How to Calculate Retained Earnings — And Make the Most of Them

Last Updated Jan 28, 2025

Every business — from massive corporations to small startups — need retained earnings to thrive. This is the money a company earns that is reinvested into the organization, powering growth. A company with a high amount of retained earnings is also able to show it’s profitable — something banks and investors value.

Understanding the ins and outs of retained earnings can help you see your business performance and potential. Let's dive in to better understand what retained earnings are, why they are important, and how to calculate them.

What Are Retained Earnings and Why Do They Matter?

Retained earnings are the portion of a business’s profits set aside to be reinvested.

A company’s profits are typically split into two different uses: dividends and re-use. Dividends, which are payments that go to a company’s shareholders, are often paid first. Whatever is left over can be used for the company’s needs — those are your retained earnings, and they can help you grow your business.

When money is put back into the organization, it can be used for any strategic investment, including:

Investment in Growth

Companies often use retained earnings to fund expansion projects, research and development, or acquisitions. This reinvestment can help the company grow its operations, enter new markets, or develop new products and services.

Debt Repayment

Retained earnings can be used to pay off debt, reducing the company's interest expenses and improving its financial health.

Operating Expenses

Retained earnings can also be used to cover day-to-day operating expenses, such as salaries, rent, utilities, and marketing costs. This helps the company maintain its operations without relying solely on external financing.

Reserve Funds

Some companies choose to retain earnings to build up reserve funds for unexpected expenses, economic downturns, or future investment opportunities. These reserves act as a financial cushion and provide stability during challenging times.

Capital Expenditures

Companies may use retained earnings to finance capital expenditures, such as purchasing new equipment, upgrading technology infrastructure, or renovating facilities. These investments can improve efficiency, productivity, and competitiveness.

Why Businesses & Investors Care About Retained Earning

Generally speaking, investors care about retained earnings because they provide insights into a company's growth prospects, financial health, dividend policy, shareholder value creation, future cash flow potential, and management's strategic decisions.

Analyzing retained earnings helps investors make informed decisions about investing in a company's stock. It can signal:

Growth Potential

Retained earnings can signal a company's growth potential. When a company retains earnings instead of distributing them as dividends, it has more funds available for investments in expansion, research and development, or acquisitions. This can lead to higher future earnings and potentially higher stock prices.

Financial Stability

Companies with healthy retained earnings are often seen as financially stable. These earnings act as a cushion during economic downturns or unexpected expenses, reducing the need for external financing and improving the company's resilience.

Dividend Policy

Retained earnings can influence a company's dividend policy. If a company retains a significant portion of its earnings, it may signal to investors that it is reinvesting in growth opportunities rather than focusing solely on distributing profits as dividends. This can be attractive to investors seeking long-term returns.

Shareholder Value

Retained earnings contribute to shareholder value in various ways: They can support share buybacks, which reduce the number of outstanding shares and increase earnings per share. Additionally, retained earnings can be reinvested in the business to generate higher returns, ultimately benefiting shareholders.

Future Cash Flows

Investors analyze retained earnings to assess a company's ability to generate future cash flows. Strong and growing retained earnings indicate that the company is profitable and has the potential to generate cash for future investments, debt repayment, dividend payments, or share buybacks.

Management's Allocation Decisions

How a company uses its retained earnings reflects management's allocation decisions. Investors pay attention to whether retained earnings are being used effectively for value-creating activities such as growth initiatives, capital expenditures, debt reduction, or strategic acquisitions.

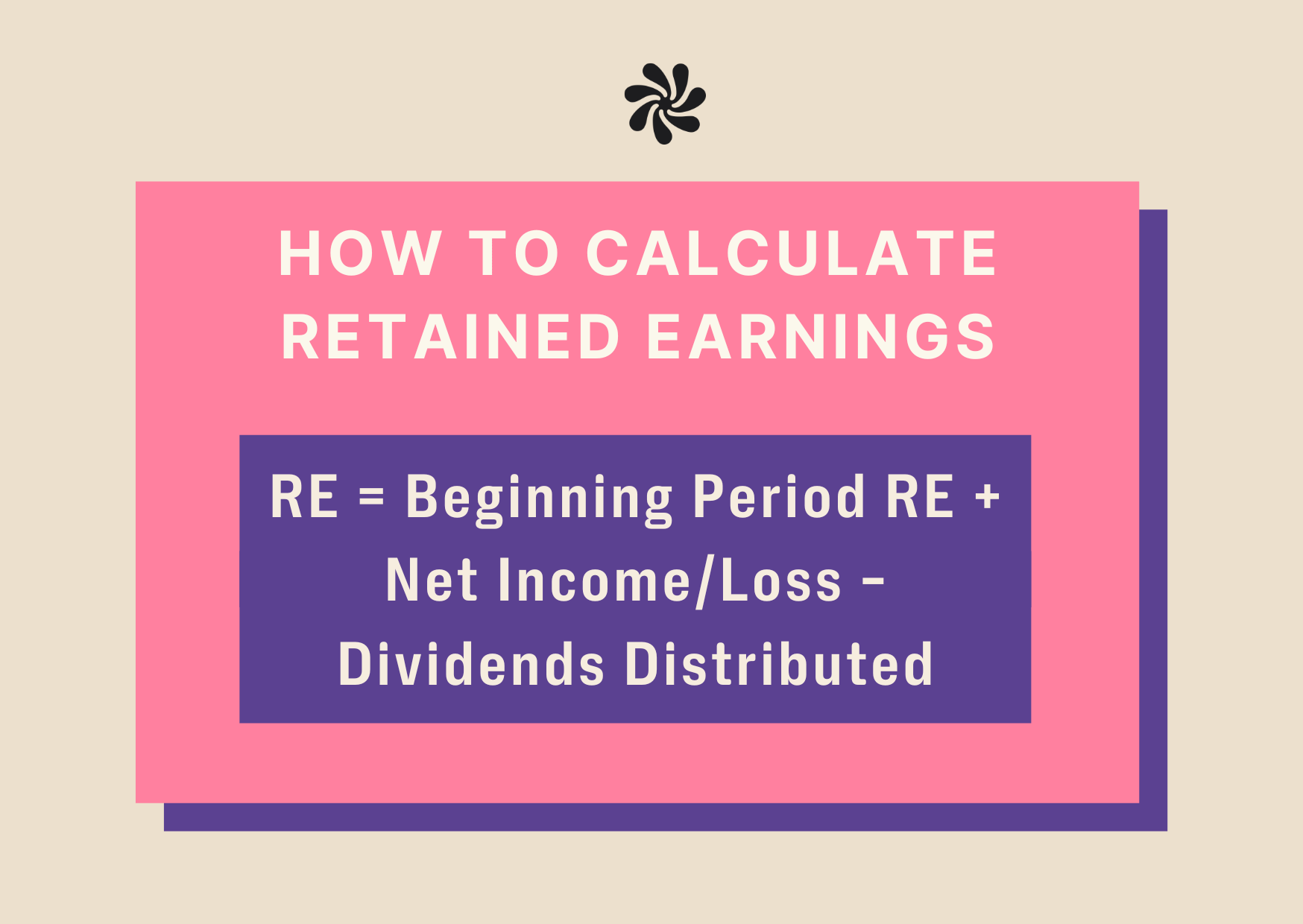

How to Calculate Retained Earnings

You can calculate your retained earnings with a simple formula.

Here’s how you get the numbers you need to populate that equation:

- Begin with Opening Retained Earnings

Begin with the retained earnings from the previous period. This information can typically be found on the company's balance sheet or financial statements.

- Add Net Income or Subtract Net Loss

Once you have your starting number, add any net income from the current period. If the company incurred a net loss instead of a net income, you would subtract the net loss from the starting retained earnings.

- Deduct Dividends

Finally, subtract any dividends paid to shareholders during the period. Dividends are distributions of profits to shareholders and reduce the retained earnings balance.

Factors Affecting Retained Earnings

So what causes a company to have more or less retained earnings? These are a few of the factors shaping what you have to work with at the end of the accounting period.

External Factors

Economic Conditions: The broader economic environment can affect a company's profitability and, consequently, its retained earnings. Economic factors such as GDP growth, interest rates, inflation, exchange rates, and consumer spending can influence sales, costs, and overall financial performance.

Industry Trends

Trends and developments within the industry in which a company operates can impact its retained earnings. For example, changes in consumer preferences, technological advancements, regulatory changes, or competitive pressures can affect revenue, expenses, and profitability.

Market Competition

Competitive dynamics in the market can impact a company's pricing strategy, market share, and margins. Intense competition may lead to pricing pressures, increased marketing expenses, or the need for innovation and investment in order to maintain or grow market position, affecting retained earnings.

Government Policies and Regulations

Government policies, regulations, and tax laws can impact a company's operations and financial performance. Changes in tax rates, trade policies, environmental regulations, or labor laws can influence costs, revenues, and profitability, ultimately impacting retained earnings.

Global Events

Events on a global scale, such as geopolitical tensions, natural disasters, pandemics, or economic crises, can have widespread impacts on businesses. These events can disrupt supply chains, demand patterns, financial markets, and consumer behavior. All of that can affect companies' financial performance and retained earnings — for better or worse.

Capital Markets

Conditions in capital markets, including interest rates, investor sentiment, stock market performance, and access to financing, can influence a company's ability to raise capital, manage debt, or undertake investment activities. These factors can impact retained earnings through their effects on financing costs and investment returns.

Technological Advances

Rapid technological changes and innovations can create opportunities or challenges for companies. Adopting new technologies, investing in research and development, or responding to digital disruption can impact costs, revenues, and competitiveness, thereby affecting retained earnings.

Social and Environmental Factors

Social and environmental trends, such as sustainability concerns, demographic shifts, changing consumer preferences, or social movements, can influence business operations and strategies. Companies that adapt to these trends effectively may enhance their long-term sustainability and profitability, impacting retained earnings.

Overall, external factors play a significant role in shaping a company's financial performance and, consequently, its retained earnings. Companies must monitor and adapt to these external factors to manage risks, seize opportunities, and optimize their financial outcomes.

Internal Factors

Profitability

The company's ability to generate profits directly impacts retained earnings. Higher profitability, reflected in strong revenues and effective cost management, leads to higher retained earnings as more profits are retained within the company.

Dividend Policy

The company's dividend policy, including the decision on whether to pay dividends and the dividend payout ratio, can impact retained earnings. A higher dividend payout ratio means more profits are distributed to shareholders, reducing retained earnings.

Investment Decisions

How the company allocates its profits for investments in growth opportunities, research and development, acquisitions, or capital expenditures can impact retained earnings. Strategic investments can lead to higher future earnings, while ineffective investments may reduce retained earnings.

Operating Efficiency

Efficient operations, such as effective cost controls, optimized production processes, and strong inventory management, can reduce overhead. This contributes to higher profits and, consequently, higher retained earnings.

Financial Management

Effective financial management practices, including managing debt levels, optimizing working capital, and controlling expenses, can impact profitability and retained earnings. Prudent financial decisions contribute to higher retained earnings over time.

Tax Management

The company's tax planning strategies and effective utilization of tax incentives and credits can impact its net income and, by extension, retained earnings. Tax-efficient operations can lead to higher after-tax profits and retained earnings.

Risk Management

The company's ability to manage risks effectively, including market risks, operational risks, regulatory risks, and financial risks, can impact profitability and retained earnings. Mitigating risks helps protect profits and supports higher retained earnings.

Corporate Governance

Strong corporate governance practices, including transparent financial reporting, accountability, and ethical business practices, can enhance investor confidence, support access to capital, and contribute to higher retained earnings.

These internal factors collectively determine the amount of profits retained within the company for reinvestment, debt reduction, dividend payments, or other uses, ultimately impacting retained earnings and the company's long-term financial sustainability.

To illustrate how these factors influence earnings, it’s helpful to see them in action. These next two two case studies showcase the dynamic reality of retained earnings in the real world.

Retained Earnings Examples

Here’s a hypothetical business called Evergreen Dynamic Solutions that offers financial consulting services. This example will go through retained earnings for four accounting periods. Each fiscal accounting period is one quarter, and, in accordance with the dividend policy, dividends are paid quarterly.

Accounting Period One

Evergreen Dynamic Solutions begins this accounting period with $20,000 in retained earnings. This is the number the company will use in the formula. At the end of the accounting period, Evergreen brought in $25,000 in net income. The CEO decides to pay $5,000 in dividends to shareholders. All of these numbers looks like this:

$20,000 + $25,000 - $5,000 = $40,000

Evergreen can now put that $40,000 of retained earnings back into its business.

Accounting Period Two

Evergreen Dynamic Solutions begins this accounting period with that same $40,000. The business doesn’t generate as much revenue, and it ends with a net loss of $10,000 for the period. The board then decides, based on the dividend policy, that the company will still pay $5,000 in dividends. This is how the accounting period looks:

$40,000 - $10,000 - $5,000 = $25,000

That $25,000 can be reinvested in the business to help with the next accounting period.

Evergreen Dynamic Solutions would repeat this process in the next two accounting periods to calculate their full year’s worth of retained earnings.

Growing Retained Earnings Through Employee Wellbeing

Retained earnings are a key part of building your business. While you can’t entirely control what you earn, you can make efforts to boost your earnings.

One way to increase retained earnings is by increasing productivity and reducing expenses associated with talent acquisition and retention.

An effective way to do that is through the use of a wellness program — wellness initiatives can reduce other expenses that otherwise drag down. For example, Wellhub clients saw their healthcare costs reduced by up to 35% for active users in a study of 19,000 employees.

Ready to get started with wellness? Talk to a Wellbeing Specialist today!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

References

- Abbamonte, K. (2022, January 2). How to calculate retained earnings (formula + examples). Retrieved November 29, 2023 from https://www.waveapps.com/blog/how-to-calculate-retained-earnings.

- Apple. (2022, December). CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited). Retrieved November 29, 2023 from https://www.apple.com/newsroom/pdfs/FY23_Q1_Consolidated_Financial_Statements.pdf.

- Corporate Finance Institute. (n.d.). Retained Earnings. Retrieved November 29, 2023 from https://corporatefinanceinstitute.com/resources/accounting/retained-earnings-guide/.

- Indeed. (2023, March 10). 12 Tips for Taking Care of Your Employees. Retrieved November 29, 2023 from https://www.indeed.com/career-advice/career-development/taking-care-of-your-employees.

- Investopedia. (2021, December 9). How does the performance of the stock market affect individual businesses? Retrieved November 29, 2023 from https://www.investopedia.com/ask/answers/042215/how-does-performance-stock-market-affect-individual-businesses.asp.

- Investopedia. (2021, May 27). How Do Operating Expenses Affect Profit? Retrieved November 29, 2023 from https://www.investopedia.com/ask/answers/040915/how-do-operating-expenses-affect-profit.asp.

- Shaw, A. (2023, April 21). Pros and Cons of Using Investors to Finance Your New Business. Retrieved November 29, 2023 from https://sba.thehartford.com/finance/investment-company-for-a-small-business/#:~:text=Engaging%20investors%20in%20your%20business,reduce%20your%20own%20financial%20risk.

- The Currency. (2023, July 19). What are retained earnings? Retrieved November 29, 2023 from https://www.empower.com/the-currency/work/retained-earnings#:~:text=Retained%20earnings%20are%20important%20because,to%20invest%20in%20the%20future.

- The Josh Bersin Company. (2021). The Healthy Organization. Retrieved November 29, 2023 from https://joshbersin.com/wp-content/uploads/2021/10/HW-21_10-DefGuide-The-Healthy-Organization-Defintive-Guide-.pdf.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Vision Statement: Examples and Tips For Writing One | Wellhub

Leverage these tips to write a powerful vision statement that shapes your company's goals and culture, creating a lasting business impact.

Business Management: Skills, Benefits, and Strategies

Use these tips to improve business management skills, enhance employee engagement, and build a stronger foundation for organizational success.

Profit and Loss Statement: Key Elements, Analysis Tips | Wellhub

The P&L is a financial snapshot of a business's income and expenses over time. Unlock the key to strategic decision-making.