

Benefits usage is often tied to awareness—so don’t just communicate at open enrollment. Make it ongoing.

Focus on High-ROI Benefits

Not all perks are created equal. Consider this:

- Wellness programs have a proven ROI:82% of CEOs report a positive return, and nearly 1 in 3 say they get back double what they put in.

- Childcare benefits can yield a 425% ROI, thanks to reduced absenteeism and higher retention.

- Mental health support is especially critical: 47% of employees say work stress is harming their mental wellbeing, and most who aren't in therapy say cost is the reason why.

These programs don’t just support wellbeing—they’re smart business.

Keep Optimizing

Benefits strategy isn’t a set-it-and-forget-it initiative. Stay current with workforce trends, track participation rates, and revisit your offerings annually. Be flexible and open to experimentation. What worked last year might not work today.

Employee Benefits FAQs

What is Employee Benefits Liability Coverage?

Employee benefits liability coverage is a type of insurance that protects employers if they make administrative errors or omissions while managing employee benefits. For example, if an HR rep forgets to enroll a new hire in health insurance and the employee incurs medical expenses, this coverage can help cover the legal and financial fallout.

How Many Hours can a Part-time Employee Work Without Benefits?

Under the Affordable Care Act (ACA), employees working 30 hours or more per week are considered full-time and may be eligible for benefits like health insurance. However, employers typically define part-time as under 30 hours, and benefits eligibility for those roles varies by company policy and state law. Always double-check your plan documents and local regulations.

What is Employee Benefits Insurance?

Employee benefits insurance refers to group insurance policies that cover employees — like health, dental, vision, life, and disability insurance. These plans are often bundled and offered at reduced rates, helping you protect your team’s wellbeing while controlling costs. Many providers offer add-ons like wellness programs or mental health support.

How do I Communicate Employee Benefits?

Effective benefits communication is ongoing, clear, and personalized. Use multiple channels (email, HR portals, live Q&As, 1:1 meetings) and tailor messages to life stages (e.g., parents vs. early-career employees). Include visuals like plan comparison charts and use plain language. Don’t just explain what’s offered—show employees how to use it and why it matters.

Are Employee Benefits Taxable?

Some benefits are taxable, others are not. Tax-free benefits include employer-provided health insurance, HSA contributions, and dependent care FSAs (up to IRS limits). Taxable benefits can include gym memberships, gift cards, and certain tuition reimbursements. Always consult a tax advisor or benefits broker to ensure compliance.

Employee Benefits Drive Engagement, Retention, and Wellbeing

Designing the right benefits strategy can feel overwhelming—especially when employee needs keep changing. Between rising healthcare costs, mental health concerns, and generational differences, HR leaders face pressure to offer more without overspending. But the real challenge? Making sure employees actually use and value what’s offered.

A holistic employee wellbeing program simplifies that work. It brings physical, mental, and financial support into one place—so employees can access the care they need, when they need it. Wellhub helps companies reduce burnout, improve engagement, and increase satisfaction. In fact, 61% of employees with access to a wellbeing program say they’re happy at work—compared to just 36% without one.

Speak with a Wellhub Wellbeing Specialist to build a benefits strategy that improves employee lives—and business outcomes.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

FSA vs. HSA Strategy for HR Leaders | Wellhub

Compare FSA vs HSA rules, tax advantages, eligibility, and rollover differences to help employees choose the right account and avoid costly compliance issues.

Employee Wellness Programs: Key Components for Success | Wellhub

Transform your workplace wellness strategy by integrating physical, mental, financial, and social wellbeing into a comprehensive wellness program that works

Benefits Strategy Roadmap: Pull and Retain Top Talent | Wellhub

Support wellbeing, reduce turnover, and maximize ROI with a benefits strategy built for today’s workforce—not yesterday’s spreadsheet.