Do Salaried Employees Get Overtime? How to Tell & Calculate Payments.

Last Updated Jan 28, 2025

It’s a weekend and you have a few employees in the office finishing a project. It’s been a long week, but at least everyone gets overtime pay, right?

Not necessarily. That’s going to depend on the employment type of all these individuals.

In general, there are two types of people at your company: hourly and salaried employees. Typically, hourly workers get overtime if they go over their weekly allotment, but do salaried team members?

Whether or not a salaried employee gets overtime will depend on a few legal requirements as well as your company’s policies. In general, they’re not eligible, but there are a few exceptions. Discover the requirements for providing overtime for salaried workers and how to calculate what they’re due!

Do Salaried Employees Get Overtime?

In general, salaried workers don’t get overtime unless they are below a certain salary threshold. That’s because these individuals are most likely considered exempt from the Fair Labor Standards Act, a law dictating overtime and benefits access. Also called the FLSA, this federal law establishes worker guidelines like minimum wage and child labor rules. The FLSA is what makes overtime a legal requirement for some types of employees and helps you determine exactly who is eligible.

Hourly employees are almost always non-exempt, and that makes them eligible for overtime pay. That being said, some salaried workers could be potentially considered non-exempt in special circumstances, which makes them eligible for overtime.

How to Determine if a Salaried Employee Is Eligible for Overtime

The FLSA has three tests that can help you determine if someone is eligible for overtime. An employee is considered exempt under three conditions:

In general, if someone receives a salary instead of a wage, they’re exempt.

However, if their salary is below $35,568, they aren’t exempt from the FLSA.

Or if the salaried worker performs blue-collar work (manual or physical labor), they are often still eligible for overtime pay.

Essentially, if your salaried employees perform white-collar work (administrative or professional duties) or make more than $35,568, they’re not eligible for overtime.

Employee Salary Payments, Explained

Payment is straightforward when someone receives a wage: they are paid for every hour they work. If they are on the clock more than the legal limit of 40 hours per week, they get overtime pay.

With salaried employees, though, measuring working hours is different. Salaried employees are paid the same amount for every paycheck . This arrangement provides workers with a sense of security, which is why people seek out these jobs.

Here’s an example of how salaries work. Our hypothetical employee receives a bimonthly paycheck of $1,000. Whether they work 38, 23, or 55 hours, they will still receive their two checks for $1,000 that month. They don’t lose money working below 40 hours or get extra by working more. It all balances out, without needing overtime pay.

If salaried individuals are going over 40 hours too often can lead to a retention problem. A role that regularly requires 50-hour work weeks is probably poorly designed and could be adjusted.

Benefits and Deductions for Salaried Employees

Sometimes people can feel discouraged that they aren’t eligible for overtime. However, these salaried individuals are often given access to other benefits instead.

Highlighting this with some employees can help them better understand that they are being compensated fairly even without overtime. Some of these perks include:

- Vacation pay: Employees may be given a certain amount of days off, or they might earn the days over time. This lets people take a holiday without losing salary pay.

- Sick pay: The same goes for sick and disability benefits: most companies provide a way for workers to miss work for illness without affecting earnings.

- Healthcare: Companies with at least 50 full-time employees are required to offer healthcare benefits to their people. Salaried employees are considered full-time, so they’re entitled to healthcare benefits.

- Deductions: An employer can deduct salaried pay if someone doesn’t complete any work hours or violates a rule. These regulations should be clearly communicated, so employees understand when they might lose money.

How to Calculate Overtime Rates for Salaried Workers

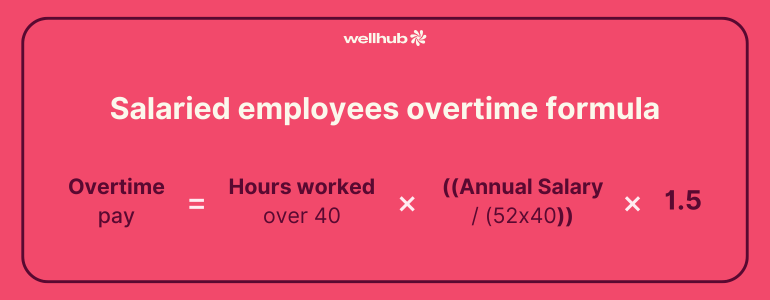

For hourly employees, overtime pay is time and a half pay. Salaried overtime is more complicated. Here are the steps to calculate overtime pay for qualifying salaried workers:

- Determine the regular rate of pay by dividing their salary into a weekly salary.

- Then divide the weekly salary by how many hours it’s meant to cover (typically 40 hours).

- Then multiply that number by one and a half.

Written out as a formula, it looks like: Overtime Pay = Hours Worked Over 40× ((Annual Salary/(52x40))×1.5)

Here’s an example:

If an employee makes $40,000 a year, divide that by 52 weeks. That’s a weekly salary of $769.23. Then divide that by 40 to get their regular rate. That’s $19.23. Then multiply that by one and a half. You now know to pay $28.85 for that individual when they do overtime work.

Investing in Employees with Wellness

Ensuring that you pay your employees the right amount for the work they do is important. Still, pay isn’t enough to keep retention high anymore. A full 93% of workers consider their wellbeing at work to be equally important to their salary — up from 83% in 2023.

Focusing on your team's wellbeing has never been more crucial. Implementing wellness programs is a powerful way to demonstrate that you genuinely care about your workers' holistic wellness. These initiatives can foster a supportive work environment that boosts morale and company loyalty. That’s because when employees feel valued, they are more likely to stay with your company — and be productive.

Talk to a Wellbeing Specialist today to learn more about how wellness programs can benefit your business!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- What is Paid Time Off (PTO?)

- An HR Leader’s Guide to Conducting Salary Reviews

- 5 Key Steps to Creating Compensation Philosophies

References

- DeBara, D. (2023, August 21). Do Salaried Employees Get Overtime? Retrieved October 27, 2023 from https://www.hourly.io/post/salaried-employees-overtime.

- FLSA. (n.d.). Fair Labor Standards Act (FLSA) Coverage (Exempt vs. Non-Exempt) -- The Online Wages, Hours and Overtime Pay Resource. Retrieved October 27, 2023 from https://www.flsa.com/coverage.html.

- Indeed. (n.d.). A Guide to Salaried Employees: Everything To Know About Hours, Overtime and More. Retrieved October 27, 2023 from https://www.indeed.com/hire/c/info/salaried-employees-guide.

- Noguchi, Y. (2019, September 24). 1.3 Million More Workers Eligible For Overtime Pay, But Some Say Rules Fall Short. NPR. Retrieved October 28, 2023 from https://www.npr.org/2019/09/24/763723397/1-3-million-more-workers-eligible-for-overtime-pay-but-some-say-rules-fall-short.

- Pendell, R. (2022, November 8). Your Employees Want Higher Pay, but Money Won't Fix Your Problems. Gallup. Retrieved October 8, 2023 from https://www.gallup.com/workplace/405257/employees-higher-pay-money-won-fix-problems.aspx.

- Radford, J. (2023, March 9). Are salaried employees entitled to overtime pay? Retrieved October 27, 2023 from https://decaturlegal.com/salaried-employees-entitled-overtime-pay/.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

What Is a Deferred Compensation Plan? | Wellhub

Explore deferred compensation plans, their benefits, tax implications, and limitations. Discover why offering one can benefit your business.

How to Build a Competitive Compensation Plan | Wellhub

Here's how to create a competitive compensation plan, from legal basics to salary strategies, benefits, and employee wellbeing.

Exempt vs Non-Exempt Employee: Differences, Pros & Cons | Wellhub

Use these tips to determine exempt from non-exempt employees, ensure compliance, and build a supportive, transparent workplace for your team.