How Digital Wellness Tools Lower Insurance Premiums

Last Updated Nov 18, 2025

Key Takeaways

- Digital wellness tools give employers and insurers real-time insight into actual health behaviors. This data moves risk assessment beyond demographics and toward measurable activity, sleep, and stress trends, enabling more accurate and proactive insurance pricing. As employees engage with these tools, insurers see lower risk—which can directly translate into reduced premiums.

- Personalized wellness data is reshaping how insurance premiums are set. Instead of relying on static health histories, insurers can reward ongoing healthy behavior with discounts, cash-back incentives, and HSA contributions. This shift incentivizes continuous engagement and helps both individuals and organizations capture meaningful cost savings.

- Strong employee engagement drives measurable financial impact for employers. Wearables and health apps increase participation in wellness programs and reduce chronic condition risks, cutting healthcare costs by up to 25%. When more employees take part, group insurance premiums often stabilize or decrease, creating long-term budget advantages for HR leaders.

- Privacy-first implementation is essential for legal compliance and employee trust. HR teams must ensure voluntary participation, informed consent, limited data collection, and rigorous vendor security practices. Transparent communication about how data is used—and why—helps build confidence and boosts adoption across diverse workforces.

- A strategic, step-by-step approach turns wellness programs into a lever for lower premiums. By auditing current costs, piloting tools, aligning incentives with insurer guidelines, and tracking ROI through aggregated data, HR teams can scale a program that delivers sustained savings. Integrated thoughtfully, digital wellness tools become a core component of a competitive total rewards strategy.

Your team’s glued to their phones—and that could be a good thing.

Right now, 62% of employees use wellness apps at least once a week. Among Gen Z workers, 72% use them weekly, and nearly one in three open them every day. These tools are shaping healthier habits, helping employees stay consistent, and giving companies a way to lower healthcare costs.

Here’s why that might be good news: HR leaders can turn screen time into savings.

Unlock the power of digital wellness tools to reduce insurance premiums.

What Are Digital Wellness Tools?

Digital wellness tools are technologies that help employees track and improve their physical and mental health. These tools include wearables, mobile health apps, and AI-powered wellness platforms. They are becoming a central part of corporate wellness programs—and they are changing how insurance premiums are calculated.

Common Types of Digital Wellness Tools:

- Wearables (like Fitbit, Apple Watch, Garmin): Track steps, heart rate, sleep, and stress.

- Health and wellness apps (like MyFitnessPal or Headspace): Monitor nutrition, fitness goals, and mindfulness.

- AI-powered platforms: Use data to deliver personalized coaching, risk assessments, and behavior nudges.

These tools collect real-time health data that can be aggregated and analyzed to assess wellness trends across an organization. That gives employers and insurers a better way to evaluate health risks and customize health plans. It also allows employees to take an active role in managing their health—one step at a time.

Why These Tools Can Influence Insurance Premiums

Traditionally, insurers used broad demographic data—age, location, preexisting conditions—to set health insurance premiums. But digital wellness tools enable dynamic, personalized risk assessments. They offer insurers a more accurate picture of how healthy a person actually is, which allows them to price premiums more precisely and approve policies faster.

This personalized data is what makes digital wellness tools so powerful. They move insurance pricing from reactive to proactive—rewarding healthy behaviors with real savings.

Engagement Matters

When employees regularly use wellness tools to track their steps, sleep, or nutrition, it drives measurable results. According to industry research, using wearables in corporate wellness programs can:

- Lower employer healthcare costs by up to 25%

- Boost participation in wellness programs by 15 to 25%

These benefits directly influence group insurance costs, making them a smart investment for HR leaders.

How Digital Wellness Tools Impact Insurance Premiums

Digital wellness tools affect insurance premiums by providing insurers and employers with real-time, personalized health data that makes risk assessments more accurate and dynamic. Instead of relying solely on static demographic data, insurers can now make pricing decisions based on actual health behaviors—like how active someone is, how well they sleep, or how consistently they manage stress.

This shift is transforming how premiums are set—and giving HR teams new ways to control group insurance costs.

- Real-Time Risk Assessment

When employees use wearables and health apps consistently, they generate data that shows trends in activity, heart rate variability, stress management, and sleep quality. This allows insurers to:

- Identify high-risk individuals earlier

- Predict chronic conditions with greater accuracy

- Set insurance premiums based on actual health metrics

As a result, insurers can price policies more precisely, approve applications faster, and reward healthy behaviors with lower premiums.

- Premium Discounts and Participation Incentives

Many insurers now offer discounts or incentives to policyholders who meet wellness goals or consistently engage with digital wellness tools. This includes:

- Reduced monthly premiums

- Cash-back rewards

- Contributions to health savings accounts (HSAs)

For example, individuals enrolled in AI-powered wellness programs can save $200 or more annually on insurance premiums through earned incentives.

- Group Health Insurance Cost Savings

The benefits aren’t limited to individual employees. Employers who integrate digital wellness tools into their benefits strategy often see a drop in overall healthcare costs. These programs:

- Lower the severity and frequency of claims

- Improve employee engagement in preventive care

- Reduce chronic condition rates over time

One study shows that wearable-based programs can cut employer healthcare costs by up to 25%, especially when participation rates rise 15 to 25% due to digital engagement.

- Tiered Wellness Incentives

Many insurers are now using tiered wellness models—rewarding employees more as they achieve specific goals, like completing biometric screenings, increasing step counts, or maintaining a healthy sleep routine. This model keeps employees motivated and improves long-term behavior change.

These tiered systems can even help keep group insurance premiums stable or even declining.

Bottom line: Digital wellness tools give both insurers and HR leaders better data—and better data leads to smarter pricing. When employees engage with these tools, insurers see lower risk, and that can directly translate into lower insurance premiums across the board.

Best Practices for HR Implementation of Digital Wellness Tools (Privacy Rules & Regulations)

Successfully integrating digital wellness tools into your employee benefits program requires more than just picking the right wearable or app. HR leaders must implement these tools in a way that protects employee privacy, ensures equity, and delivers measurable value. Here’s how to do it right.

- Ensure Voluntary Participation and Informed Consent

Digital wellness programs must always be voluntary, especially when they involve collecting health data. Under federal regulations like the Americans with Disabilities Act (ADA) and guidance from the Equal Employment Opportunity Commission (EEOC), incentives must not be coercive, and participation must be free from pressure.

Your program should:

- Clearly state that participation is optional

- Explain what data is being collected and how it will be used

- Provide written consent forms, especially if biometric data is involved.

This transparency builds trust and reduces legal risk.

- Limit Data Collection to What’s Necessary

Only collect the data you need to meet your program goals. If your aim is to improve step count engagement or sleep hygiene, you don’t need access to heart rate variability or geolocation data.

Limiting data collection protects employee privacy and aligns with state laws like the California Consumer Privacy Act (CCPA) and Illinois Biometric Information Privacy Act (BIPA).

- Conduct Vendor Due Diligence

Your wellness vendor is your data partner—so choose wisely. Look for platforms that:

- Offer strong encryption and secure data storage

- Are transparent about their data usage policies

- Allow you to retain ownership over employee data

- Provide indemnity protections in their contracts

Conduct regular security audits and hold vendors accountable for compliance with relevant privacy laws.

- Communicate Transparently With Employees

Clear and continuous communication is critical for adoption and trust. Let employees know:

- How the program works

- What benefits they can expect

- How their data is protected

- Who can access their information and why

Provide FAQs, internal webinars, and a point of contact for any data or security concerns. The more you inform, the more likely employees are to participate and stay engaged.

- Design for Equity of Access

Not every employee has a smartwatch—or wants one. To ensure inclusivity:

- Offer app-based or desktop alternatives

- Provide devices to employees who need them

- Build in analog participation options (e.g., manual logs, wellness coaching)

A wellness program only succeeds if everyone can participate. By offering multiple engagement paths, you make the benefits accessible to your entire workforce.

These Are the Components of a Truly Comprehensive Employee Wellness Program

- Use Aggregated Data—Not Individual Metrics—for Insights

Avoid using individual employee data for performance reviews or employment decisions. Instead, focus on aggregated, anonymized data to:

- Track overall participation rates

- Identify common wellness challenges (e.g., poor sleep, low activity)

- Tailor program enhancements based on workforce needs

This approach mitigates legal risks and strengthens employee trust.

- Track Results and Demonstrate ROI

To keep leadership support (and justify budget increases), measure the outcomes of your wellness program. Key metrics include:

- Changes in group insurance premiums over time

- Participation and engagement rates

- Reductions in claims or healthcare spend

- Improvements in employee satisfaction and retention

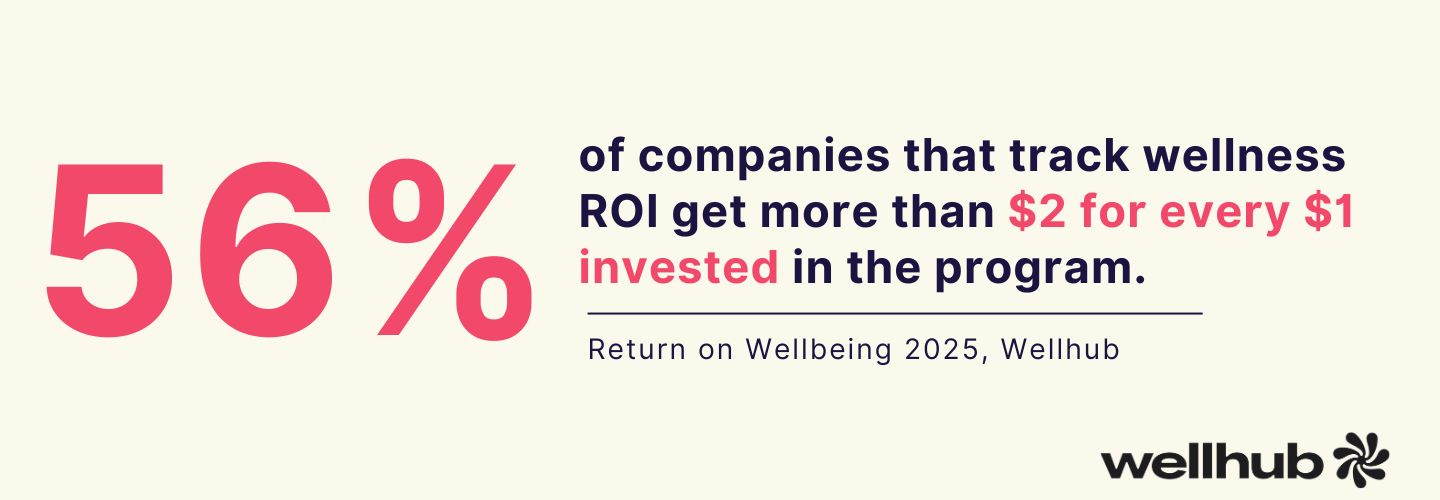

Chances are, the savings will make you smile: 82% of CEOs say their wellness programs show a positive ROI, and nearly one-third report returns of over 100%.

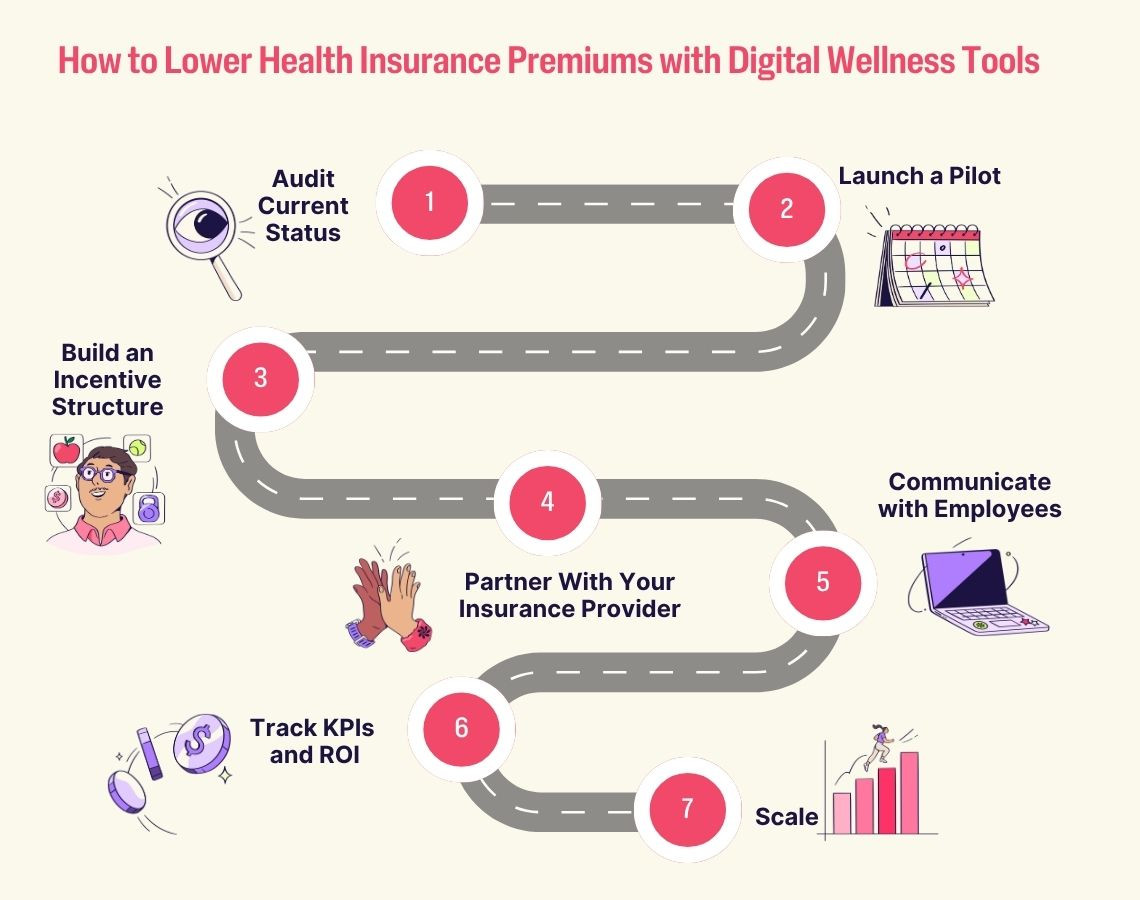

Step-by-Step: HR Action Plan for Lowering Insurance Premiums with Digital Wellness Tools

Integrating digital wellness tools into your employee benefits strategy can directly reduce healthcare costs and insurance premiums—but only if it's done intentionally. Here’s a step-by-step HR action plan to help you launch, optimize, and scale a wellness program that drives real savings and delivers lasting value.

Step 1: Audit Your Current Wellness and Insurance Premium Status

Start by analyzing your baseline:

- What are your current group insurance premiums?

- What wellness programs are in place now?

- What data (if any) are you collecting about employee health engagement?

This initial audit gives you a clear understanding of your current costs, participation rates, and opportunities for improvement.

Step 2: Select and Pilot a Digital Wellness Tool

Choose a wearable, wellness app, or AI-driven platform that aligns with your team’s needs and preferences. Look for:

- High adoption potential across roles (desk-based, frontline, remote)

- Customizable goals and activity tracking

- Robust data privacy and security standards

Pilot the program with a small group first, and define success metrics in advance (e.g., participation rate, average steps/day, sleep hours logged).

Step 3: Build an Incentive Structure Aligned with Insurance Savings

Design an incentive system that motivates participation and supports long-term behavior change. Examples include:

- Health insurance premium discounts

- Wellness program bonuses or gift cards

- HSA contributions based on activity goals

Incentives should be meaningful but not coercive—voluntary participation is essential for legal compliance.

Step 4: Partner with Your Insurance Provider

Collaborate with your broker or insurance carrier to:

- Share anonymized engagement data from your wellness platform

- Explore eligibility for premium discounts or adjustments

- Align your wellness program metrics with insurer guidelines

Many insurers now reward real-time engagement with tiered premium reductions or incentives.

Step 5: Communicate Transparently with Employees

Roll out your program company-wide with clear, consistent communication. Emphasize:

- Voluntary participation

- Data privacy protections

- Available tools for remote, hybrid, and onsite employees

- The link between participation and personal + organizational benefits

A strong communication plan boosts engagement and trust.

Step 6: Monitor Key Metrics and Track ROI

Set up a dashboard to track:

- Participation and engagement rates

- Common health trends (e.g., sleep, movement, stress)

- Claim severity and frequency

- Changes in insurance premium costs

This data will help you report on ROI and identify areas for improvement.

Step 7: Scale and Integrate into Your Total Rewards Strategy

Once your pilot is successful, expand the program to the entire organization. Integrate digital wellness tools into:

- Onboarding and open enrollment

- Total rewards communication

- Performance and wellbeing reviews

Position your wellness program as a core part of your employee value proposition—not a side benefit.

By following these steps, you turn digital wellness tools from a trend into a strategic advantage. You’ll reduce healthcare costs, improve employee engagement, and position your organization as a proactive, people-first employer.

Digital Wellness Tools Create Smarter Insurance Strategies

Rising insurance premiums and low engagement in wellness programs create pressure for HR teams. Many struggle to control healthcare costs while still offering meaningful benefits that employees actually use.

A digital wellbeing program helps solve both. Tools like wearables and AI-powered platforms drive real-time engagement and give insurers the data they need to offer smarter pricing.

Speak with a member of the Wellhub sales team to lower healthcare costs and boost employee participation through digital wellness tools.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Corporate Wellness Trends HR Must Know for 2026 | Wellhub

See the top 2026 wellness trends shaping performance, retention, and culture—plus how HR can build a unified, ROI-driven wellbeing strategy.

Wellness Points Programs: Boost Employee Health & Engagement | Wellhub

Turn your workplace wellness strategy around with a points program that rewards healthy behavior with perks, from extra time off to gift cards.

Employee Financial Wellness Programs: Ultimate HR Guide | Wellhub

Create an effective financial wellness program that supports your employees in their financial needs, boosting productivity and retention.