Independent Contractor vs. Employee: What’s The Difference and Who to Hire

Last Updated Jan 28, 2025

As a human resources professional, you’ve probably encountered a situation where you need to decide whether you should hire either an independent contractor or an employee to complete work that needs to happen. And you probably know the basic differences:An employee is someone who works for your company on a full-time or part-time but regular basis. An independent contractor is usually temporarily contracted to work on a specific project or for a specific period of time.

But how do you decide which set up is best for your current needs? What are the regulations surrounding each employment agreement? And what happens if you do mix up the two types of workers?

Let’s review all of this so you’re ready to hire someone as efficiently as possible.

What Are the Differences Between Employees and Independent Contractors?

The main difference between an employee and an independent contractor is that an employee works directly for the company and is subject to relevant taxes, required benefits, and other regulations applicable to part- and full-time workers. In contrast, an independent contractor is self-employed, so they work for themselves rather than an employer. They are often brought on for a specific time or project, rather than the indefinite arrangement companies have with employees.

Legal Differences

The laws surrounding independent contractors and employees are important for businesses to understand. In the United States, the distinction between an employee and an independent contractor is determined by the Department of Labor’s Fair Labor Standards Act (FLSA).

The FLSA defines an employee as someone under a contract of employment that specifies the duties they are to undertake and the wages they will receive in return. Independent contractors may also request a written contract stating the service length, type of service, and fees.

With regard to taxes, both employees and independent contractors have to pay their own taxes. They must pay social security tax, Medicare tax, and state and federal income tax. Employees will fill out a W-4 and an I-9 when they first start with your company and typically pay their owed taxes out of each paycheck. Otherwise, they pay during tax time.

Independent contractors are technically their own businesses and must pay self-employment taxes to the IRS on income earned from contracted work. They’ll fill out a W-9 form when they sign on with you. Then at tax time, you’ll provide them with a tax form, like a 1099-MISC or a 1099-NEC, that shows how much income they generated from doing work for you.

Financial Differences

Compensation laws typically address employees, not independent contractors.

Employers must provide at least a minimum wage to all employees and also adhere to hour laws. These laws are established at both the state and federal levels. Employees also receive benefits such as vacation pay, health insurance coverage, retirement plans, and worker’s compensation from their employers. Employees may also be entitled to unemployment insurance when they are laid off.

Independent contractors, on the other hand, are not entitled to employer benefits. Instead, they usually negotiate their own terms of payment for services rendered.

Another financial difference to consider is the cost of supplies and tools. Employers generally give their employees access to everything they need to do their jobs, including technology, tools, and office supplies. Independent contractors are responsible for sourcing their own tools and supplies to complete their work tasks.

In some cases, companies will give independent contractors access to certain programs that they need to do the assigned work. For example, if you hire someone for graphic design work, you may grant them access to your Adobe program if they don’t have their own license.

Difference in Oversight

Employees are typically subject to the employer’s control and direction about their work duties and schedule. An employee is bound by a contract and expected to follow specific instructions. Independent contractors have a different type of working relationship and are generally given more freedom and autonomy in executing tasks.

When it comes to behavioral control employees are usually subject to their employer’s control and direction regarding their work duties, schedule, and how they conduct themselves at work.

Difference in Responsibilities

Independent contractors generally have focused tasks, projects, or assignments and work with a specific person or department. They work within the confines of that department and don’t usually have a lot of interaction with a company outside of their tasks.

In contrast, employees have an ongoing, regular workload and tasks that they’re responsible for every day. Their tasks are typically assigned by their direct supervisor. Employees generally have performance reviews where managers give feedback and critiques, whereas independent contractors have informal check-ins with their points of contact.

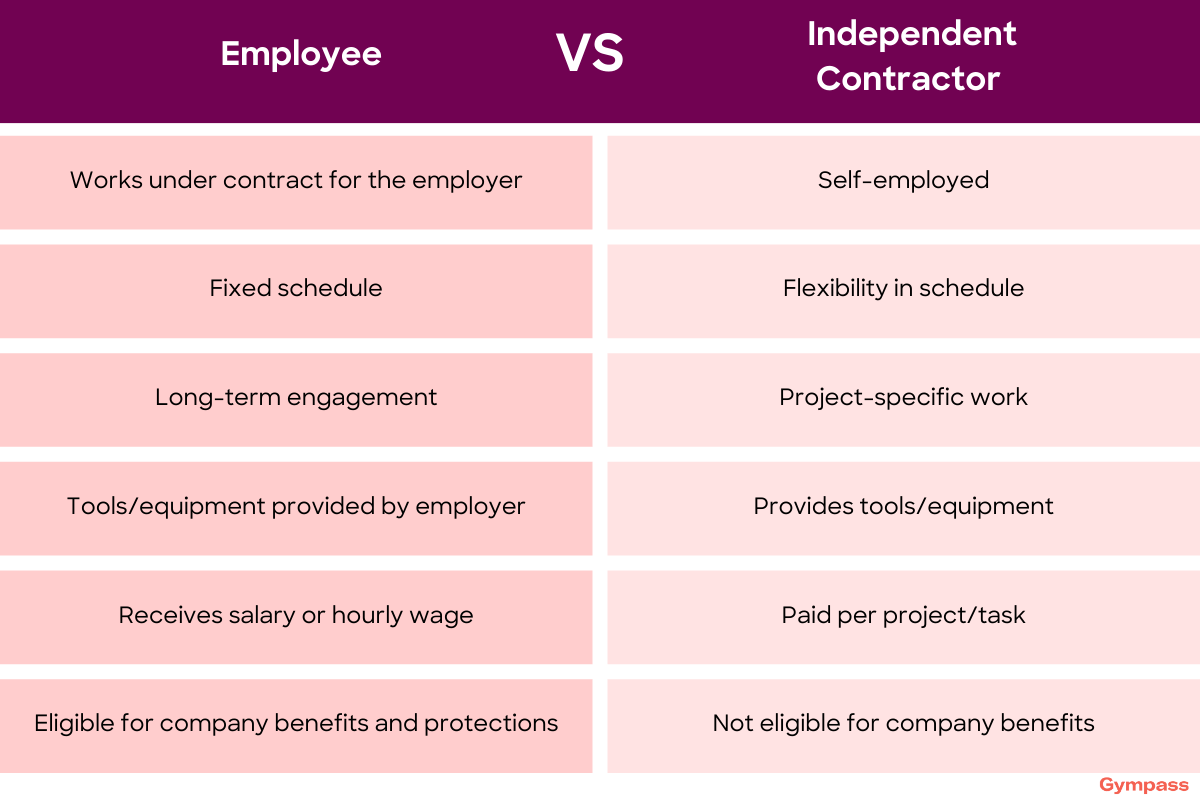

Independent Contractor vs. Employee Chart

Whether you hire an independent contractor or an employee, each situation has its own advantages and disadvantages depending on your workforce needs as an employer.

Misclassification of an Employee or Independent Contractor

Misclassifying someone who works for your company means incorrectly categorizing their employment status. This can happen in various ways, such as listing employees as contractors on IRS forms, misstating the number of hours an employee worked, and failing to pay overtime wages to employees.

Proper worker classification is important and legally required. The repercussions of misclassifying someone as an independent contractor instead of an employee can be severe and costly. Not only can it lead to legal action from the contractor or employee, but it can also lead to fines and other penalties from the IRS and damage your employer branding.

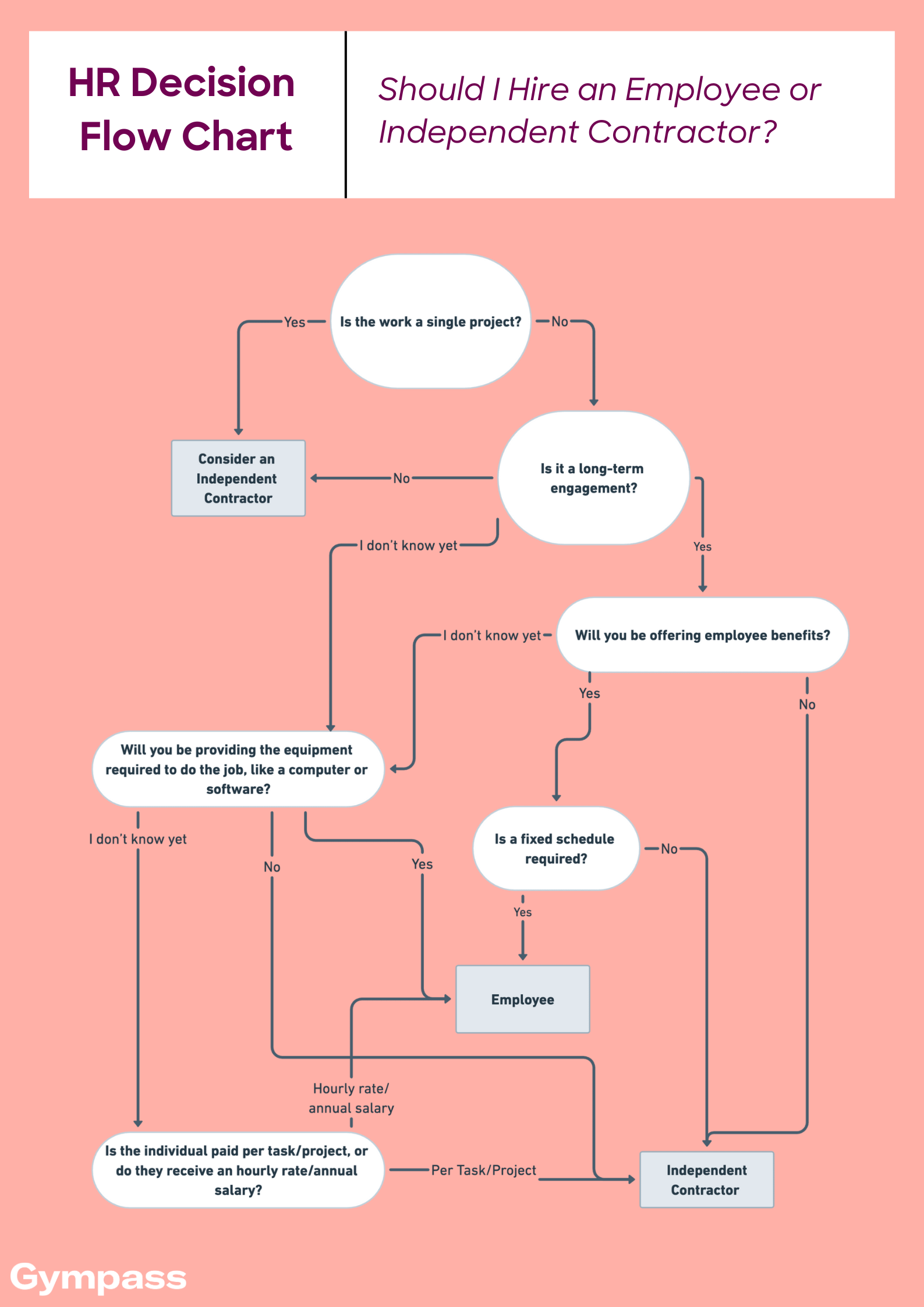

If you're still struggling to decide which classification is a better fit, you can use this flowchart to make an initial recommendation that your legal department can verify.

Examples of Hiring an Independent Contractor vs. an Employee

When you’re looking for someone to fill a role, consider the type of work they’ll be doing. An independent contractor may be suitable if you have to address a specific project or short-term needs. For example, you might choose to hire a freelance photographer to take photos of company events, instead of keeping an in-house photographer on the payroll.

By opting for an independent contractor, you can benefit from their experience and flexibility while avoiding the extended commitment and cost of hiring a full-time employee.

When a company needs to fill a permanent, full-time position, it may be better to hire an employee instead of someone with independent contractor status. For example, if you need professional marketing assistance to help with ongoing social media and digital marketing management, it can make sense to hire a Marketing Specialist or similar role.

Support Wellness Across Your Workforce

A corporate culture that supports employee wellbeing makes your company a place people want to work, no matter their employment classification. After all, 93% of workers believe their wellbeing is just as important as their salary!

Just like employment arrangements, there’s no one-size-fits-all approach here. Companies have plenty of tools available to them to support their employees’ wellbeing. From nutrition counseling to personal trainers, smoking cessation programs to meditation apps, and in-office exercise classes to gym subscriptions, today’s wellbeing programs are as unique as each of your staffers.

If you’re interested in furthering a culture of wellness at your organization, connect with a Wellbeing Specialist today.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

References

- Business News Daily. (2023, February). 1099-MISC vs. 1099-NEC: Which One Do You Need? Retrieved April 10, 2023 from https://www.businessnewsdaily.com/payroll/1099-misc-vs-1099-nec.

- Indeed. (2022, June). W-4 vs. W-9: What’s the Difference? (With FAQs). Retrieved April 10, 2023 from https://www.indeed.com/career-advice/career-development/w4-vs-w9.

- Internal Revenue Service. (n.d.). Independent Contractor Defined. Retrieved April 10, 2023 from https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-defined.

- JustWorks. (2017, December). Improperly Classifying Employees as Independent Contractors: The Penalties. Retrieved April 10, 2023 from https://www.justworks.com/blog/consequences-misclassifying-workers-independent-contractors.

- US Department of Labor. (2008, July). Fact Sheet #22: Hours Worked Under the Fair Labor Standards Act (FLSA). Retrieved April 10, 2023 from https://www.dol.gov/agencies/whd/fact-sheets/22-flsa-hours-worked.

- US Department of Labor. (n.d.). How Do I File for Unemployment Insurance? Retrieved April 10, 2023 from https://www.dol.gov/general/topic/unemployment-insurance.

- US Department of Labor. (n.d.). Minimum Wage. Retrieved April 10, 2023 from https://www.dol.gov/agencies/whd/minimum-wage.

- US Department of Labor. (n.d.). Misclassification of Employees as Independent Contractors. Retrieved April 10, 2023 from https://www.dol.gov/agencies/whd/flsa/misclassification.

- US Department of Labor. (n.d.). Wages and the Fair Labor Standards Act. Retrieved April 10, 2023 from https://www.dol.gov/agencies/whd/flsa.

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

Is a Functional Structure the Best Fit for Your Company? | Wellhub

Discover what a functional organizational structure is and find out if it's the right choice for your company's performance and growth.

Organizational Structure: What it is, Types, and Benefits | Wellhub

The right organizational structure can impact your business strategy. These are the different types to choose from, including pros, cons, and benefits.

Use Contingency Theory to Develop Dynamic Leaders | Wellhub

Contingency contradicts the "one size fits all" notion of leadership by acknowledging how complex challenges warrant the need for adaptable leaders.