Three Compensation Types That Attract and Retain Employees (With Examples)

Last Updated Jan 28, 2025

Offering employees proper compensation is a vital part of attracting and retaining top-notch employees: Salary is the most important factor to employees considering a new position.

But salary is only one type of payment organizations can offer employees. And, while vital, it alone is not enough to support a corporate talent acquisition strategy. Employees across industries are looking for robust compensation packages that mix and match different kinds of remuneration and benefits.

A firm grasp of the different kinds of compensation you can offer employees is the first step in building a competitive plan for your organization. So let’s dig into your options and assess how to evaluate which tools your organization may want to adopt to enhance its compensation packages.

Different Compensation Types Explained

Compensation refers to the total value of the wages and benefits offered to an employee in exchange for their work. This most notably includes annual or hourly pay, but also includes valuable benefits like paid time off, health insurance, and retirement contributions.

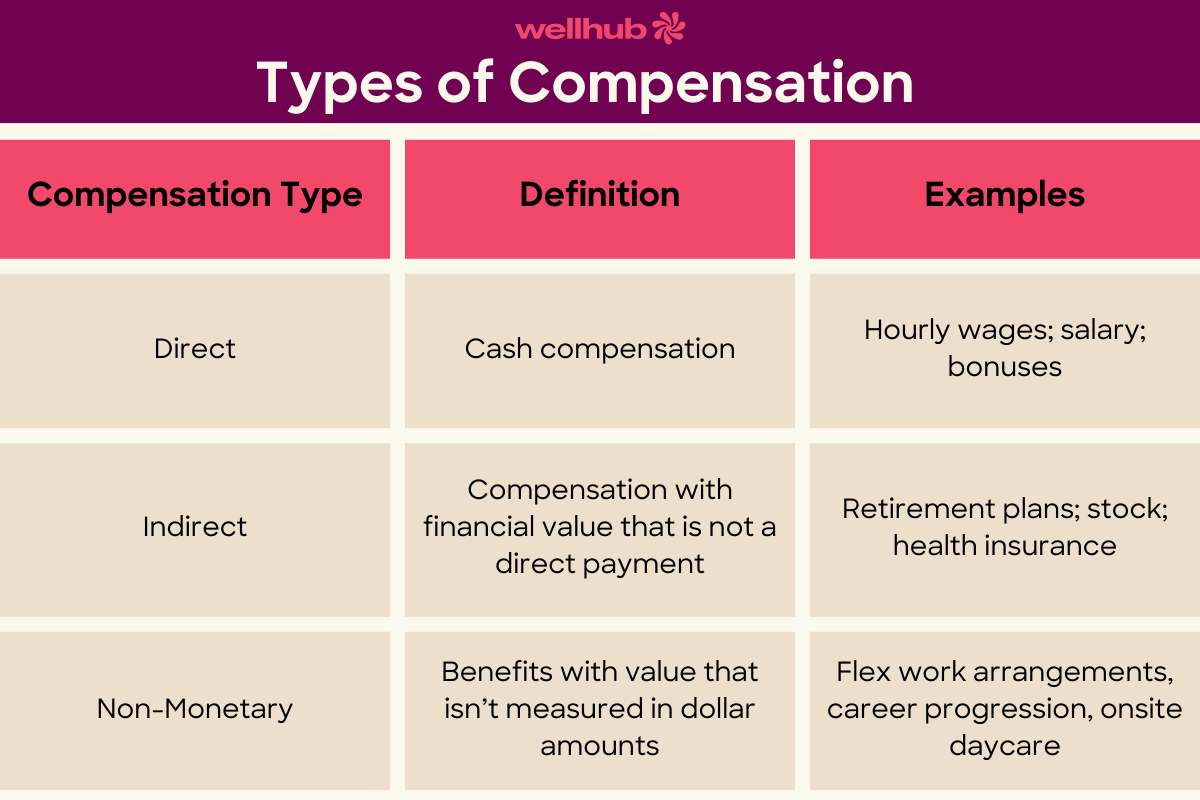

There are three types of compensation:

- Direct: Compensation of immediate cash value (e.g., wages or salary).

- Indirect: Compensation with a financial value but not a direct payment (e.g., stock options or retirement plans).

- Non-monetary: Compensation in the form of benefits that aren’t measured in dollar amounts (e.g., flexible work options or career development).

Each of these plays an important role in attracting and retaining the best talent for your organization. Let’s dig into each individually to see how they can contribute to a competitive compensation package.

Direct Compensation

Direct compensation is money employees receive for performing their work, like salary or hourly wages. While some companies offer competitive salaries that reflect an employee’s experience level or performance goals, others may provide wage increases based on job titles or responsibilities.

Direct Compensation Examples

Base Pay

Base pay, or base salary, is the foundational element of direct compensation. It can be paid as either an hourly rate or a salary, depending on the type of job and the employer. It is typically the bulk of an employee’s total remuneration and directly affects their take-home pay.

Salaried employees generally receive a higher base pay than hourly workers, but all workers must be paid at least minimum wage. This compensation floor is the lowest amount an employer can legally pay an employee for their work. The federal minimum wage currently stands at $7.25 per hour, though some states and cities have higher floors.

Incentive Pay (Commissions and Bonuses)

Incentive pay is an extra form of compensation given to employees when they achieve certain predetermined performance goals or objectives, like bonuses or commissions tied to sales targets.

Incentive pay is also referred to as merit pay, performance pay, and pay-for-performance. They can be offered for individual contribution, team achievements, leadership qualities, and high performance.

Overtime Pay

Overtime pay is a form of extra compensation employers must provide their employees, based on theFair Labor Standards Act (FLSA). It is designed to compensate full-time employees who work beyond the standard 40 hours per week. Overtime pay is calculated at “time and a half,” or 1.5 times the employee’s regular pay rate.

Paid Time Off

Paid time off (PTO) is a critical component of any employee compensation package, supportingessential work-life wellness for both employers and employees and flexibility. Examples of PTO include vacation days, sick days, bereavement leave, and jury duty leave. This compensation type allows employees to address the demands of their personal life during normal business hours without taking a hit to their paycheck.

Indirect Compensation

Indirect compensation is a form of compensation that has monetary value but is not part of salary or wages. This compensation is not a direct payment, so employees typically can’t cash in the value right away.

Indirect Compensation Examples

Equity and Stock Options

Equity is a form of ownership that can be granted through stock options, restricted stock units, or phantom stock. An equity package gives your employees part ownership of the company, which can result in large cash payouts for those who stay with the company longer.

Stock options give employees the right to purchase company stock at a set price within a specific time period. Stock options differ from equity as they do not grant any ownership to the employees. Both ideally increase in value over time, rewarding employees in the long term.

Health Benefits and Insurance Coverage

Health benefits and insurance coverage are other forms of indirect compensation.

- Health benefits provide financial protection for employees against potential medical costs that can arise due to illness or injury.

- Insurance coverage packages can include medical, dental, vision, life, disability, and other types of healthcare coverage. Medical insurance plans are typically provided either by employers or through private health insurance marketplaces.

Many employers also offer discounted gym memberships and other wellness initiatives, such as cycle-to-work schemes or workplace nutrition plans that help build awell-nourished workforce.

Retirement Plans and Pension Funds

Retirement plans and pension funds are effective indirect compensation that can help employees save for the future.

Retirement plans, such as401(k)s andRoth IRAs, are tax-advantaged investment accounts that allow employees to contribute a portion of their paychecks to save for retirement.

Pension funds guarantee a fixed, periodic payment after retirement and can be defined contributions or defined benefit plans. Defined contribution plans are arrangements where both employer and employee make contributions that are then invested on behalf of the employee. Defined benefit plans, however, guarantee a set amount of benefits when the employee retires.

Non-monetary Compensation

Non-monetary compensation is a form of reward that cannot be measured in dollar amounts but is offered as employee benefits. It is intended to motivate and encourage employees to stay with a company and retain their best talent.

Non-monetary Compensation Examples

Flexible Work Options

Flexible work options, such as remote work and flexible time off, are popular non-monetary benefits for employees. Studies have shown that flexible work options can positively impact employee engagement, productivity, and morale.

In addition to flexible work schedules or environments, consider offering other perks that complement them, such as a home-office budget or lunch stipends.

Professional Development Opportunities

Professional development offerings provide a great way to foster a culture of continuous learning and growth. Employers have numerous options in how they structure such opportunities, such as providing access to courses, networking events, summits, or supporting fees for employees pursuing a degree or certification.

Additional initiatives include career planning, creativity workshops, or mentorship programs that empower employees to take ownership of their growth and career paths.

Commute & Family Assistance

Commute assistance ranges from public transportation vouchers to company cars or rideshare services. Family assistance programs might include childcare subsidies, parental leave programs, or access to on-site nurseries and daycares.

These secondary monetary benefits can remove a potentially huge employee burden and expense. By taking these logistics off your employees’ plates, you demonstrate your company’s commitment to employee wellbeing and provide valuable support for employees and their families.

How To Create a Compensation Plan

A comprehensive compensation analysis is a process businesses go through to assess how the pay and benefits they offer employees compares externally, with market rates, and internally, in regard to equity.

This involves a thorough review of the company’s current total rewards strategy and an evaluation of its effectiveness in talent acquisition. It uses external data, such as the average salaries and equity options offered in your industry. It will also require company data, such as what the pay ranges offered across different grade levels. You will want to consider the full spread of an employee’s total remuneration, including wages and salary, benefits, perks, and other forms of recognition.

A thorough compensation analysis will determine how competitive your program is, as well as your opportunities you have to improve your compensation strategies.

Ready to develop a compensation strategy that holds onto top talent? Let's get started

- Determine Your Compensation Philosophy

A compensation philosophy is your company's formal statement outlining its approach to paying employees. It guides how you determine things like pay scales, salary increases, bonuses, and benefits. It determines the strategies you'll follow and outlines how they support your business goals. A compensation philosophy may include:

- The types of compensation your employees will receive

- Your compensation plan's legality

- Inclusivity and pay equity measures

When defining your organization's compensation policy, decide what's most important to you in terms of rewarding your employees. Do you prefer a pay-for-performance structure where individuals who bring the most value to the company receive the highest pay? Or is equitable compensation more important to you? Those are both valid considerations that can guide your overall compensation structure.

- Gather Data From Various Sources

To create solid foundation for your strategy, collect information from internal and external sources that you can use to create a compensation plan. This empowers you to create a data-driven compensation package.

Internal data can include:

- Your team members' names and titles

- The pay bands and benefits for each role

- Locational and geographical pay differential impacts

- A survey of existing pay structures

External data sources might be:

- Pay rates and benefits for similar roles at other organizations within your area

- Wage information from the Bureau of Labor Statistics

- Data sourced from professional organizations or consulting companies

Consider writing out the duties and responsibilities of each position in your company. When you know exactly what your staff does for you, it's easier to determine the value they bring to the organization. To get this information, you can ask your employees to provide their input. You can also source job descriptions from similar roles at other organizations. Make sure to include compensation details, such as base wages, salary, and commission rates.

- Benchmark Internal Compensation Against Similar External Roles

Once you have gathered your employees' titles, job descriptions, and compensation rates, you can compare them against similar roles at other companies to determine whether you're paying your staff fair market rates.

If you find significant differences between your compensation and other organizations, consider how you might adjust your pay to match or beat the competition. Otherwise, you may have difficulty attracting and retaining qualified employees.

- Implement Your Compensation Plan

Once you've defined your organization's job titles, wages and salaries, incentives, and benefits, document them. Consider sharing the details of your compensation plan with executives, managers, and employees. That way, everyone is on the same page and understands the salary and benefits they'll receive.

It's good practice to evaluate your compensation plan at regular intervals. For instance, you might review it yearly to account for evolving market changes or more frequently if you're increasing staff or opening new locations.

Getting Creative With Your Benefits Package

Developing a competitive compensation package isn’t a straightforward endeavor. Whether you’re a startup offering awesome fringe benefits or an established legacy company covering college tuition, there are so many ways your human resources team can support your employees.

If you’d like help enhancing your compensation packages with flexible wellbeing benefits contact a Wellbeing Specialist today!

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

References

- Consolidated Minimum Wage Table. (2023). US Department of Labor. Retrieved on April 2, 2024 from https://www.dol.gov/agencies/whd/mw-consolidated.

- Crafting a Competitive Employee Compensation Plan Guide (with Templates). (January 29, 2024). Clockify. Retrieved on April 2, 2024 from https://clockify.me/blog/business/compensation-plan/

- Digital Workers Say Flexibility Is Key to Their Productivity. (June 09, 2021). Gartner. Retrieved on April 2, 2024 from https://www.gartner.com/smarterwithgartner/digital-workers-say-flexibility-is-key-to-their-productivity#:~:text=Flexible%20work%20hours%20is%20key,them%20to%20be%20more%20productive.

- How Do Pension Funds Work? (April 29, 2022). Investopedia. Retrieved on April 2, 2024 from https://www.investopedia.com/articles/investing-strategy/090916/how-do-pension-funds-work.asp.

- How To Create a Compensation Plan. (June 24, 2022). Indeed. Retrieved on April 2, 2024, from https://www.indeed.com/career-advice/career-development/how-to-create-a-compensation-plan

- How to Create a Desirable Compensation Plan. (November 6, 2023). Retrieved on April 2, 2024 from https://www.businessnewsdaily.com/15831-create-compensation-plan.html

- How to Create an Employee Compensation Plan. (September 8, 2023). Ramsey Solutions. Retrieved on April 2, 2024, from https://www.ramseysolutions.com/business/how-to-create-an-employee-compensation-plan

- Nearly 70% of Americans are looking for extra work to combat inflation. (September 27, 2022). CNBC. Retrieved on April 2, 2024 from https://www.cnbc.com/2022/09/27/nearly-70-percent-of-americans-are-looking-for-extra-work-to-combat-inflation.html.

- Overtime Pay. (2023). US Department of Labor. Retrieved on April 2, 2024 from https://www.dol.gov/agencies/whd/overtime.

- Roth IRAs. (2023). IRS. Retrieved on April 2, 2024 from https://www.irs.gov/retirement-plans/roth-iras.

- Wages and the Fair Labor Standards Act. (2023). US Department of Labor. Retrieved on April 2, 2024 from https://www.dol.gov/agencies/whd/flsa.

- 401(k) Plans. (2023). IRS. Retrieved on April 2, 2024 from https://www.irs.gov/retirement-plans/401k-plans.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

What Is a Deferred Compensation Plan? | Wellhub

Explore deferred compensation plans, their benefits, tax implications, and limitations. Discover why offering one can benefit your business.

How to Build a Competitive Compensation Plan | Wellhub

Here's how to create a competitive compensation plan, from legal basics to salary strategies, benefits, and employee wellbeing.

Exempt vs Non-Exempt Employee: Differences, Pros & Cons | Wellhub

Use these tips to determine exempt from non-exempt employees, ensure compliance, and build a supportive, transparent workplace for your team.