The Ultimate Payroll Checklist for HR Leaders in 2024

Last Updated Jan 28, 2025

When it comes to payroll, there's a lot to think about. Calculating gross pay, taxes, and withholding the right deductions is enough to make anyone totally confused — especially if you don't have a payroll software system!

But don't break a sweat. There are ways to ease your payroll burdens and prepare yourself for the inevitable payroll questions and audit. Use this payroll checklist to stay on top of pay without missing a beat.

What is a Payroll Checklist?

A payroll checklist is a tool that allows HR leaders to track employee pay, manage deductions, and ensure accuracy. It's also used to review payroll data before issuing payment to employees. The checklists may include:

- Components of the employee record (e.g., name, address, Social Security number)

- Accurate withholding calculations for taxes and other deductions

- Payroll register for verifying payroll calculations

- Double-checking to ensure the accuracy of pay data

- Making sure employees are paid correctly and on time

Using a payroll checklist can help minimize errors, reduce costs associated with manual audits, and give HR leaders peace of mind that all their employees are being paid accurately. It also ensures compliance with government regulations, which can help prevent costly fines and penalties. Plus, it's a simple way to ensure payroll accuracy in the long run.

Employees should also be aware of their rights when it comes to their paychecks. They should be informed of any changes to their earnings, deductions, or other related information so they can make sure everything is correct and up-to-date. HR representatives can use the payroll checklist to keep track of any changes and ensure all employees are being treated fairly.

Finally, using a payroll checklist helps protect against fraud and other dishonest practices. By regularly reviewing it, employers can spot irregularities in payments or discrepancies between employee records and actual pay data. This can help minimize losses due to theft or misuse of funds by external parties.

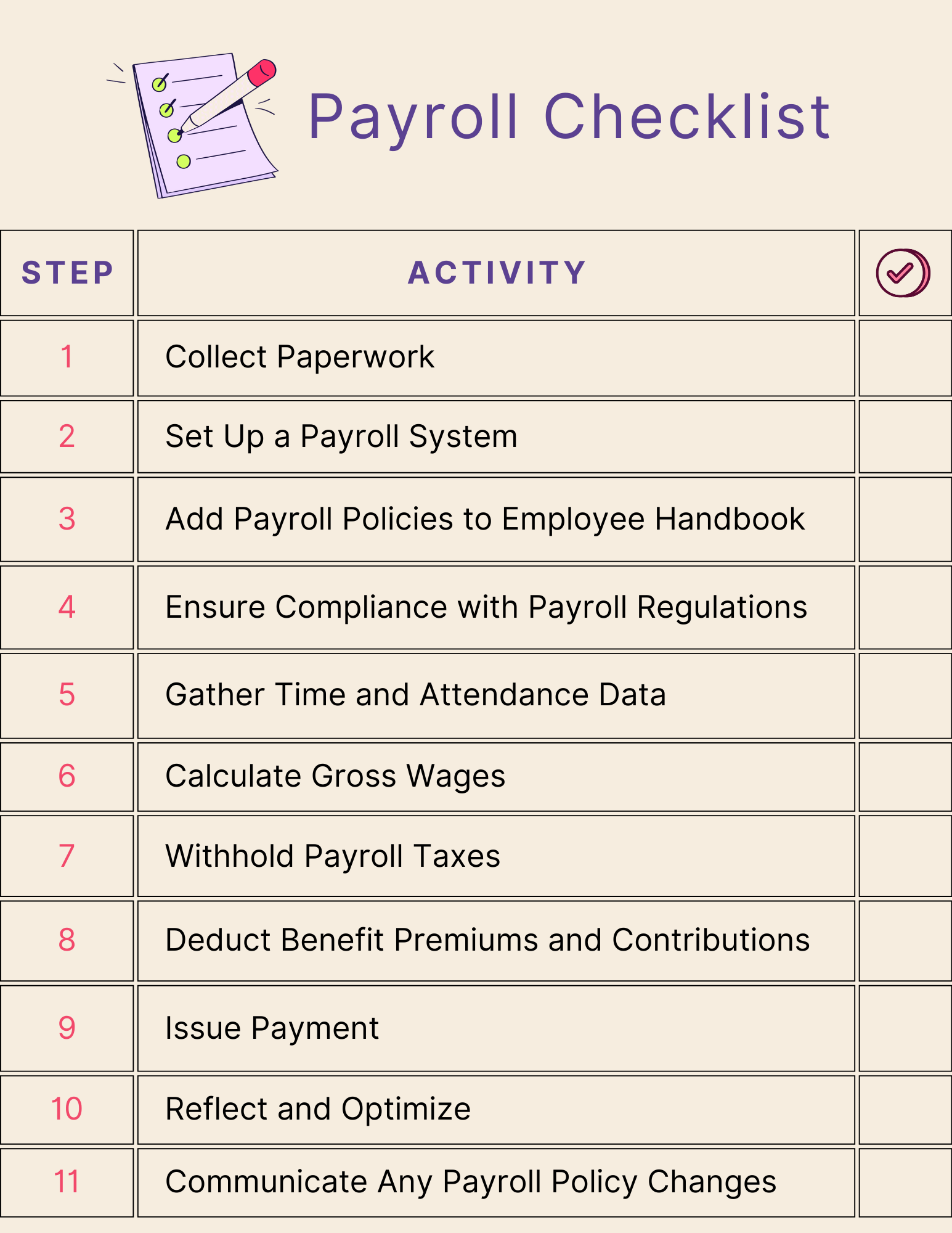

Payroll Checklist

There are three stages to a payroll run. The first stage is pre-payroll, where you gather employee information, set up your payroll system, and establish payroll processes. During the second stage — payroll processing — you'll calculate your team's paychecks after deducting employee benefits and taxes. The final stage is post-payroll, which involves payroll automation and keeping staff informed of payroll changes.

Pre-Payroll

Collect paperwork

Before you can process payroll, you need some specific information about your employees to determine their employment eligibility, tax withholdings, contact details, and where to deposit their pay. You can start by gathering these documents:

- I-9: An I-9 form verifies your employees are who they say they are and provides evidence of their employment eligibility. Employees may submit information to verify employment eligibility, such as a passport, driver's license, or birth certificate.

- W-4: The Form W-4 allows employees to identify their federal tax withholding status and claim any dependent or other credits.

- State Tax Withholding Forms: Workers who live in a state that collects income tax may need to fill out a state tax withholding form or certificate.

- Direct Deposit Form: This form provides employees' banking details, including routing and account number, so you may direct deposit their earnings.

- Benefit Elections: Collect information on each employee's benefit elections and contributions for medical and dental insurance, retirement plans, and any other benefits that require payroll deductions.

Set up a payroll system

Most companies that run payroll don't process it manually. Instead, they use a dedicated payroll software system or provider that can streamline the process and store payroll records. You may also implement a time and attendance system to track employee work hours, making it easier to calculate pay, especially for hourly employees. As you set up a payroll and time and attendance system, you may need to configure it for payroll deductions and taxes using the forms you gathered from each employee.

Include payroll policies in your employee handbook

It's helpful to create an employee handbook that outlines your payroll policies. Some examples of policies to include in your handbook include payroll frequency, commission and bonus eligibility and calculation, and overtime. Make sure all employees receive access to the handbook and encourage them to reach out to the human resources department if questions arise.

Stay compliant with payroll regulations

Keep in mind that there are federal, state, and local regulations concerning employee pay. Regulations may change, so it's vital to stay on top of updates that impact your payroll policies. Consider signing up for reputable payroll newsletters through human resource organizations like the Society for Human Resource Management (SHRM). The IRS also releases a regular newsletter highlighting recent payroll legislation and announcements for payroll professionals.

Payroll Processing

During payroll processing, you or your payroll team will calculate gross wages, tax withholding amounts, benefit deductions, and net pay. You'll issue every employee their net earnings via direct deposit, a paycheck, or a pay card.

Gather time and attendance data

To initiate the payroll process, start by collecting time and attendance data. Many companies rely on a time and attendance system that tracks employee hours and stores the data for payroll calculations. Your time and attendance system may integrate directly with your payroll system, allowing you to pull total hours worked during the pay cycle automatically. It's good practice to have managers and employees sign off on hours worked to avoid potential errors.

Calculate gross wages

Next, you'll calculate gross pay. An employee's gross pay includes regular wages and any earnings from overtime, bonuses, or commissions. A payroll system can help you track each employee's salary or hourly rate, which you can apply in gross pay calculations.

Withhold payroll taxes

Your next step is calculating and deducting the appropriate federal, state, local, Medicare, Social Security, and other applicable taxes. You'll use the employee's W-4 and state withholding certifications to identify how much to withhold.

Deduct benefit premiums and contributions

After deducting the appropriate taxes, you may withhold any benefit deductions for health insurance, retirement, life insurance, or similar programs. In some cases, you may need to withhold garnishments or court-ordered deductions.

Pay employees

The final amount after deducting taxes and benefits is net pay. You'll issue net pay according to your payroll policies or employee preferences. Some companies provide direct deposit, which allows employers to submit pay directly to their worker's bank account. Other options include issuing a paper check or using a pay card.

It's essential to pay your employees according to your regular pay schedule. Late payments can adversely impact employees, making it hard for them to meet obligations such as rent, mortgage, and auto payments. They may also have legal repercussions for your organization.

Post-Payroll

The post-payroll stage is a good time to reflect on your current payroll processes and look for improvements. If you're calculating payroll manually, you may consider investing in automated payroll software to reduce the risk of errors and initiate an audit trail.

Manual pay calculation is very time-consuming, and it's easy to make mistakes, no matter how organized or careful you are. So many factors go into calculating pay that it's nearly impossible to guarantee a perfect payroll run every pay cycle, especially if you're handling it manually. With payroll software, you alleviate the burden on yourself and the payroll staff.

Consider outsourcing payroll

If payroll takes too much time, you may consider outsourcing the process to a professional payroll organization or contractor. Payroll companies specialize in all things payroll, and by working with them, you can save time and money since you won't need to invest in payroll software.

Communicate payroll policy changes

Whether you keep payroll in-house or outsource it, staff will want to be aware of any changes to your payroll policies. For instance, if you decide to shift your payroll cycles from weekly to bi-weekly, that's a significant change your employees will want to know. You'll also want to notify them of updates to your overtime or bonus policies.

It's an industry best practice to review payroll laws and regulations regularly. Staying on top of new rules can help keep your organization compliant and avoid unnecessary fines or penalties.

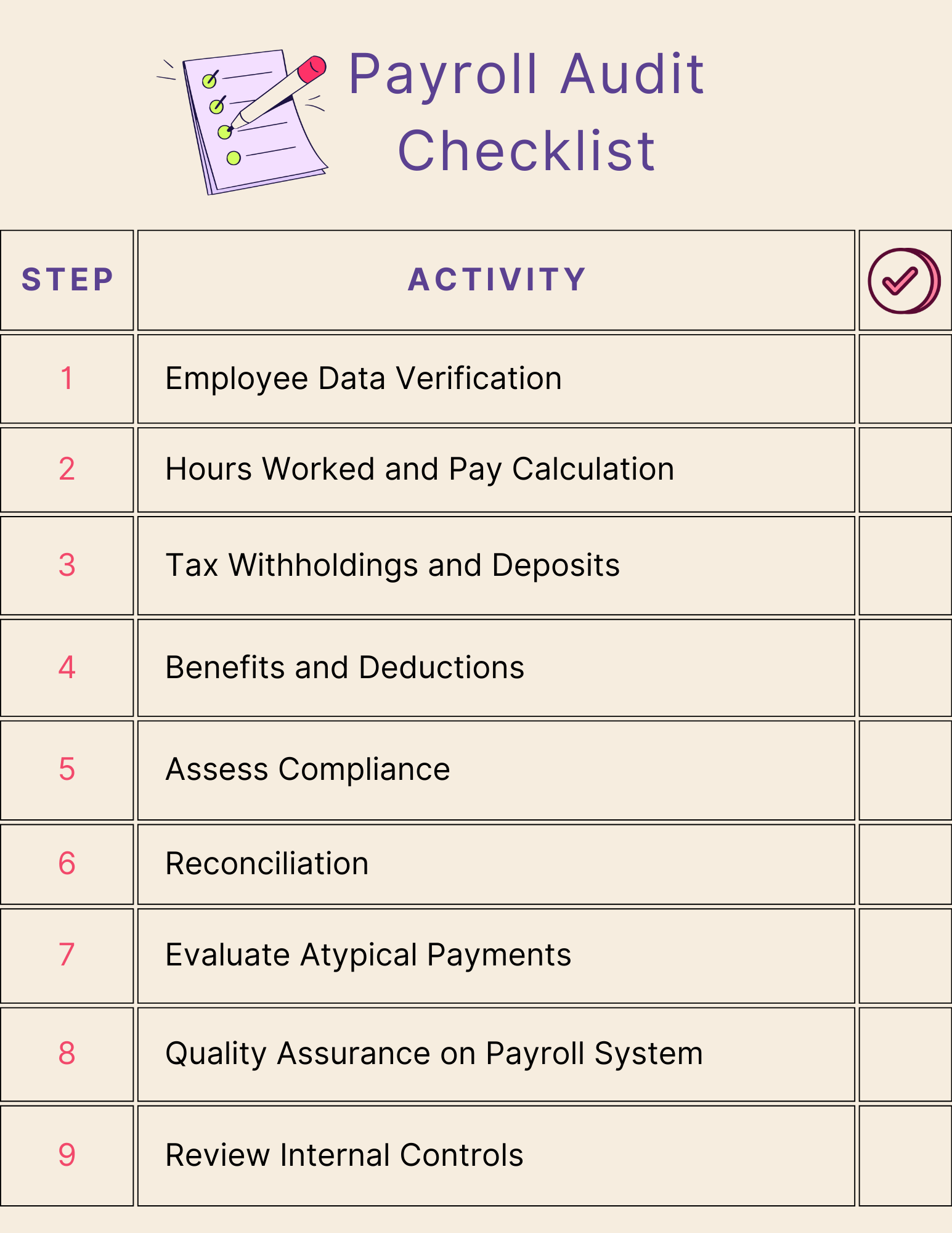

Payroll Audit Checklist

Running a payroll audit is an integral part of your business processes. An audit can help you catch errors in the payroll process early before they become significant problems. Mistakes like miscalculating overtime hours, using the wrong rate of pay for an employee, or deducting incorrect benefit premiums from a worker's paycheck can lead to big future consequences, like government fines or even lawsuits. It's a good idea to incorporate this payroll monthly audit checklist into your business-as-usual process so no problem goes unnoticed for too long.

You may conduct payroll audits internally or externally. Many companies do both. An internal audit requires in-house staff to review current payroll processes for errors. You may conduct internal audits monthly, quarterly, annually, or some other frequency that makes sense for your business.

An external payroll audit uses an outside accounting firm to review your payroll processes. External payroll audits may be part of finalizing the financial statements for your organization, or you may instigate if you feel an outside consultation could assist in uncovering payroll inefficiencies.

Whether you undergo an internal or external payroll audit, it will likely unfold something like this:

Employee Data Verification

Verifying your employee's information, including their name, identification number, address, phone number, and other details, helps keep your records up-to-date and catch any inconsistencies. During the employee data verification process, you can ask workers to verify the details you have and report any necessary changes.

You can also verify employee data across different systems and sources, such as your payroll system, timekeeping system, and any benefits they enroll for, such as health insurance or a retirement plan.

Hours Worked and Pay Calculation

Recalculating gross pay is a critical part of any payroll audit. To verify your prior gross pay calculations, you can sample a portion of employee paychecks and reconcile timesheets, overtime, holiday pay, leave, and any manual adjustments made. If you find any mistakes in your sample calculations, expanding the audit to include additional employees is a good idea. That way, you can determine if it's a one-off mistake or a bigger issue.

Tax Withholdings and Deposits

Calculating tax withholdings can be messy, especially when you have employees working in different states or even countries. Your employees may have varying withholdings, making the process even trickier. On top of that, federal and state governments require organizations to submit withholdings according to specific deadlines.

When auditing payroll taxes, start with a sample of paychecks and compare the withholding amounts with the employee's W-4 and state withholding certificates. You may also confirm accurate Social Security and Medicare taxes and any other applicable tax withholdings.

Organizations are responsible for preparing accurate W-2 and 1099 forms, which total annual compensation for employees and contractors. Consider double-checking W-2s and 1099s against data in your payroll system.

Benefits and Deductions

Employees who opt into your company's health insurance, retirement plan, and other benefit options may pay premiums or contributions for their participation, which payroll administrators deduct from their pay. Since premiums may fluctuate when you update benefits or an employee opts to change their elections, reviewing deductions frequently is good practice.

To verify the accuracy of benefit deductions, compare employee elections with the deductions on their paycheck. You may also review any garnishments or court orders to confirm the correct amounts and that you're fulfilling the terms of the order.

Compliance

Employees are responsible for complying with federal and state labor laws and regulations set by the Occupational Safety and Health Administration (OSHA) and other agencies. Consider setting aside some time to review current regulations, particularly those concerning overtime, breaks, minimum wage, and discrimination, to confirm your organization's adherence to the laws.

Reconciliation

Besides verifying your employees receive accurate pay, you'll also want to confirm your organization correctly records the pay in the general ledger and that bank statements accurately reflect payroll disbursements.

During this part of the audit, try working with your accounting team, which likely has access to the general ledger and bank statements. Consider sharing details of net pay and payroll tax deposits so your company's accountants can verify them. If there are any discrepancies, you may need to collaborate further to investigate.

Additional Considerations

A payroll audit is an excellent time to evaluate other aspects of the payroll process, including unusual payments such as bonuses and reimbursements. Since bonuses and reimbursements may be infrequent, there's a risk of miscalculation among payroll staff who don't handle them regularly. You may also test your payroll software and review internal controls for deficiencies.

Key Elements of a Payroll Checklist for Scaling Businesses

A well-structured payroll checklist acts as a roadmap. It is particularly essential during scaling, when the influx of new employees, changes in roles, team updates, and evolving organizational structures can easily lead to confusion and errors if not managed systematically. This proactive approach ensures that payroll adjustments are made seamlessly, eliminating any disruptions or confusion and protecting your overall human resource strategy.

When an organization scales its teams to keep up with business growth, it’s best to address these key elements of a payroll checklist to ensure the process unfolds smoothly. Following a methodical process — rather than simply "going with the flow" — lays the foundation for successfully transitioning to a new organizational structure.

Here are the most important aspects to consider as your organization evolves.

- Clear Job Roles and Descriptions

As the organization grows, new positions and responsibilities emerge. Defining clear job roles and responsibilities is essential to avoid role ambiguity, set expectations for employees and executives, appropriately plan for expenses, and streamline operations. To create a thriving organizational culture during company growth, delineating these roles becomes even more critical to maintaining efficiency and accountability.

Without establishing definitive roles and responsibilities of those roles, change can be extra confusing for employees —which negatively affects operations, employee engagement, and satisfaction, too. On the other hand, defining these roles ahead of time minimizes overlaps, reduces confusion, and enables efficient collaboration throughout the entire organization, new employees included.

- Effective Onboarding Process

A seamless onboarding process is essential to integrate new team members smoothly. During scaling, new hires join the organization with varying levels of experience. An effective onboarding process not only introduces them to their roles and responsibilities but also immerses them in the company's culture and values.

For example, HR specialists typically introduce benefits available to employees — such as Wellhub’ wellness program. Promoting employee wellness from day one shows exactly what your company culture looks like and the care your organization has for its employees. This early integration for new employees enhances their sense of belonging, accelerates their productivity, and contributes to lower turnover rates as your organization adjusts to change.

- Accurate Compensation and Benefits

When a whopping 81% of workers say they are more productive when they’re paid fairly, managing compensation and benefits becomes even more important and intricate as the team scales. First, it’s helpful to have an ongoing compensation strategy in place so that as your organization grows, HR has a firm grasp on what their workforce needs to be successful and satisfied at their jobs. From there, HR can tighten up their payroll practices to ensure accurate compensation for each employee, along with benefits such as healthcare, retirement plans, and wellness resources, becomes paramount. A comprehensive understanding of each employee's package ensures equity and satisfaction, contributing to a positive work environment.

- Compliance with Labor Laws

Adhering to labor laws and regulations is always a must. Core laws such as the Fair Labor Standards Act (FLSA) in the United States dictate minimum wage, overtime, and child labor standards. These basics should be some of your top priorities in HR as you scale your teams, especially since violations can lead to legal consequences and damage the organization's reputation. To avoid these types of violations, payroll checklists should include rigorous checks to ensure compliance and avoid costly penalties.

- Payroll Technology and Automation

As the organization scales, manual payroll processes become less efficient and error-prone—it can be life-changing for HR to have payroll technology that is built to accommodate growth. Whether your workforce doubles or triples in size, automated systems can handle the increase in data and transactions without a significant increase in effort.

Investing in payroll technology and automation streamlines complex tasks, reduces human errors, and ensures timely and accurate payments, including data from important documentation such as payroll register reports. This not only boosts operational efficiency but also frees up HR teams to focus on strategic initiatives.

- Transparent Communication

Forty percent of workers agree that poor communication reduces trust both in leadership and in their team. That’s not a firm foundation on which to build your growing business. That’s why open communication between HR, management, and employees is paramount during growth. Changes in roles, compensation, or benefits should be communicated clearly and honestly to avoid misunderstandings and uncertainties. Engaging in ongoing dialogue, including with frequent meetings, one-on-ones, and HR surveys, fosters trust, alignment, and a collaborative environment.

Ramp up Your Payroll Processes for Happier Employees

While your staff likely loves their job and your organization, they do work for a paycheck. Mistakes and errors in pay can lead to discontent among workers — something you definitely don't want. By implementing an effective, fine-tuned payroll process, you're benefiting your business and keeping your staff happy and motivated.

A payroll process is an opportunity to consider other ways to improve employee satisfaction, like offering wellbeing benefits. Integrating a holistic program that gives employees access to tools that benefit their physical and mental wellness can increase retention rates by over 40%, according to a Wellhub study.

To discover how Wellhub can enhance employee wellbeing and retention, talk to a Wellhub Wellbeing Specialist today.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- Reduce Employee Healthcare Costs: The Ultimate Guide

- How Much is Health Insurance? Costs for Employers

- Beyond the Basics: Variable vs. Fixed Costs

References:

- Duncan, C. (2022, July 25). How to conduct a payroll audit for small business. Business.org. Retrieved on August 8, 2024, from https://www.business.org/finance/accounting/how-to-conduct-a-payroll-audit-for-small-business/

- IRS. (n.d.) About Form W-4, Employee’s Withholding Certificate | Internal Revenue Service. Retrieved on August 8, 2024, from https://www.irs.gov/forms-pubs/about-form-w-4.

- IRS. (n.d.) e-News subscriptions | Internal Revenue Service. Retrieved on August 8, 2024, from https://www.irs.gov/newsroom/e-news-subscriptions.

- Internal Audit vs. External Audit: Understanding the Difference. (n.d.) BlackLine. Retrieved on August 8, 2024, from https://www.blackline.com/resources/glossaries/internal-audit-vs-external-audit/.

- Landau, H. (2024, January 29). What is payroll software? Everything small businesses need to know. Fit Small Business. Retrieved on August 8, 2024, from https://fitsmallbusiness.com/what-is-payroll-software/.

- OSHA. (n.d.) Law and Regulations. Retrieved on August 8, 2024, from https://www.osha.gov/laws-regs.

- Payroll Audit. (n.d.) ADP. Retrieved on August 8, 2024, from https://www.adp.com/resources/articles-and-insights/articles/p/payroll-audit.aspx

- Payroll Audit: What It Is & How To Conduct It. (2024, January 9). FreshBooks. Retrieved on August 8, 2024, from https://www.freshbooks.com/hub/payroll/payroll-audit.

- Piccolo, K. (2023, July 31). 17 items that need to be included in your employee handbook. GenesisHR Solutions. Retrieved on August 8, 2024, from https://genesishrsolutions.com/peo-blog/what-should-be-included-in-an-employee-handbook/.

- Qureshi, A. (2024, April 3). What are the Different Types of Attendance Systems? Jibble. Retrieved on August 8, 2024, from https://www.jibble.io/article/types-of-attendance-systems.

- USCIS. (2024, August 1). Employment eligibility verification. Retrieved on August 8, 2024, from https://www.uscis.gov/i-9.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Eight KPIs for Payroll That HR Can Track

Managing payroll is one of the most critical HR tasks. Here’s what KPIs can help you optimize this process.

How to Master Payroll Correction | Wellhub

Most companies make payroll errors, and it could be costing you. Discover how you can avoid common mishaps and how to correct them.