How to Value a Business: 6 Methods

Last Updated Jan 28, 2025

Nothing woos investors quite like financial confidence. Imagine walking into a room filled with potential buyers — could you name your price without second-guessing the worth of your business? When you do know your business value, you not only know the figures but also your organization's health, potential, and opportunity.

Whether you’re preparing to sell, seeking investment, or planning your next big move, knowing how to value a business gives you the power to shape its future. These six methods for business valuation can give you a clear roadmap to uncovering your company’s true value — beyond the balance sheets.

What is Business Valuation? Why Does it Matter?

Business valuation is the process of determining how much a business is worth in monetary terms. This might sound a lot like your revenue, but it’s more than that — the valuation includes any monetary value your company has, including assets and stocks.

Determining the value isn’t a one-time exercise, either. Business leaders understand how dynamic a business valuation is and how it shapes both long-term strategies and immediate actions. Knowing your business’s value can help in key scenarios like:

- Mergers and Acquisitions: Enter negotiations with confidence by knowing your company’s worth.

- Fundraising: Attract investors by showcasing your value.

- Exit Strategies: Plan for retirement or succession with accurate numbers.

- Partnership Agreements: Fairly priced buyouts or incoming partnerships.

- Performance Benchmarking: Identify areas for improvement and set goals.

To have an accurate picture, it’s important to understand that every valuation hinges on several factors that reflect a company’s strengths, weaknesses, and opportunities:

- Financial Performance: Revenue, profitability, and cash flow are critical indicators of health.

- Market Conditions: Industry trends and economic shifts can impact value.

- Customer Base & Brand Reputation: Loyal customers and strong branding can significantly enhance worth.

- Management Team & Employee Expertise: A skilled workforce and strong leadership drive innovation and performance.

- Intellectual Property: Patents, trademarks, and proprietary technologies add competitive value.

- Legal & Regulatory Environment: Compliance or pending legal issues can impact valuation.

Together, these elements provide a full picture of a business’s worth.

6 Business Valuation Methods

When it comes to determining a business’s value, no single method fits all. Each approach offers unique insights depending on your business type, size, and objectives.

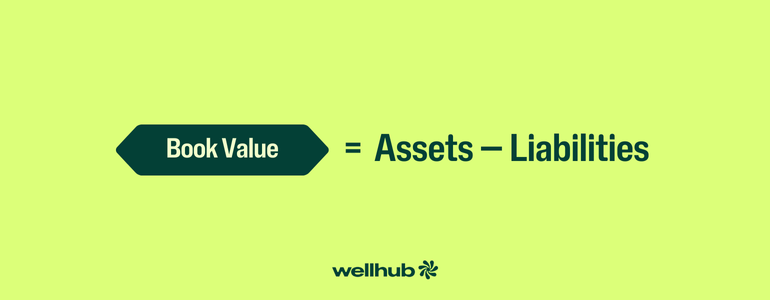

Method 1: Book Value

Book value is often considered the foundation of business valuation. It calculates the company’s net worth by subtracting its total liabilities from total assets, as listed on the balance sheet. Think of it as a snapshot of your business’s tangible financial standing — a straightforward way to measure what remains if everything were liquidated.

This method is popular for small businesses and industries with significant physical assets, such as manufacturing or real estate. However, it may fall short for businesses driven by intangible value, such as tech startups or creative firms. It's calculated with the following formula:

Suppose your business owns assets like equipment, property, and cash valued at $2 million, while liabilities such as loans and accounts payable total $500,000. The book value of your business is:

$2,000,000 − $500,000 = $1,500,000

This $1.5 million represents the tangible equity of the business, or book value, providing a clear baseline for valuation.

Pros

- Simplicity: Book value relies on data from the balance sheet, making it quick and easy to calculate.

- Useful for asset-heavy industries: Companies with significant physical assets often benefit from this method.

Cons

- Doesn’t account for future potential: Book value focuses on the present and ignores growth opportunities or market trends.

- Misses intangible assets: Factors like brand reputation, intellectual property, or customer loyalty aren’t reflected.

- Static view: Because it uses historical data, this method may not represent the current market value of assets.

For growth-focused businesses looking to project long-term potential, the discounted cash flow method offers a deeper look into future earnings.

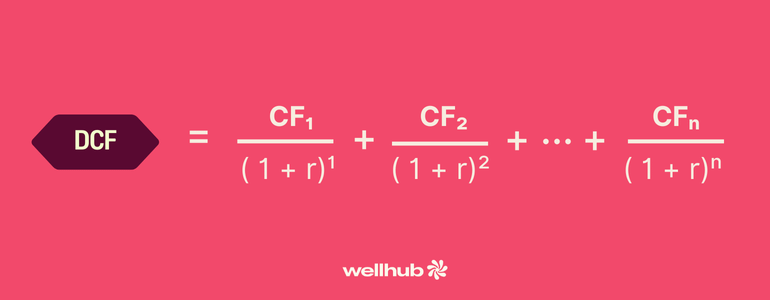

Method 2: Discounted Cash Flow (DCF)

Discounted Cash Flow or DCF is a valuation method that focuses on a business’s future potential. It estimates the present value of a company by projecting its future cash flows and discounting them back to today’s dollars. This approach is particularly helpful for businesses with steady, predictable earnings or significant growth opportunities.

Unlike book value, which looks at what the business has today, DCF asks, “What could this business generate in the future?” It’s a great method for forward-thinking business owners or investors aiming to understand long-term profitability.

Imagine a business that expects to generate $1 million annually in cash flow (which you can find on a cash flow statement) for the next 10 years. A discount rate (representing risk and the time value of money) is set at 10%. The DCF formula estimates how much these future earnings are worth today:

Using this method, the present value of $1 million per year over 10 years with a 10% discount rate is approximately $6.14 million. This number reflects the current value of future earnings after accounting for risks and the decreasing worth of money over time.

Pros

- Accounts for growth: Unlike static methods, DCF highlights future potential.

- Customizable: Adjusts for risks and industry-specific factors using the discount rate.

- Investor-friendly: Provides a detailed forecast for long-term decision-making.

Cons

- Complexity: DCF calculations require precise projections of cash flow and discount rates, which may involve advanced financial tools or expertise.

- Sensitive to assumptions: Small changes in cash flow estimates or discount rates can significantly impact results.

- Not ideal for volatile businesses: Companies with inconsistent cash flows may find DCF less reliable.

Next is market capitalization, a quick yet effective way to value businesses with publicly traded shares.

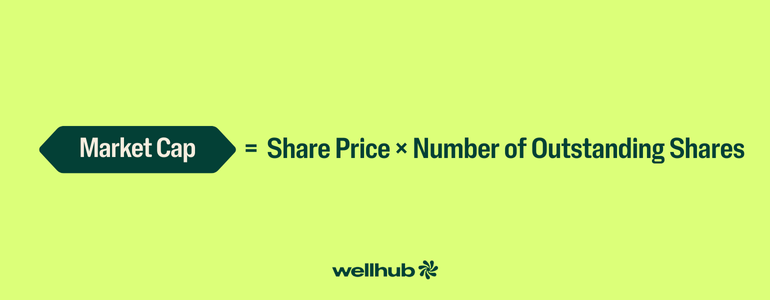

Method 3: Market Capitalization

Market capitalization, or market cap, is one of the most straightforward ways to value a publicly traded company. It represents the total value of a company’s outstanding shares and is calculated by multiplying the current stock price by the total number of shares in circulation.

Think of it as the stock market’s way of placing a price tag on a company. While it doesn’t account for factors like debt or cash reserves, it offers a snapshot of how the market perceives a company’s value at any given moment.

For example, if a company has 10 million shares trading at $50 each, the market cap would be:

$50 × 10,000,000 = $500,000,0000

This means the company is valued at $500 million by the market.

Market cap can help classify companies into different categories, which often correlates to their size and risk profile:

- Large-cap: Companies worth over $10 billion, typically stable and well-established.

- Mid-cap: Companies valued between $2 billion and $10 billion, balancing growth and stability.

- Small-cap: Companies between $300 million and $2 billion, often in growth stages but with higher risk.

- Micro-cap: Companies under $300 million, usually early-stage businesses with significant risk but potential upside.

Pros

- Real-time valuation: Market cap adjusts instantly to reflect market sentiment and trading activity.

- Simple to calculate: Requires only stock price and share data.

- Common benchmark: Useful for comparing public companies within the same industry.

Cons

- Limited scope: Doesn’t include debt, cash reserves, or other financial factors.

- Market-driven: Subject to fluctuations based on investor sentiment, not always reflecting intrinsic value.

- Not applicable to private companies: Since private businesses don’t have publicly traded shares, alternative valuation methods are needed.

While market cap offers a quick valuation snapshot, it’s often paired with methods like enterprise value for a more comprehensive perspective.

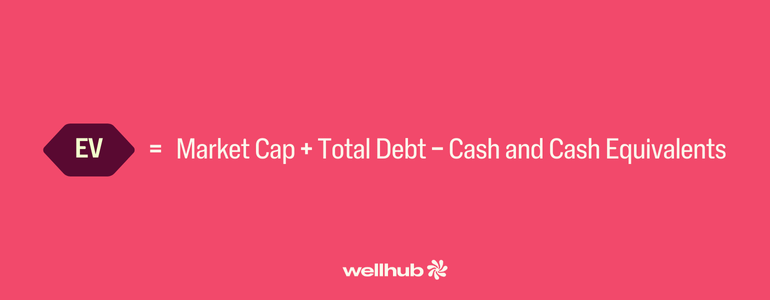

Method 4: Enterprise Value (EV)

Enterprise Value (EV) provides a more well-rounded picture of a company’s worth by factoring in not just equity (market cap) but also debt and cash. It’s often referred to as the "takeover price" because it reflects the cost to acquire the entire business, including its obligations.

Unlike market capitalization, which focuses solely on equity, EV accounts for the broader financial structure, making it a favorite among investors assessing acquisition opportunities or comparing companies across industries.

The formula looks like this:

Let’s say a company has:

- A market cap of $500 million.

- $200 million in total debt.

- $50 million in cash and cash equivalents.

The enterprise value would be:

$500,000,000 + $200,000,000 − $50,000,000 = $650,000,000

This $650 million represents the cost to acquire the company and assume its debt while benefiting from its cash reserves.

Pros

- Holistic valuation: Includes both equity and debt, offering a realistic acquisition price.

- Comparable across industries: Ideal for benchmarking businesses with different capital structures.

- Investor-friendly: Provides a clearer view of financial health than market cap alone.

Cons

- Limited to financial metrics: Like market cap, it doesn’t factor in intangible assets like brand value or customer loyalty.

- Requires accurate data: Relies on up-to-date financial reporting for debt and cash balances.

While EV offers a broad perspective, businesses in asset-heavy industries often turn to EBITDA to measure operational profitability and efficiency.

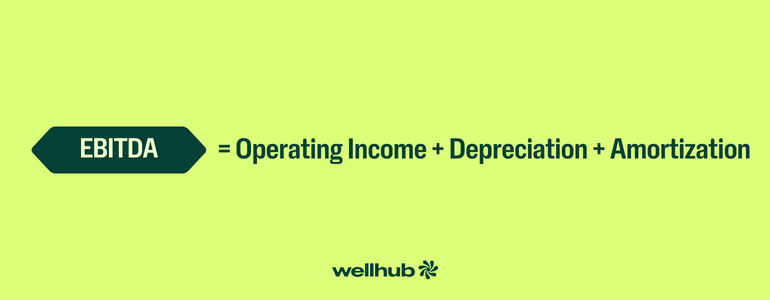

Method 5: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

EBITDA is a widely used valuation metric that measures a business’s operating performance without accounting for financing decisions, tax environments, or non-cash expenses like depreciation and amortization. It offers a clear view of profitability by focusing on the core operations, making it especially valuable for companies in asset-heavy industries like manufacturing or real estate.

In simple terms, EBITDA answers the question: How profitable is this business at its core? To calculate this figure, use the following formula:

Imagine a company reports:

- Operating income: $3 million

- Depreciation: $500,000

- Amortization: $200,000

The EBITDA would be:

$3,000,000 + $500,000 + $200,000 = $3,700,000

This figure reflects the company’s earnings before considering non-operational costs.

Pros

- Focus on operational efficiency: Strips out non-operational variables like taxes or interest to show true profitability.

- Standardized comparisons: Useful for comparing companies across industries by eliminating external factors.

- Favored for valuation multiples: Investors often use EBITDA multiples (e.g., 5x EBITDA) to estimate company value.

Cons

- Ignores capital structure: Excludes interest payments, which may be significant for highly leveraged companies.

- Overlooks cash flow impacts: Depreciation and amortization are non-cash expenses, but they can affect long-term financial health.

- Can inflate profitability: By excluding key expenses, EBITDA may paint an overly optimistic picture of a business’s financial position.

For businesses aiming to project long-term cash flows with consistent growth, the present value of a growing perpetuity formula provides a forward-looking perspective.

Method 6: Present Value of a Growing Perpetuity Formula

The present value of a growing perpetuity formula is designed for businesses that anticipate generating consistent cash flows indefinitely, with some level of growth over time. This method is often used to value stable, mature companies in industries like utilities or consumer goods, where future earnings are predictable.

Unlike other valuation methods, it projects infinite cash flows, adjusted for growth rates and the discount rate, making it a unique tool for long-term projections. Use the following formula to calculate the value:

Suppose a business generates $1 million annually in cash flow, expects a 3% annual growth rate, and uses a discount rate of 8%. The present value of growing perpetuity would be:

Value = $1,000,000 / (0.08 − 0.03) = $20,000,000

This $20 million represents the present value of the business’s infinite cash flows, adjusted for growth and risk.

Pros

- Long-term perspective: Captures the value of steady cash flows over an indefinite period.

- Growth-inclusive: Accounts for cash flow increase, offering a more dynamic valuation.

- Simplified for stability: Works well for mature businesses with predictable growth.

Cons

- Requires stable cash flows: Businesses with volatile earnings may not fit this model.

- Sensitive to assumptions: Small changes in growth or discount rates can drastically affect results.

- Complexity: Advanced financial tools or expertise may be required for precise calculations.

This method works best for companies with reliable cash flows and moderate, steady growth rates. It’s commonly used in industries with low volatility and high market stability, like utilities or telecommunications.

Choosing the Right Valuation Method

Choosing the best valuation method for your business depends on several factors, including your goals, industry norms, and the data you have at hand. For instance, if you’re planning to sell your business, potential buyers will want to see evidence of profitability and growth, making methods like EBITDA or DCF a better option. If you’re seeking investors, Enterprise Value offers a comprehensive picture by incorporating equity, debt, and cash.

Industry standards also play a role. Sectors like technology often emphasize future potential through DCF, while asset-heavy industries like manufacturing and real estate rely on Book Value or EBITDA. The availability of financial data can influence your choice, too. Complex methods like DCF or Growing Perpetuity require detailed cash flow projections, whereas simpler methods like Book Value or Market Cap are more accessible for businesses with limited data.

To guide your choice, here’s a practical framework:

- Clarify your goal: Are you selling, fundraising, or benchmarking performance? Your objective will shape the method you choose.

- Evaluate industry standards: Consider the methods commonly used by similar businesses in your field.

- Assess your resources: Determine whether you have the financial data and expertise needed for advanced calculations.

- Combine methods: Use multiple approaches to present a well-rounded valuation that resonates with stakeholders.

Choosing the right valuation method isn’t about picking one “best” option — it’s about crafting a narrative that aligns with your business’s story and goals.

How to Value a Small Business

Valuing a small business comes with unique challenges. Unlike larger companies, small businesses often lack public stock, extensive financial records, or predictable cash flows. These limitations make it essential to use methods that reflect the business’s true earning potential and unique circumstances.

One common approach is Seller’s Discretionary Earnings (SDE), which calculates profitability by adding back expenses like the owner’s salary, non-essential costs, and personal perks to the net profit. This method works well for businesses where the owner plays a significant role in operations. Owner’s Benefit is a similar concept, focusing on total economic benefits to a potential buyer, including salary and perks.

For more asset-driven businesses, methods like Book Value or EBITDA may be more suitable, providing a straightforward look at tangible value or operational efficiency. Combining these approaches ensures a valuation that captures both financial performance and market potential.

Increase Business Value Internally for Employees

A business’s value isn’t determined by financials alone. Internal factors like employee satisfaction, company culture, and organizational wellbeing significantly impact how a business is perceived by investors and stakeholders. Investing in employee wellbeing is good for morale, but it’s a strategic move, too.

Programs that support physical, mental, and financial wellness enhance productivity, reduce turnover, and attract top talent. In fact 93% of employees value workplace wellbeing as much as their salary, making it a key factor in retention and recruitment. And, 56% of companies see a return over 100% from their investment in a wellbeing program — meaning they get more than $2 back for every $1 invested.

Creating internal value starts with employee engagement initiatives, and by combining financial metrics with those values, your business becomes a compelling investment. Discover how to better engage your employees with a wellness program and speak with a Wellbeing Specialist today!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- The Golden Circle Theory: What’s Your Business’s “Why”?

- How to Drive Businesses Success by Optimizing Day-to-Day Operations

- A Leader’s Guide to Key Business Management Basics

Resources:

- Wellhub (2024, October 16). The State of Work-Life Wellness 2025. https://wellhub.com/en-us/resources/research/work-life-wellness-report-2025/

- Wellhub (2024, May 16). Return on Wellbeing 2024. https://wellhub.com/en-us/resources/research/return-on-wellbeing-2024/

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Vision Statement: Examples and Tips For Writing One | Wellhub

Leverage these tips to write a powerful vision statement that shapes your company's goals and culture, creating a lasting business impact.

Business Management: Skills, Benefits, and Strategies

Use these tips to improve business management skills, enhance employee engagement, and build a stronger foundation for organizational success.

Profit and Loss Statement: Key Elements, Analysis Tips | Wellhub

The P&L is a financial snapshot of a business's income and expenses over time. Unlock the key to strategic decision-making.