Classification of Employees: A Guide for HR Departments

Last Updated Jan 29, 2025

Your company is growing fast. You’ve just added a full-time project coordinator, a part-time graphic designer, and an independent contractor for social media. It’s a solid team and the expansion is exhilarating!

But with team scaling comes the responsibility of properly classifying each role. Getting it right is how HR ensures that everyone is paid fairly and receives the benefits they’re entitled to by law.

Even then, employee classification isn’t just about compliance—it’s about creating an environment where employees feel valued and supported. When classifications are accurate, HR can help avoid potential issues while also enhancing employee engagement and wellbeing. Discover how you can achieve this with best practices and supportive policies.

What is Employee Classification?

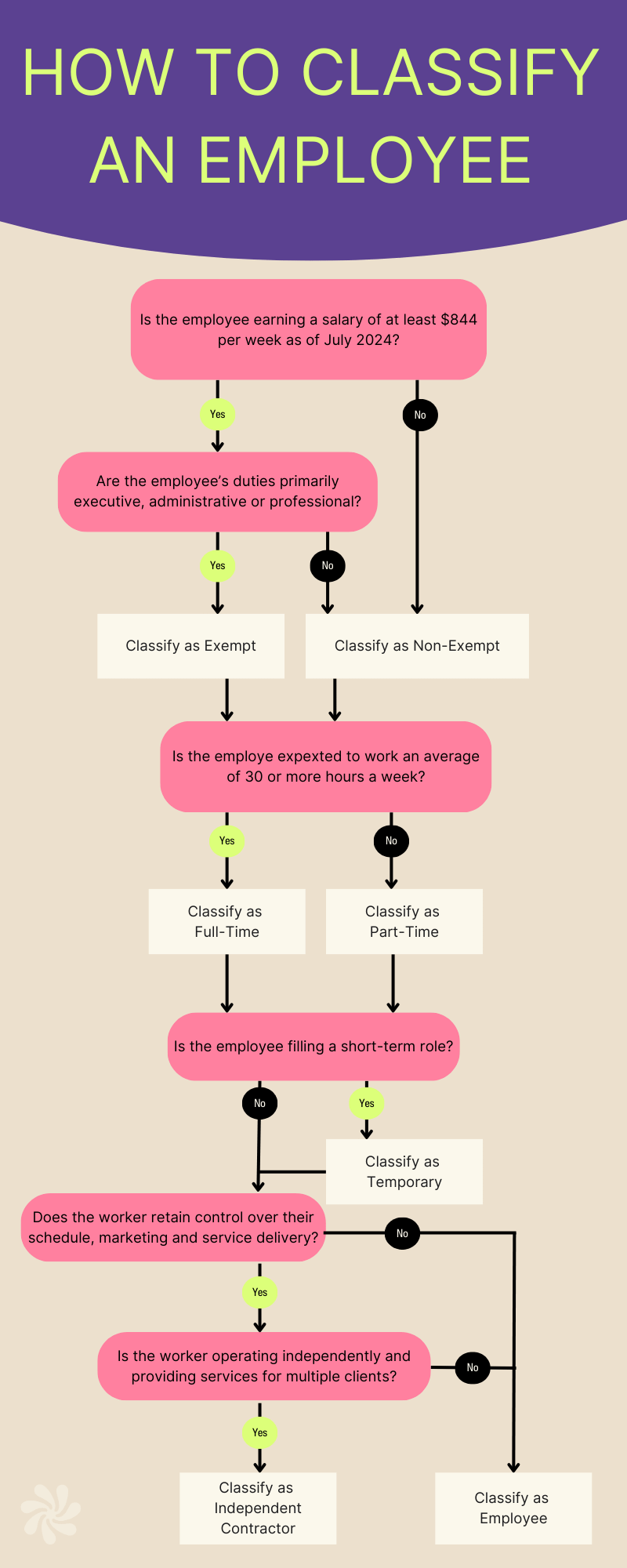

Employee classification is the method companies use to categorize employees based on their roles, responsibilities, and work hours. At its core, it’s about knowing who your team members are in the eyes of the law. It defines how they get paid, what benefits they’re entitled to, and how they’re protected under labor regulations.

Whether you’re hiring a full-time team lead, a part-time assistant, or bringing on a contractor for a short-term project, classifying them correctly ensures everything runs smoothly—from payroll to compliance.

Nail the classification, and you’re setting up your team (and your business) for success. Slip up, and you could be dealing with legal headaches. But with a clear understanding of how each employee type is defined, you’ll have no problem managing your workforce with confidence.

Why Proper Employee Classification is Critical

HR professionals know that even small errors in classification can lead to significant issues. Misclassification can result in overtime discrepancies, benefits mismanagement, and penalties that hurt your bottom line. But beyond the financial risks, there's the human element—employees who feel misclassified may think they’re being undervalued or shortchanged, which can harm trust and morale.

By staying on top of employee classification, HR teams ensure everyone gets what they’ve earned—whether that’s overtime pay, benefits, or fair treatment. It also sets the stage for a healthier, more engaged workforce and reinforces the trust between employees and leadership.

Legal Framework for Employee Classification

So what exactly does compliance with labor laws look like for classification? These laws define everything from overtime eligibility to tax obligations, so getting familiar with them is especially important for any HR team.

Fair Labor Standards Act

The compensation-administration/fair-labor-standards-act-flsa-washington-minimum-wage-act-wmwa/fair-labor-standards-act-flsa">Fair Labor Standards Act (FLSA)</a> sets the rules for classifying employees as exempt or non-exempt. Exempt employees aren’t entitled to overtime pay, while non-exempt employees must receive overtime for hours worked beyond 40 per week. To be classified as exempt, employees need to meet specific salary thresholds and perform certain job duties, like executive or professional tasks.

For non-exempt employees, tracking hours is key. Overtime miscalculations can result in penalties or even lawsuits—take Walmart for example. The company faced claims from workers who alleged they were incorrectly classified as exempt, which led to unpaid overtime violations. Cases like this show just how critical accurate timekeeping practices are for compliance.

Independent Contractor vs. Employee

Classifying someone as an independent contractor or employee can be tricky. The IRS provides three key factors to consider: behavioral control (how the work is done), financial control (how the worker is paid), and the relationship between the worker and the company. Misclassifying a contractor as an employee—or vice versa—can lead to legal and tax implications, including back taxes, fines, or even lawsuits.

Take FedEx, which agreed to a $228 million settlement in 2015 for misclassifying delivery truck drivers as independent contractors. This led to years of back pay, overtime, and penalties—clearly, keeping these classifications clear is key to avoiding unnecessary risks.

State and Local Laws

Beyond federal guidelines, state and local labor laws may impose additional requirements for employee classification. For example, California, known for its stricter labor laws, introduced AB5, which set more stringent standards for classifying workers as independent contractors. This law uses a three-prong test (the “ABC test”) that makes it harder for companies to classify workers as contractors, particularly in gig economy roles.

On the other hand, states like Texas and Florida tend to have more business-friendly labor laws, which can create conflicting requirements for companies operating in multiple states. There are also places like New York and Massachusetts, which have state-specific overtime pay regulations that differ from the FLSA. It’s important that HR monitor these variations closely so that they are always in compliance with both federal and state laws.

Exempt vs. Non-Exempt Employees

One of the most important distinctions HR professionals need to make is betweenexempt and non-exempt employees. This classification determines whether an employee is entitled to overtime pay under FLSA, which has a big impact on wages and working hours.

What Are Exempt Employees?

Exempt employees are typically salaried workers who aren’t eligible for overtime pay, regardless of how many hours they work. To qualify as exempt, employees must meet specific criteria set by the FLSA, including earning a minimum salary (currently $43,888 annually in most states) and performing certain job duties like executive, administrative, or professional tasks.

For example, a marketing manager overseeing a department and making key decisions may be classified as exempt. They earn a consistent salary, and their compensation isn't based on the number of hours they work. However, their responsibilities usually go beyond just clocking in and out—they involve strategy, leadership, and significant decision-making.

What Are Non-Exempt Employees?

Non-exempt employees are entitled to overtime pay for any hours worked beyond 40 hours a week. They’re often paid hourly or have their pay tied directly to the number of hours worked. Under the FLSA, these employees must receive at least 1.5 times their regular rate of pay for overtime hours.

Take a retail associate who works an hourly schedule—they would likely qualify as non-exempt. If they end up working 45 hours in one week, they’re legally entitled to overtime pay for those extra five hours. Just remember that, to comply with the FLSA, employees eligible for overtime must complete a time and attendance record or timesheet. Violating FLSA laws can result in criminal prosecution and monetary penalties for employers.

Full-Time vs. Part-Time Employees

Whether someone is working 40 hours a week or 20, how you classify them can affect everything from their benefits to their legal rights. Defining the difference between full-time and part-time employees isn’t just about the number of hours worked—it’s about benefits, expectations, and legal obligations.

Characteristics of Full-Time Employees

Full-time employees constitute 70% of the workforce and typically work around 40 hours per week, though some companies consider employees full-time if they work as few as 32 hours. These employees often receive a comprehensive benefits package, including healthcare, paid time off, and retirement savings plans. In the U.S., companies with 50 or more full-time employees are required to offer health insurance under the Affordable Care Act (ACA).

Keep in mind that full-time status doesn’t always mean exempt from overtime. If a full-time employee is non-exempt, they must be paid overtime for any hours worked beyond 40 per week.

Characteristics of Part-Time Employees

Part-time employees generally work fewer than 30 hours per week, though the specific cutoff varies by employer. These employees are often paid hourly and may not qualify for the same benefits as their full-time counterparts, such as health insurance or paid vacation time. However, part-time workers are typically still protected by labor laws, including receiving overtime pay if they work beyond 40 hours in a week.

Managing Benefits for Full-Time and Part-Time Employees

Offering fair and inclusive benefits to both full-time and part-time employees is an important consideration for HR departments. Some companies have started offering scaled benefits to part-time employees, such as prorated paid time off or access to wellness programs, to create a more inclusive work environment and improve retention.

For example, Starbucks offers benefits like 401(k) matching and furthering education support for qualifying part-time employees—all valuable perks for everyone at the company.

Contract vs. Independent Contractors

When companies need flexible talent or specialized skills, they often turn to contract employees or independent contractors. While these two classifications can seem similar, they carry different responsibilities and legal obligations for employers.

Contract Employees

A contract employee works for a company for a specific period or on a project basis, but unlike independent contractors, they are often treated similarly to regular employees. These workers may receive certain benefits, like health insurance, particularly if they work full-time hours during their contract. However, their job security is limited to the length of the contract, which can range from a few months to a year or more.

For example, a contract IT specialist might be hired to implement a new system for a company. They would work full-time for the duration of the project and could be eligible for certain benefits, but once the contract ends, so does their employment.

Independent Contractors

Independent contractors, often referred to as freelancers or contingent workers, operate as self-employed professionals. They typically work on a project or deliverable basis and aren’t entitled to company benefits like health insurance or paid time off. Independent contractors have more control over their work, including setting their own hours and managing multiple clients. However, they’re also responsible for their own taxes and expenses.

For example, a graphic designer working for several companies at once would be classified as an independent contractor. They control their schedule, use their own tools, and aren't on any one company’s payroll.

Other Employee Types

In addition to full-time and part-time workers, there are several other classifications that HR teams should be aware of:

- Seasonal Employees: Temporary workers hired to meet increased demand during specific times of the year (e.g., holidays, summer). Although these workers may be full-time or part-time during their employment, their jobs are temporary and cyclical.

- On-Call Employees: Workers who are available to work as needed, often in industries like healthcare or emergency services, but not on a regular schedule. On-call workers are generally considered non-exempt, meaning they’re eligible for overtime pay if they work beyond 40 hours in a week.

- Interns: Short-term workers, either paid or unpaid, who are often students gaining experience in a particular field. FLSA has specific guidelines about unpaid internships, such as ensuring that the intern is the primary beneficiary of the arrangement and that the intern is gaining meaningful educational benefits.

Special Classes

These particular groups often come with specific rules regarding pay, employee benefits, and protections:

- Unionized Workers: Employees who are part of a labor union and work under a collective bargaining agreement that outlines compensation and working conditions.

- Apprentices: Individuals who undergo formal training while performing job tasks, typically in skilled trades.

- Volunteers: Unpaid workers who usually operate within non-profit organizations and are not classified as employees under labor laws.

Inclusive Policies to Support Varied Employee Types

To create a truly supportive workplace that embraces diversity and inclusion, it’s important for HR to implement policies that cater to all employee classifications—whether full-time, part-time, seasonal, or contract. These strategies can help you foster greater inclusivity at work:

Flexible Work Arrangements

Offering flexible schedules or remote work options can accommodate the needs of various employee types. This not only helps employees balance personal and professional responsibilities but also increases overall job satisfaction and retention. For example, part-time employees may need flexibility to accommodate other commitments, while contractors may thrive with a remote or project-based setup.

Wellness Programs for All Employees

A comprehensive wellness program can include accessible options for every employee, regardless of their classification. This could mean offering virtual fitness classes, on-site health screenings, or mental health resources like counseling sessions. Even for part-time or seasonal employees, wellness perks—such as discounted gym memberships or access to meditation apps—can improve their overall wellbeing and engagement with the company.

Training and Development Opportunities

Offering development programs, certifications, or workshops for all employees, including interns and part-time workers, fosters a culture of continuous learning. These opportunities can be key for retaining talent, as employees across classifications will feel valued and invested in the company’s success. Providing training also helps align all workers with organizational goals, which boosts performance.

Recognition and Rewards Systems

Whether it's through public employee recognition, bonuses, or incentives, rewarding contributions can significantly improve morale and productivity. For example, a contractor or part-time employee who goes above and beyond should receive acknowledgment just as much as a full-time worker. This reinforces that everyone’s contributions matter and helps you avoid unconscious bias.

Best Practices for Employee Classification

To effectively manage employee classifications while staying compliant and fostering employee satisfaction, consider these strategies:

Develop Clear Classification Policies

It can be helpful to develop written guidelines that outline how employees are classified based on their roles, duties, and hours. By maintaining clear policies, you ensure consistency across your organization, which could lead to fewer misclassification issues and a more transparent process for employees.

Conduct Regular Audits

Conducting periodic reviews of how employees are classified may help HR teams catch potential misclassifications before they turn into larger issues. Regular audits could help you ensure that your classifications are up-to-date and aligned with any evolving job roles or responsibilities.

Stay Updated on Legal Changes

Labor laws frequently change, particularly regarding contractor vs. employee classifications and overtime rules. Staying informed about federal, state, and local employment law updates will help you make informed decisions. You might consider subscribing to legal newsletters or offering ongoing training to your HR team to stay on top of the latest changes.

Consult with Legal Counsel

When handling complex classifications, such as gig workers or hybrid roles, consulting with legal professionals may help ensure you’re on the right track. Engaging legal experts can provide an extra layer of confidence, especially when roles don’t fit neatly into standard classifications.

Creating a Workplace That Works for Everyone

Whatever their classification, it’s important to keep your workforce healthy and engaged — and a competitive benefits package is key. When employees feel secure in their roles and confident in the benefits they receive, they’re more satisfied at work.

In fact, wellness is becoming more of a non-negotiable for employees—83% of workers say they would consider leaving a company that does not focus on employee wellbeing.

You can focus on wellness for all employees with an inclusive wellness program like Wellhub! To learn more about how to integrate Wellhub into your strategy, speak with a Wellbeing Specialist today.

Company healthcare costs drop by up to 35% with Wellhub*

See how we can help you reduce your healthcare spending.

[*] Based on proprietary research comparing healthcare costs of active Wellhub users to non-users.

You May Also Like:

- Exempt vs. Non-Exempt Employees: Differences, Pros & Cons

- Job Evaluation: Methods, Benefits, and Best Practices

- Strategic Benefits Strategy for Employee Retention and Engagement Long-Term

Resources

- Fair Labor Standards Act (FLSA). Office of Financial Management. Accessed March 28, 2023 from https://ofm.wa.gov/state-human-resources/compensation-job-classes/compensation-administration/fair-labor-standards-act-flsa-washington-minimum-wage-act-wmwa/fair-labor-standards-act-flsa.

- Fair Labor Standards Act Advisor, U.S. Department of Labor. Accessed March 28, 2023 from https://webapps.dol.gov/elaws/whd/flsa/docs/volunteers.asp.

- Greenhouse, Steve. Temp Workers At Microsoft Win Lawsuit, Dec. 13, 2000. The New York Times. Accessed March 28, 2023.

- Work Experience of the Population 2021, Dec. 8, 2022. Bureau of Labor Statistics. Accessed March 28, 2023 from https://www.bls.gov/news.release/pdf/work.pdf.

- Fact Sheet #71: Internship Programs Under The Fair Labor Standards Act. U.S. Department of Labor. Accessed March 28, 2023 from https://www.dol.gov/agencies/whd/fact-sheets/71-flsa-internships.

- Uber Suffers Independent Contractor Classification Setbacks in CA. National Trial Lawyers. Accessed October 22, 2024 from https://thenationaltriallawyers.org/article/uber-suffers-independent-contractor-misclassification-setback/

Category

Share

The Wellhub Editorial Team empowers HR leaders to support worker wellbeing. Our original research, trend analyses, and helpful how-tos provide the tools they need to improve workforce wellness in today's fast-shifting professional landscape.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

Subscribe

Our weekly newsletter is your source of education and inspiration to help you create a corporate wellness program that actually matters.

You May Also Like

How to Build an Inclusive Return to Office Policy | Wellhub

The trend of remote work is reversing, and quickly. How are employers creating an inclusive policy?

Diversity and Inclusion in the Workplace: Why It Matters | Wellhub

Diversity and inclusion in the workplace improves innovation, performance, and wellbeing. A guild to build a culture where everyone thrives.

Expert Guide to Eliminating Weight Discrimination at Work | Wellhub

Build an welcoming workplace with practical strategies and expert guidance on policies, training, and culture to prevent weight discrimination.